![]()

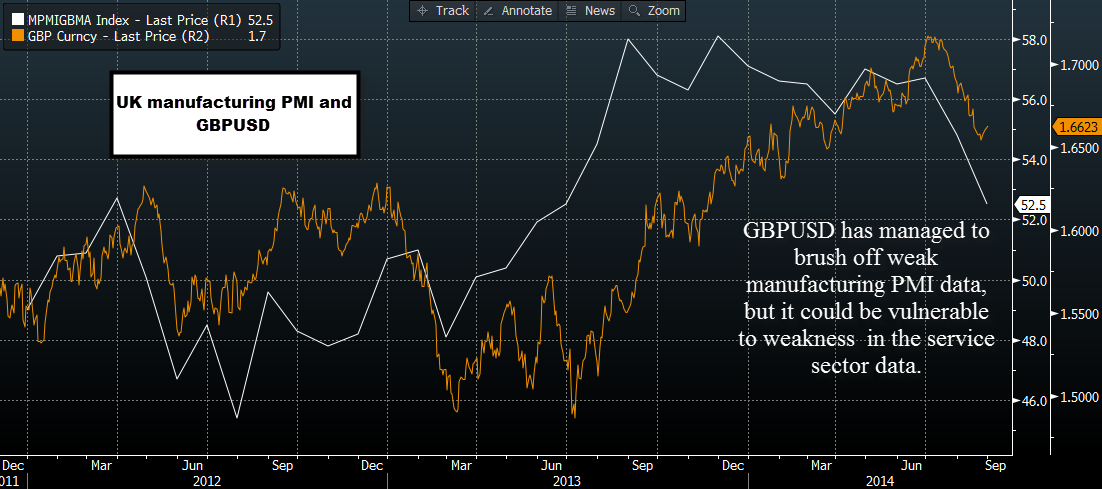

Although the UK manufacturing PMI for August fell to its lowest level since June last year, the pound’s reaction has been fairly muted, and GBPUSD remains at its highest level since 20th August. So why was the reaction so muted?

From a fundamental perspective, GBPUSD’s reaction this morning wasn’t too surprising since consumer credit and mortgage approval data was better than expected. Since consumption and the housing market are important components of the UK economy, the market may have been willing to turn a blind eye to the weak PMI. However, history tells us that if we continue to see disappointing PMI data then this could spell bad news for the pound (see figure 1). If we get weak service sector data on Wednesday then the mini recovery in the cable could be jeopardised.

The technical view:

Having posted a fresh low last Monday, GBPUSD has been in recovery mode since then, and momentum has started to point to the potential for further upside. However, we continue to think that this is still a recovery within a down-trend; hence, we believe that future upside potential is fairly limited.

1.6695 – the 200-day sma – is a key resistance level, and as we get closer to this level then we may see some caution (and some potential selling) set in. Above here 1.6765 – the 38.2% retracement of the July – August decline could stem the recovery. As long as these two levels hold then we could see a resumption of the downtrend, opening the way to key support at 1.6460 – the March low.

Takeaway:

GBPUSD had a fairly muted reaction to the weak PMI data, although the consumer credit and mortgage approval helped to sweeten the blow from the PMI news.

This pair is still consolidating after reaching a five month low, although we continue to think that this pair remains in a downtrend.

In the long-term, PMI data tends to move in the same direction as the pound, so if we see weak service sector PMI later this week then we could see a resumption of GBP weakness.

Key resistance lies art 1.6695 – the 200-day sma, a failure to break above this level could signal further weakness.

Initial support lies at 1.6563 – the August 29th low, then 1.6460 – the low from March 24th.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.