Yesterday, we examined the longer-term charts of the USD/CAD, concluding that the bias remains generally to the topside above 1.0850 support (see “USD/CAD: The Long View Remains Bullish” for more). Today’s Canadian Retail Sales figure helped validate that view; though the headline number came in as expected at 0.5%, the previous month’s report was revised sharply lower – from 1.3% to 0.9% - leading traders to view the release as negative for the loonie. The USD/CAD has seen only a limited reaction to this morning’s data, but the EUR/CAD is forming a much more actionable near-term technical pattern.

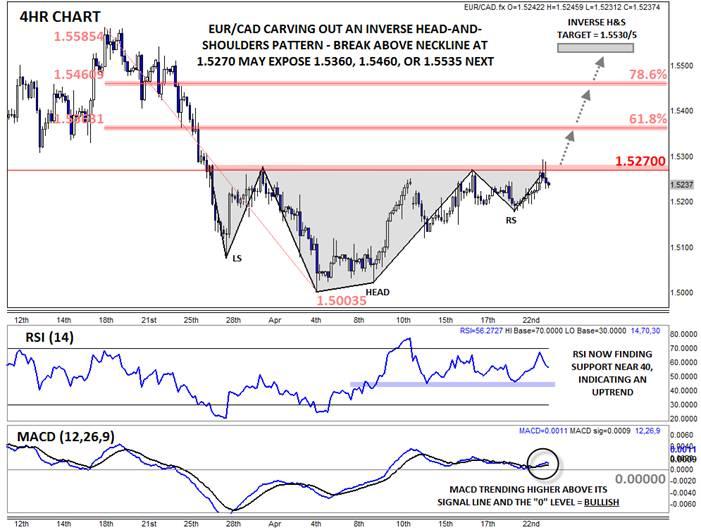

After peaking near 1.5600 last month, the EUR/CAD collapsed down to trade near the 1.5000 handle early this month. Now, the pair has recovered back to test key previous resistance at 1.5270. A cursory look at the 4hr chart reveals that 1.5270 is the neckline of a clear inverted Head-and-Shoulders pattern. For the uninitiated, this classic technical pattern shows a shift from a downtrend (lower lows and lower highs) to an uptrend (higher highs and higher lows) and is confirmed by a conclusive break above the neckline.

The secondary indicators are also suggesting a possible shift to a more bullish environment. The Relative Strength Index (RSI) indicator is now finding support at the key 40 level, indicating that the recent uptrend remains intact. Meanwhile, the MACD is trading above its signal line and the “0” level, showing that the momentum remains generally with the bulls, despite the stall in price over the last week.

Of course, more conservative traders may want to wait for a daily close above the 1.5270 level, or even 1.5300, before turning outright bullish. If we do see a confirmed breakout, bulls may look to target the Fibonacci retracements of the March-April drop at 1.5363 (61.8%) and 1.5460 (78.6%) next, followed by the measured move target projection of the inverse H&S pattern near 1.5530-5. Meanwhile, a drop below the 1.5200 area would postpone any breakout and turn the near-term bias back lower.

Source: FOREX.com

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.