![]()

As we noted earlier today, there’s not much hitting the wires in terms of actionable economic news (beyond the slight negative, but still better-than-expected revision to Q3 US GDP data), so we wanted to revisit one of the forex market’s strongest correlations: the relationship between EUR/USD and USD/CHF.

One of the most common problems I see from newer FX traders is that many of them analyze the Swiss franc in isolation. Even though the Swiss National Bank officially ended the EUR/CHF floor back in January, trade in the franc is still driven predominantly by flows in the euro. That’s because the Swiss economy is still heavily dependent on its neighbors to the east (and west and north and south)… in other words, the Eurozone. It’s worth noting here that the Eurozone’s economy (~ $13T USD) is nearly 20 times larger than that of Switzerland ($685B USD), and traders tend to lump these two currencies together under the umbrella of “European currencies.”

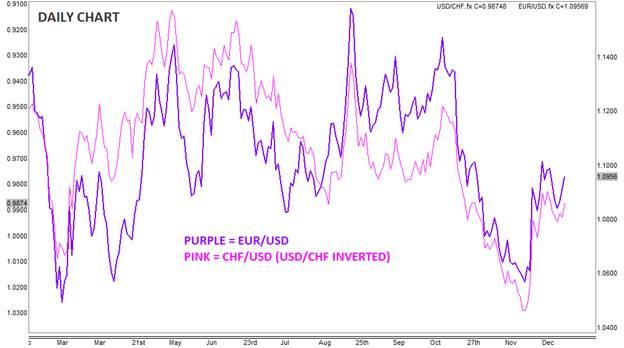

To add some meat to the discussion, the current 50-day correlation between EUR/USD and USD/CHF is -0.97, amazingly close to the 1.0 figure that would signal that the two instruments move in lockstep. For more visual traders, I’ve plotted chart of the EUR/USD vs. CHF/USD (inverted version of the USD/CHF):

Why does it matter?

Beyond the obvious implication that USD/CHF traders should be extremely plugged in to Eurozone economic news, we can also use the two pairs to confirm moves in one another. In other words, if EUR/USD sees a bullish breakout above a resistance level, traders could look to see if there’s a corresponding bearish breakout below a support level in USD/CHF to give them more confidence in the move (and visa-versa).

Though 2015 brought the officially brought the end of the central bank enforced relationship between USD/CHF and EUR/USD, traders have created a correlation that is nearly as strong. With the Swiss National Bank’s monetary policy moves now more in-line with the European Central Bank, EUR/USD traders could use moves in USD/CHF to gain an edge in 2016.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.