![]()

It’s been a busy morning for US dollar traders, with an onslaught of data releases all hitting at 8:30 ET. In probably the most important report, the Consumer Price Index (CPI) fell by -0.7%, more than the 0.6% that traders and economists had been expecting. However, the Core CPI figure, which filters out volatile energy and food prices, actually came in above expectations at 0.2%. Given the Federal Reserve’s repeated comments that the fall in oil prices should only have a temporary impact on inflation, the stronger-than-expected Core CPI figure is more relevant for traders and a marginal positive for the US dollar.

Today’s other US economic reports were similarly mixed: the always-volatile Durable Goods Orders report beat expectations, but Core Durable Goods Orders missed, and Initial Unemployment Claims also edged up to a 6-week high of 313k. After throwing all this data in a blender and setting it to puree, traders have come to the conclusion that this morning’s reports represent a small positive for the world’s reserve currency, and the dollar index is now edging up back up to the mid-94.00s.

Technical View

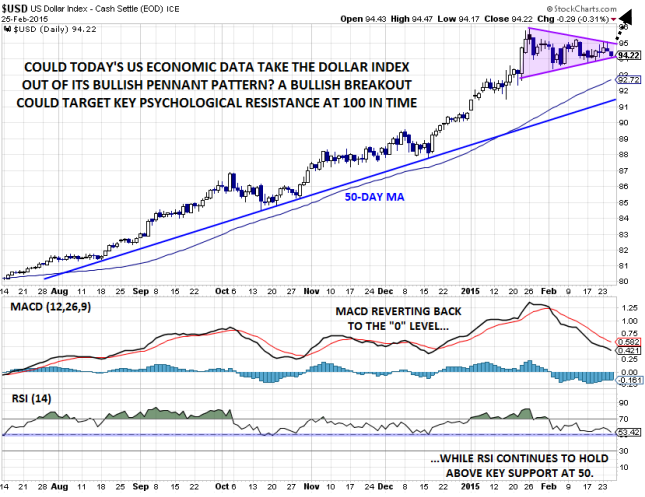

On a technical basis, the US dollar remains firmly within its recent consolidation pattern. Over the last month, the dollar index has formed a clear bullish pennant formation at the top of its uptrend, and the classic interpretation is that this pattern shows a brief pause in the trend before an eventual continuation higher. As always though, it’s important to wait for price to confirm the pattern and break out before trading too aggressively to the long side. Meanwhile, the secondary indicators are also painting a mixed picture. The MACD continues to revert back to the 0 level, showing waning bullish momentum, while the RSI has pulled back from overbought territory but is still holding above the 50 level that has provided support throughout the entire uptrend.

At this point, it’s difficult to say whether today’s US economic data will be enough to break the dollar out of its sideways range. If the index can break the 2-week high at 95.00, then bulls may cautiously start to dip their toes in to buy the dollar, but it will take a conclusive break above 96.00 to reinvigorate the uptrend for a possible move up to key psychological resistance at 100 next. Conversely, a break below 93.50 support could signal at a medium-term top in the index for a possible pullback toward the 50-day MA in the mid-92.00s, but based on the current fundamental and technical situation, we view that as a lower probability outcome.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.