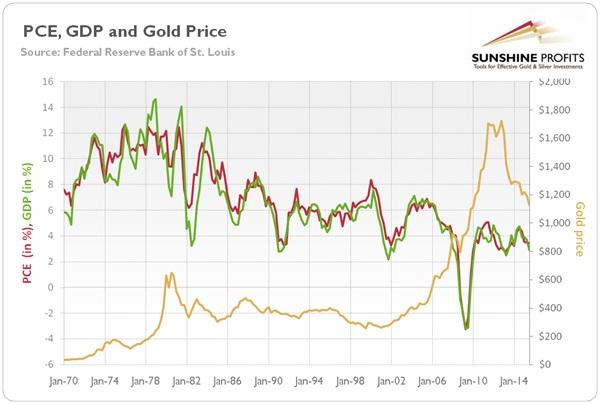

GDP, employment and inflation are a Holy Trinity of economic indicators. However, reports on consumer activity are also extremely important for the financial markets. It is not surprising: consumers are the ultimate rulers of the economy and their actions affect GDP, corporate profits and stock prices, labor market, inflation, the housing market and so on. There are several ways of measuring consumer activity, but it is the Personal Income and Outlays report that is the most widely watched data on consumer spending. The report includes data both on personal income and personal consumption expenditures (PCE). The latter primarily measures consumer spending on goods and services in the U.S. economy. It indicates the economic growth, since it is released monthly (while GDP is published quarterly) and it accounts for about two-thirds of the final domestic spending. Therefore, it should move very closely together with the GDP. Does it really do so? Let’s look at the chart below.

Indeed, as one can see, there is a very strong correlation between PCE and GDP growth. Not surprisingly, given that the former indicator is actually used to calculate the latter. Therefore, PCE exerts impact on gold through changes in the expectations of economic growth and, thus, Fed’s policy. However, since the Personal Income and Outlays report comes out later than other indicators, such as the retail sales, it attracts less interest. This is also probably why Rohan Christie David et al. in the paper “Do Macroeconomic News Releases Affect Gold and Silver Prices” found that the announcements of this report have no detectable effects on gold futures.

Let’s move therefore to the analysis of relationship between retail sales and gold. This indicator measures the sales of retail goods, but does not include money spent on services (except for food services). Hence it represents less than half of total consumption within a month. Nevertheless, the Fed watches it very closely. Retail sales provide relatively new data that are released about two or three weeks earlier than the personal consumption expenditures. This is why the data on retail sales is used to forecast consumer expenditures and GDP. Let’s analyze the chart below, which presents the relationship between retails sales, personal consumption expenditures and gold prices since 1993 (the current series on retail sales started in 1992).

As one can see, there is a strong correlation between percent changes in retail sales and personal consumption expenditures, and thus also with GDP. The retail sales are visibly more volatile, due to the impact of the volatility of motor vehicle sales. Similarly to PCE, the retail sales affect gold through changes in expectations of economic growth (GDP) and, thus, Fed’s policy. According to the IMF Working Paper “The Effects of Economic News on Commodity Prices: Is Gold Just Another Commodity”, retail sales are one of the most influential indicators for the gold market.

The bottom line is that reports on consumer activity, such as Personal Consumer Expenditures and Retail Sales, are widely analyzed by the financial market. Gold investors also should be aware of them as they provide insight into trends in economic growth and future GDP. However, because data on PCE is released much later than retail sales, the latter indicator is seen as much more important for the gold market.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the December Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.