![]()

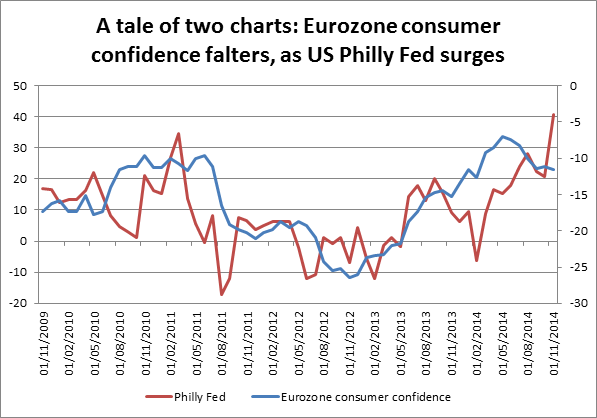

Figure 1 below shows the extent of the contrast between the US and Europe’s economic fortunes. The red line shows the Philly Fed, which almost doubled in November to 40.8 from 20.7, the highest level since 1993. The blue line shows Eurozone consumer confidence, which has headed south since May. The contrast between the two – with US manufacturing confidence surging while the Eurozone consumer woes continue to build – highlights how the US and the Eurozone are at very different stages of the economic cycle, which should limit the upside in EURUSD.

The outlook for EURUSD

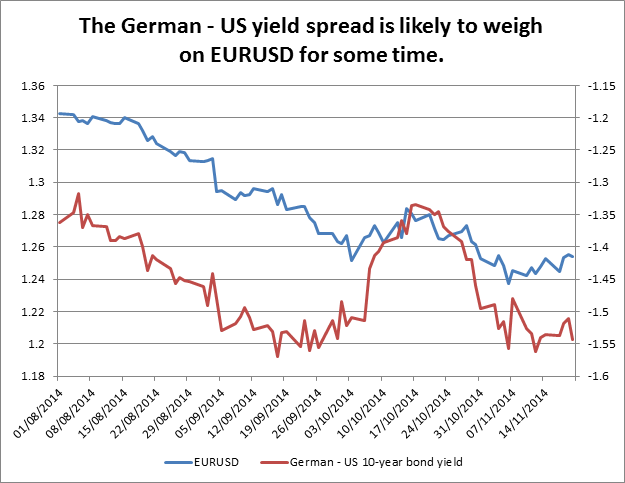

Figure 2 shows EURUSD and the spread between German and US bond yields. This spread is mired in negative territory; it’s actually at its lowest level since 1989, as the market prices in the prospect of Fed-style QE for the ECB at the same time as the Fed thinks seriously about tightening interest rates.

On Thursday, the yield spread has fallen further on the back of the weak European data, while EURUSD has managed to hold onto recent gains. This divergence is not sustainable in our view, which is why the market has been hesitant to push EURUSD above 1.2570-00, a noted area of resistance. Even if we do get above this level in the near-term, we still think upside will be capped, and the next level of resistance lies at 1.2663 – the 50-day sma.

Conclusion:

- It has been a good data day for the US, with the Philly Fed and existing home sales smashing expectations.

- Inflation has also ticked higher in the US, bucking the global disinflationary trend, suggesting that the US is firing on all cylinders.

- In contrast the Eurozone remains mired in economic trouble and consumer confidence continues to plunge.

- The contrasting economic fortunes are weighing on the German – US yield spread, which fell deeper into negative territory today.

- This should limit EURUSD upside, and we expect this pair to resume its downtrend in the coming days, potentially targeting 1.20 sometime in Q1.

Figure 1:

Source: FOREX.com and Bloomberg

Figure 2:

Source: FOREX.com and Bloomberg

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.