![]()

It has been a bad day for the UK retail sector. First it was Tesco which confirmed that its first half profit had been overstated and said chairman Sir Richard Broadbent would step down. The news weighed heavily on the stock, while some of the other UK retailers lost ground in Tesco’s slipstream. Then we had the latest retail sales data for the month of September, which disappointed expectations as the mild weather hit sales of winter clothes. The 0.3% month-over-month dropped was worse than a fall of 0.1% expected, although this was offset to a degree by a revision in the August reading to +0.3 from +0.2 per cent previously. On top of the retail sector pessimism, sentiment took another knock on news that mortgage approvals rose by a below-forecast 39,300 applications in September. To make matters worse, the CBI industrial trends survey fell for a second straight month in October, printing -6. This was the biggest drop since July 2013, easily missing expectations of -3.

As a result, the FTSE was unable to join the European market rally that was triggered by some positive PMI numbers from the Eurozone, although as the session wore on their rally faded too as investors read the details of the PMI surveys and realised they were not as good as the headline numbers would have you believe. The pound, too, has been out of favour as short-covering in the EUR/GBP cross caused the GBP/USD to momentarily drop below the psychological 1.60 handle. Although it has since bounced back a little, further losses could be on the way, especially if the preliminary third quarter UK GDP reading also disappoints expectations (+0.7%) tomorrow. The downbeat UK data pushes the first Bank of England rate hike further out, which is obviously not good for the pound.

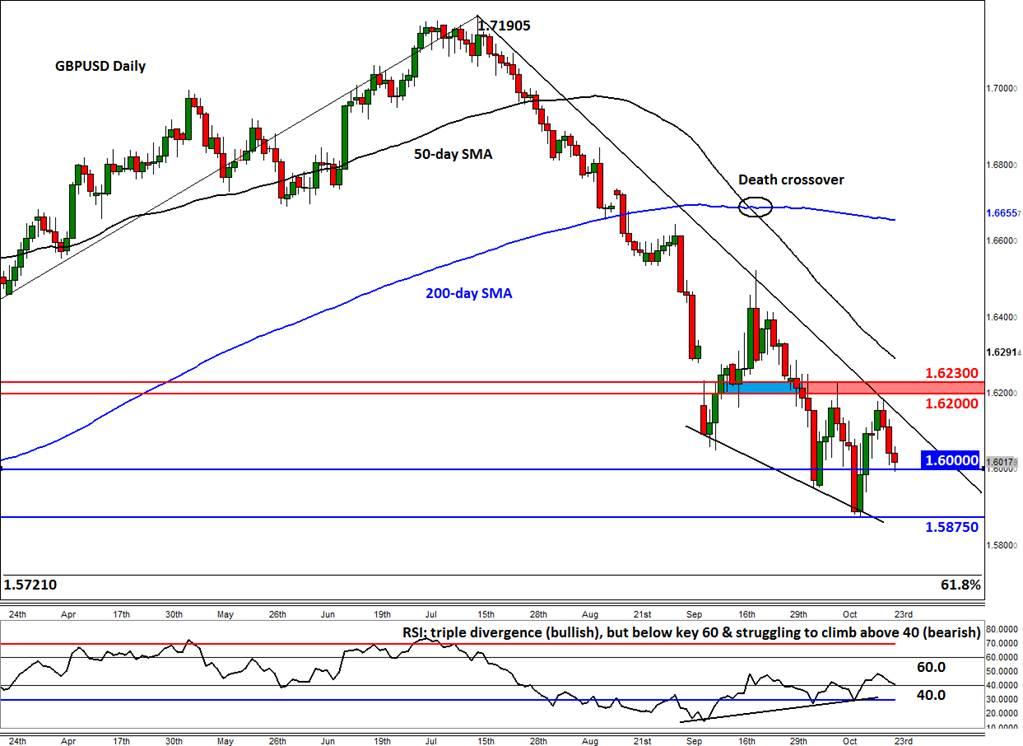

On top of the macro concerns, the technicals are looking bleak for the Cable. As can be seen on the daily chart in figure 1, the GBP/USD has been stuck in a strong downward trend ever since it topped at just below 1.72 in July. The 50 and 200 daily averages are both pointing lower after forming a bearish “Death Crossover.” The momentum indicator RSI, has been unable to climb above the key 60 level and is struggling to hold above 40, despite forming a bullish triple divergence recently. If support at 1.6000 is decisively broken now then we could see a move down to last week’s low of 1.5875 soon. Below that level, the next bearish targets are at 1.5850, 1.5800 and 1.5720 – the latter being the 61.8% Fibonacci retracement level of the rally from July 2013 low.

A close look at the 1-hour chart in figure 2 reveals that the Cable has been stuck in a short-term bearish channel over the past few days. As mentioned, price has bounced off the 1.5990/1.6000 area following the data releases. As well as psychological support, this is where we have the 61.8% Fibonacci retracement level of the upswing from last week’s low. So, it is a key support area. Thus if this level is broken then that could give rise to follow-up technical selling. On this time frame, the next level of support is at 1.5940, which, as well as the support trend of the bearish channel, ties in with the 78.6% Fibonacci level. Meanwhile a potential break above the upper trend of the channel would end the near-term bearish outlook, particularly if price also takes out resistance at 1.6060. In that case, a move towards the key 1.6200/30 area could get underway (see the daily chart).

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.