![]()

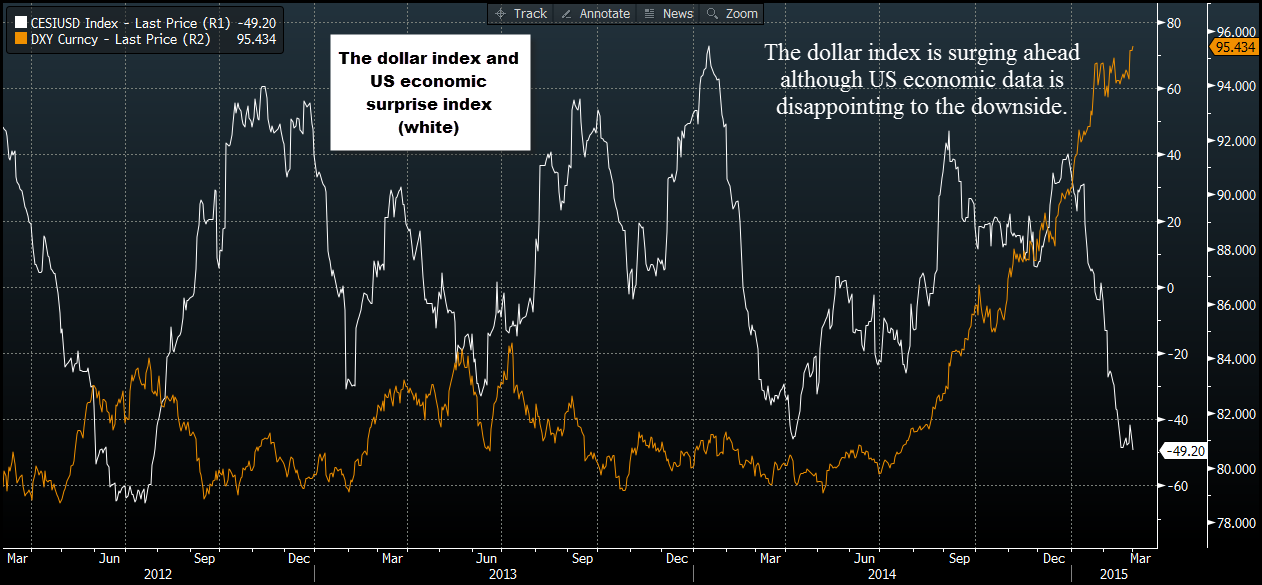

One to ponder late on a Monday afternoon. After another set of economic data misses today from the US, with personal income, personal spending, construction spending and ISM manufacturing all disappointing expectations, why is the dollar still rising? These data misses have sent the Citigroup US economic surprise index tumbling to its lowest level since 2012.

The FX market seems to be completely ignoring the downturn in the US data. In contrast to the US economic misses of late, Eurozone economic data has surprised to the upside, and Citigroup’s economic surprise index for the Eurozone is at its highest level since mid-2013.

Fundamental analysts may be pulling their hair out at this stage – although US economic data has taken a serious turn for the worst, the dollar is still surging. The dollar index (the dollar versus its largest trading partners) is nearly at its highest level in 11 years and EURUSD is close to its lowest level since 2003. Monday’s data misses from the US barely dented the dollar’s dominance, with the dollar the top performer in the G10 apart from the Danish Krone.

So what does this mean?

Deflation and relative monetary policy is still driving FX markets. Even though Fed chair Janet Yellen erred on the side of caution during her Congressional testimony last week, the Fed still looks poised to hike rates later this year, while the ECB is about to embark on its first ever round of full scale QE this month. Liquidity fever is helping to drive European stocks higher and the EUR lower, while we have seen US equities start to underperform their European peers. The prospect of weaker growth and a rate hike from the Fed could make US stocks vulnerable in the coming weeks and months as they teeter at close to record highs.As for the dollar, the FX market seems unwilling to doubt the Fed’s intention to make its first rate hike in the coming months, and the market famously doesn’t stand in the way of the Fed. This can drive the dollar for now, but the greenback could be moving into vulnerable territory. The last time the US economic surprise index was this low, the dollar index was hovering around 80.0, today it is above 95.0. The Fed has said that a rate hike is data dependent. If the Fed starts to back track from the prospect of hiking rates in Q2 or Q3 this year then watch the dollar tumble. If you are a dollar bull, our advice would be to be on your guard.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.