![]()

This pair broke key resistance during the Asian session rising to a high of 109.75 – the highest level since September 2008. The break above 109.49 – the recent high – was significant, and opens the way to test 110.67 – the high from August 2008.

Prime Minister Abe helped to give USDJPY a boost earlier, after announcing a strategy for his key economic reforms; this includes a review of the crippling seniority-based pay system in Japan. Typically, when the Japanese government announce key economic statements it can weaken the yen, which tends to move inversely to positive domestic economic news. However, there are a couple of things that make us a little nervous about the future of USDJPY:

Although USDJPY managed to break another record high overnight, the weakness in the yen has not been broad-based, for example, EURJPY is close to a 2-week low, and its push higher overnight was fairly lacklustre. If the yen is not weak across the board, it could be tough for USDJPY to break fresh highs, as it is starting to look stretched to the upside.

The pro-Democracy protests in Hong Kong escalated over the weekend, and they show no signs of stopping any time soon. This weighed heavily on the Hang Seng index overnight, and if the protests continue then we could see safe haven flow into the yen, which may make USDJPY vulnerable.

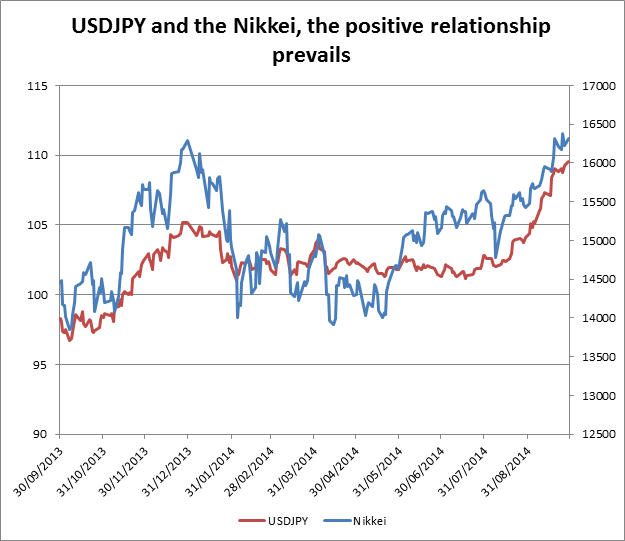

USDJPY and the Nikkei

Interestingly, the Nikkei was able to buck the trend of weaker Asian equities and actually managed to eke out a gain. This helped to protect USDJPY; these two tend to have a fairly close, positive relationship. The Nikkei may have attracted some interest as investors diversified away from Hong Kong, but how long can this continue?

The Nikkei is close to its highest level since 2009, if anti-China protests in Hong Kong continue, could negative sentiment to Asia dent the attractiveness of the Nikkei? If it does then there could be a knock-on effect for USDJPY.

The technical view:

While the technical picture remains strong, we could expect some choppy trading conditions as protests in Hong Kong threaten to drive safe haven flows into the yen. Critical resistance is at 110.66, the August 2008 high. If the protests die down and the Nikkei can make fresh multi-year highs, then we expect the positive momentum to prevail and for USDJPY to meet this milestone. However, if you start to see weakness in the Nikkei, then watch USDJPY, which could come under pressure. Key support lies at 108.26 initially, last week’s low, then 106.81, the low from September 16.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.