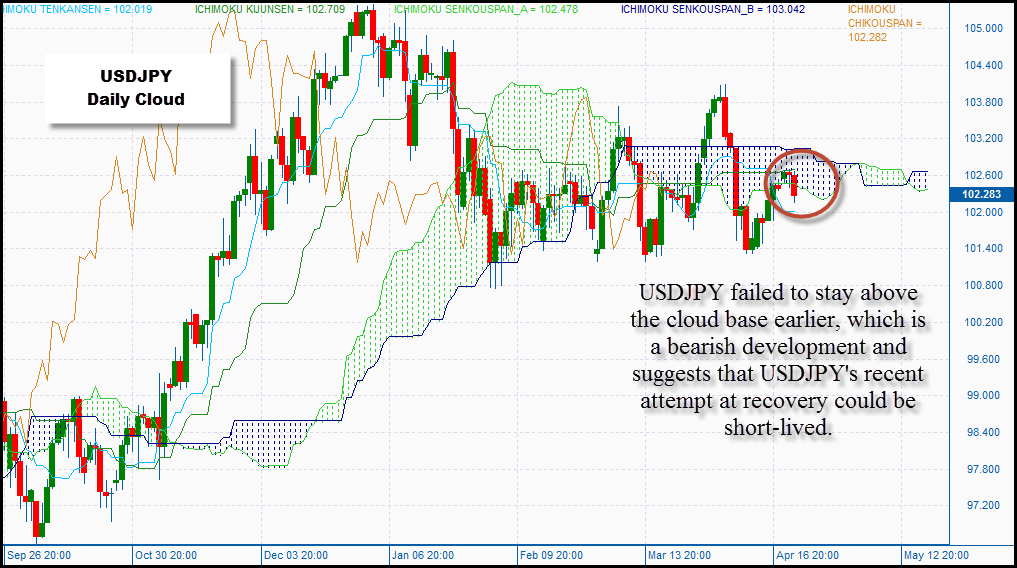

This morning USDJPY has come under pressure, and has fallen below its 50-day moving average at 102.38. This is another set-back in USDJPY’s recovery, and suggests that the recent rally was half-hearted at best since the bulls could not push this pair above a key resistance level at 102.48 – the base of the daily cloud. Below the cloud suggests a technical downtrend.

Inter-market relationships

So what is weighing on the USD? Economic data from the US has actually been quite good, so we can’t blame the weakness in the greenback entirely on the fundamentals. The greenback seems to be moving less on its own back and instead it is following stock and bond markets.

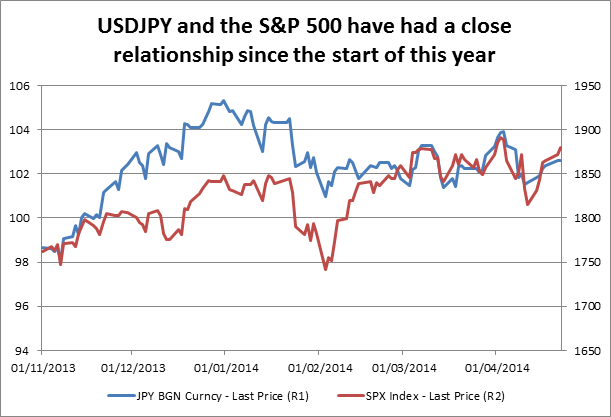

Stocks have been falling today, which is bad news for USDJPY as these asset classes have a positive correlation of 0.63 since the start of this year. This means that USDJPY and the S&P 500 have moved together 63% of the time, since January.

This is worth noting since USDJPY also has a statistically significant correlation with Treasury yields. It has moved with the 10-year yield 73% of the time since the start of this year. USDJPY has a historical relationship with Treasury yields, so we should not be surprised that it has been falling at the same time as the 10-year yield has dropped 3 basis points in the last 24 hours. What is surprising is that stocks are also falling at the same time as Treasury yields, which tend to move in the opposite direction to each other.

A broader sign of risk aversion

Historically, USDJPY does not move in the same direction as the S&P 500, but with markets still choppy and risk sentiment vulnerable, this price action could be a sign of overall risk aversion. So watch gold and also tech stocks in particular, which sold off sharply earlier this month, to see if the negative sentiment in the European session feeds through to a deeper sell off across markets later today. Watch the US Markit manufacturing PMI number for April, which is released at 1445 BST/ 0945 ET to see if this can turn things around for the ailing dollar, the market is expecting a pick-up in this index to 56.0 from 55.5 in March.

Overall, if you are trading USDJPY make sure you watch stock markets, alongside Treasury yields to try and get a grip on where this pair may go next.

The technical picture:

The failure to stay above 102.48 is a bearish development as this leaves us below the daily cloud, which keeps hopes of 103.06 – the 61.8% Fib retracement of the latest sell-off – on the back-burner for now. A daily close below the 50-day sma at 102.38 could signal further declines potentially back to 101.87 – the 17th April low – then 101.20 – solid support from March 3rd.

If we get a strong PMI report from the US later today then we may see this pair try to stage a recovery, although 102.48 (cloud base) and then 103.06 could thwart any upside in the short term.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.