![]()

When Fed chief Yellen speaks in San Francisco at 1945 GMT/ 1545 ET later today the markets may pay as much attention as they did during last week’s FOMC meeting as her topic is monetary policy. Back then she was very cautious on the outlook for rates, although the Fed mentioned that they would no longer be patient when it comes to rising rates, they weren’t impatient to raise them either. This caused a major move in the markets, with EURUSD moving more than 400 pips in the immediate aftermath. So could Yellen’s words have a similar effect today?

The market will be looking to see if Yellen mentions the following:

The prospect of a rate hike – potentially in September.

Her views on the threat of deflation.

Her views on the strength of the dollar – is it doing the hard monetary lifting for the Fed?

If she mentions these points, particularly anything about the dollar, expect a large market reaction. Her speech comes after a volatile week for markets, with EURUSD rallying above 1.10 at one point, before giving back gains on Thursday. Oil has rallied $5 so far this week, although it has faltered on Friday, and the dollar index is also managing to claw back some losses after a rough few days for dollar bulls.

The dollar’s performance on Friday suggests that the market expects a bullish tone from Yellen. While we won’t pretend to know what tone Yellen will adopt during this speech, we think there are two potential outcomes for the dollar later today:

1: Dollar positive: the market perceives Yellen to be hawkish and ready to hike rates some point in Q3:

This could harbour the next leg of the dollar rally. We think that the dollar could outperform vs. the commodity currencies, EURUSD and GBPUSD, while any upside in USDJPY could be more muted as the yen continues to benefit from fiscal year end in Japan. This would also be bad news for oil, which has already given back gains after Thursday’s geopolitical-inspired rally after Saudi Arabia started to bomb Yemen.

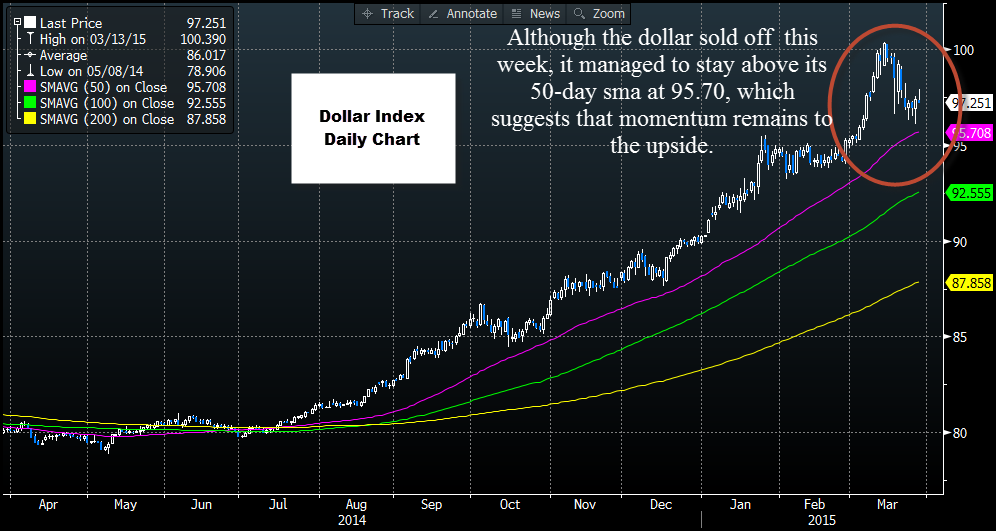

The technical signals also support a continuation of the dollar uptrend, as the dollar index managed to find good support on Thursday ahead of its 50-day sma at 95.71 (see chart below). It also remains above the daily Ichimoku cloud, which also suggests the uptrend remains in play and the recent dollar weakness was temporary.

2: Dollar negative: Yellen backs away from a rate hike and bemoans the strong dollar:

Although we think that there is a low probability of this happening, we believe that if Yellen sounds concerned about the strength of the USD then we may see the buck fall dramatically. We may see EURUSD break above critical resistance at 1.10, and GBPUSD get back above 1.50. We could also see sharp losses for USDJPY and an uptick in gold. A break below 95.71 – 50-day sma – in the dollar index opens the way to 94.13 – the top of the daily Ichimoku cloud. Below this level would signal an end to the dollar uptrend, and could herald deeper losses for the buck.

Interestingly, as you can see in figure 1, the bond market is not as bullish leading up to the Yellen speech as the dollar is, with 2-year yields down nearly 3 basis points today. For the dollar to rally once more we may need Treasury yields to move higher.

Takeaway:

Fed chair, Janet Yellen, is speaking later on Friday and could determine the direction for the dollar next week.

The dollar is rallying into this speech suggesting that the FX market may expect a hawkish tone to her comments.

However, Treasury yields are lower, so this sentiment is not consistent across the market.

There are two potential outcomes from this speech, which we look at above.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.