![]()

This week promises to be a big one for EUR/USD traders. In addition to all the major US and Eurozone data later this week (see below for more details), the pair has already been buffeted by a couple of fundamental crosswinds earlier today.

Undoubtedly, the biggest data release so far this week has been the Eurozone CPI reading, which came in below expectations at only 0.5% vs. 0.6% expected. This reading represented a 4-year low in the measure and marked the sixth consecutive month that inflation has come in below 1%, raising the odds that the ECB may look to increase stimulus on Thursday.

However, traders were able to shrug off this seemingly concerning report for two reasons. Firstly, Jens Weidmann, a powerful ECB member, stated over the weekend that two-thirds of the recent drop in inflation has been due to temporary factors including falling energy prices and seasonal effects. If this view is shared by the other members of the ECB, the bank is unlikely to cut interest rates or otherwise loosen policy later this week. Secondly, today’s German retail sales report unexpectedly rose, supporting a more constructive outlook for the economy.

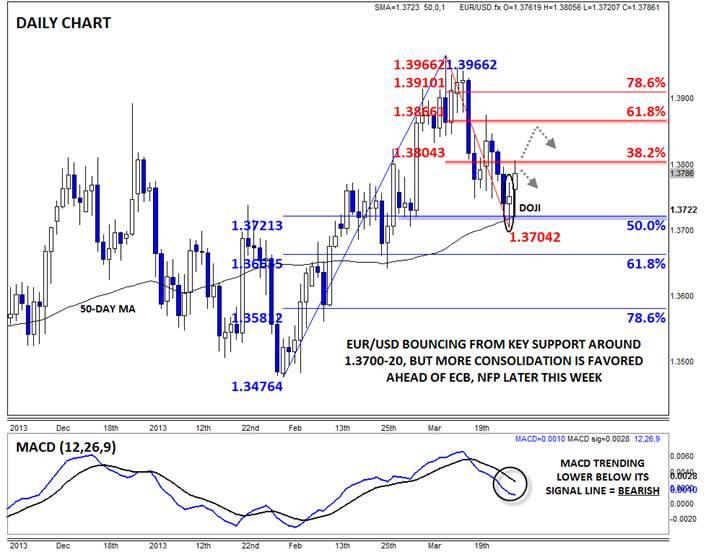

Thus far this week, the EUR/USD has bounced from key technical support in the lower-1.3700s. Friday’s low marked the convergence of two key support levels: the 50% Fibonacci retracement of the Feb-Mar rally and the 50-day MA, which also provided support in late February. From a price action perspective, the market formed a clear Doji* candle on Friday, indicating balanced, two-way trade. After the consistent selling pressure for most of last week, this candle provided a warning of a possible shift to buying pressure in the early part of this week.

Moving forward, further upside may be limited though. On a technical basis, the pair is testing the 38.2% Fibonacci retracement of the late March drop and the MACD continues to trend lower below its signal line. Most importantly though, traders may be cautious about placing large trades in either direction ahead of a highly-uncertain ECB decision on Thursday. For that reason, rates may generally consolidate between support near 1.3700 and resistance around 1.3800 (or if that’s broken, the next Fib resistance level at 1.3865) ahead of Thursday’s ECB decision.

Economic Data and Events that May Impact EUR/USD This Week (all times GMT):

Ø Monday: Chicago PMI (13:45), Fed Chair Janet Yellen Speech (13:55)

Ø Tuesday: German Unemployment data (7:55), Eurzone Manufacturing PMI (8:00), Eurozone Unemployment (9:00), US ISM Manufacturing PMI (14:00)

Ø Wednesday: Eurozone Final GDP (9:00), ADP Employment report (12:15), US Factory Orders (14:00)

Ø Thursday: Eurozone Retail Sales (9:00), ECB Interest Rate Decision and Statement (11:45), ECB Press Conference (12:30), US Initial Unemployment Claims and Trade Balance (12:30), ISM Non-Manufacturing PMI (14:00)

Ø Friday: German Factory Orders (10:00), US Non-Farm Payroll report (12:30)

*A Doji candle is formed when rates trade higher and lower within a given timeframe, but close in the middle of the range, near the open. Dojis suggest indecision in the market.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.