![]()

Dollar bulls are back in the saddle again on the first full trading day of this holiday shortened week as speeches from important Federal Reserve members has sparked a bit of USD love. Harkening back to late last week, Fed Chairwoman Janet Yellen didn’t mince any words in suggesting that rates will most likely be hiked this year, and Vice Chairman Stanley Fischer echoed that same sentiment shortly before lunchtime here in the US today. The confidence in which the two highest ranking members on the Fed’s voting board voiced their intentions has struck a chord with investors and the old saying about “Don’t Fight the Fed” is being respected. Potentially adding to the rate hike fever is the Richmond Fed’s Jeffrey Lacker, a noted hawk, who will be speaking to the LSU Graduate School later this evening.

With the Fed speaking in hawkish tones while US data hasn’t been too encouraging shouldn’t be too much of a surprise to many. They have been speaking in this manner since Yellen’s press conference to announce the end of Quantitative Easing back in October 2014; indicating that they would move forward with rate hikes, but after a considerable time. We must remember that the Fed is a very slow moving vessel, and it doesn’t usually change its mind on the back of a slow month, or even a slow quarter for that matter. They have been relatively unchanged in their planned actions for about the last year.

Considering the Fed is simply telling us what they’ve already told us before, the USD love affair might not have the brevity and scope it had in the previous 8 or 9 months. Back when we were just realizing the Fed was REALLY going to be raising rates for the first time in eons while most of the other central banks of the world were battening down the hatches, the USD went on a tear. However, we are now familiar with the path the Fed has laid out, and USD strength may get a little choppy from here; some days it will be great, other days, not so much. Overall though, the USD could continue to be the overall benefactor of the Fed’s plan.

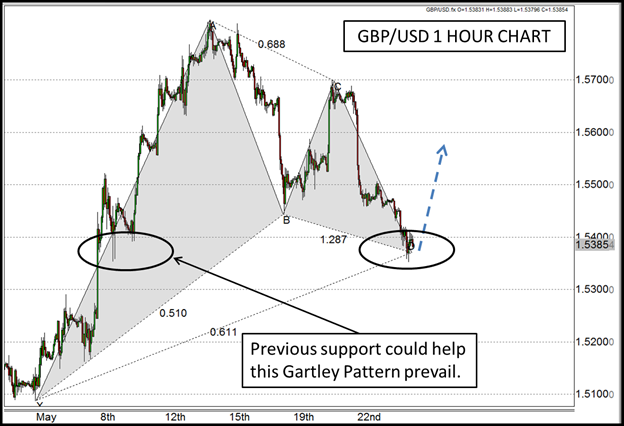

On the technical front, the bounciness of the USD may start to play out in the GBP/USD very soon. After losing some ground on the talk of a leaked secret Bank of England document dubbed “Project Bookend” that detailed the bank’s plans in case of a Brexit, the GBP/USD may have found some support. There is a Fibonacci based Bullish Gartley Pattern that recently completed near 1.5350 that also correlates to previously established support that could help this pair climb back above 1.54. In addition, there is very little on the economic release front in either the UK or the US that could derail this technical pattern until Thursday. If Lacker continues to tow the same line this evening, profit taking could be the main story on the USD as we head in to the Asian trading session.

Figure 1:

Source: www.forex.com

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.