![]()

The sharp drop in inflation has seen the pound fall below the psychologically important 1.60 level, its lowest reading since early March. The drop in CPI to 1.2% from 1.5% is close to the 1.1% low from September 2009, when the UK was still mired in the post-financial crisis recession.

The Office for National Statistics (ONS) blamed the decline in prices on motor fuel and food, saying that if they were excluded then the rate of inflation would be a third higher. However, it looks like price declines are becoming broader based, with core CPI falling to its lowest level since March 2009.

The pace of the decline in the UK’s inflation rate could scare the Bank of England. Although two members have voted twice to raise interest rates, since the BOE’s only mandate is to maintain price stability, which it is failing at woefully, so rate increases could be off the agenda for some time.

The market certainly seems to be re-assessing its view on potential interest rate rises from the UK. The two-year UK Gilt yield, which is sensitive to changes in UK rate expectations, has fallen sharply and is back at early March levels. In recent weeks the inter-bank swaps market, another good indicator of market expectations for interest rates, has also pushed out the timing of the first expected rate hike from the BOE to Q3 2014, earlier in the summer expectations were for a rate hike at the end of Q1.

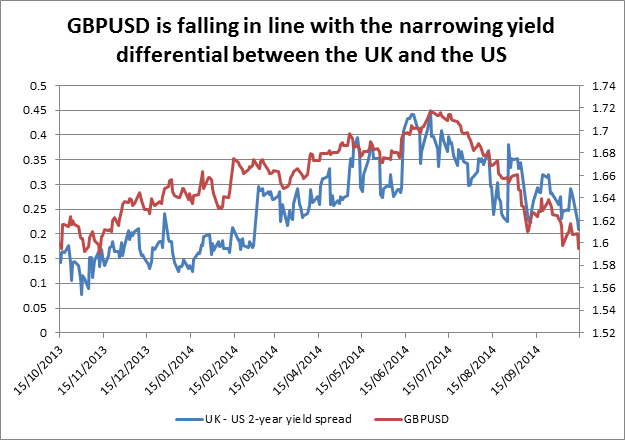

Shifting expectations for UK interest rates have weighed on the UK – US yield spread. The 2-year yield spread has narrowed by 25 basis points since peaking in July, in the last 3 days it has narrowed by 10 basis points, as the prospect of weak UK inflation weighs on BOE rate expectations.

What next for the BOE?

The minutes from the October BOE meeting will be released on 22nd October, it will be interesting to see if the members of the MPC mention concerns about inflation as an obstacle to hiking rates. We doubt that anyone joined Weale and McCafferty in voting for higher rates this month, November’s meeting will be interesting to see if both of these members stick to their guns and vote for rate hikes even though the inflation rate has fallen sharply. If either Weale or McCafferty change their minds, which we may not find out until mid-November with the release of the BOE minutes, then we could see another sharp fall in the pound.

Has GBPUSD crossed the Rubicon?

The pound looked nervous ahead of the CPI reading, and the sharp drop in prices was enough to send this pair well below the 1.60 level, and the next target may be 1.5944- the low from 5th October. A daily close below 1.5944 would be a bearish development that could open the way to 1.5901 then 1.5848 – key support levels on the daily pivot.

Beware fundamental risks for the pound, tomorrow we get UK labour market data. The market may focus on the wage component. Weak wage growth could add to the UK’s inflation concerns and weigh even further on the pound, even if GBPUSD is starting to look a little oversold on the short term charts.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.