There are no winners from this Greek tragedy; only losers

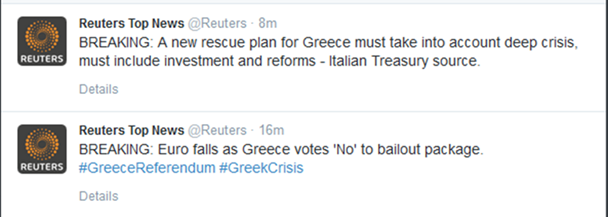

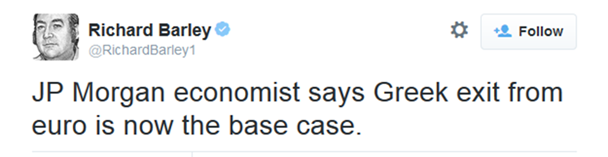

Grexit has now become the base case scenario

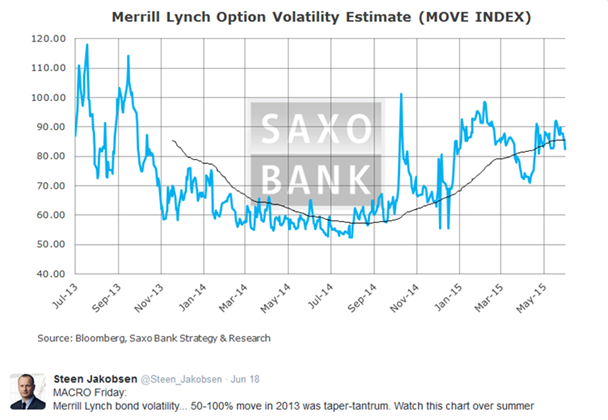

Illiquidity is now the big risk

By Steen Jakobsen

In many ways, it is relatively easy to understand why the result was a No from Greece. There was very little to lose, as a Yes to more austerity hardly was a great choice for a society on the brink of social break down.

The vote clearly was not helped by the fact that the actual vote: Yes or No was confusing. What did they actually say No to?

This does not change what I firmly believed: that is, that Greece would say yes and unseat a government that is more interested in its own survival than the country’s destiny. What comes next politically is difficult to predict but markets are slightly easier:

DAX will open down 5% – again – and probably lose 10% during next few weeks unless the ECB and Fed does a repeat of 2010-11 plunged protection teams

The Club Med spreads will rise 20 to 50 basis points over the next few weeks…

Bulgaria, Croatia, Romania should see considerable spread increases

EURUSD – that is the difficult one: I expect a weaker open, but if… Greece is actually going to leave the euro, then it will be stronger by the end of week. For now I expect 2%-5% range the first 24 hours to 48 hours (Early Sunday night indication points to: 1.0990/1.1000 (i.e. down 120 pips)

Compared with CNBC’s prediction: Greek nays have it; how markets will react.

The real risk remains the illiquidity of the market. Do not forget that through government intervention (quantitative easing) in the bond market there is no two-way market. No market makers and no risk capital (due to capital requirement and regulation).

The big other risk is that banks will NOT reopen despite the assurances by Greek government on Tuesday. Will it lead to 30% haircut on depositors as FT wrote over the weekend?

Comments are fast and furious – many gloating and playing games, but where is the long-term solution?

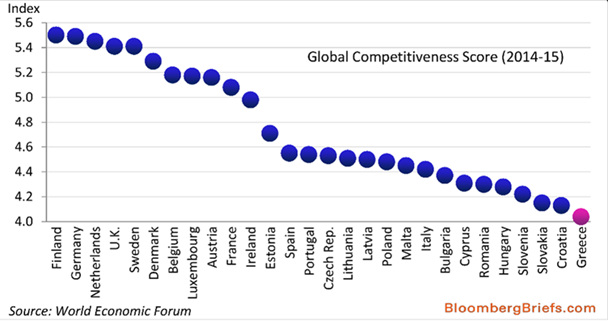

The solution where Greece gets a haircut but also make real commitments to redefining a new Greece. Syriza showed how powerful it is in an environment of “pretend-and-extend” from Europe, but the same “pretend-and-extend” is now dead. The change of macro policies always comes from failing. This is one of the biggest failings in Europe history.

The Plan A was to do pretend-and-extend. Plan B was to use “carrot and sticks” – and Plan C – was not to have a plan! Having no plan is not a plan, as it’s pretty obvious now, but its good news in the sense that someone now needs to own up to the loss, which has been moved forward and forward with no reforms, no structural changes and with no hope.

Zero hope, Zero reform and Zero willingness to change equals Greece of tomorrow, with no access to finance, very few friends and a future which is, if possible, is even more dire.

Tragedy without solution

Europe on the other hand also lost – my classic argument since day one: The Greek tragedy is one without solutions. No winners, only losers. Europe looks inflexible and stubborn. Clearly, us finance people understand and mostly agree with the medicine prescript, but at all times any policy needs to embedded in democracy and in the ability of carrying through on the plan. Europe, as often before, did not fail but played for broke.

Syriza and Greece, however, probably lost more. The mere idea they will have a new deal in 24 hours is pure fantasy as it has been every week when finance minister Varoufakis promised us a plan 'by next week'.

Like Europe, however, Greece does not have a Plan B or Plan C. All it has is rhetoric – which reminds me of Eastern Europe before 1989.

I love sports analogies as much as most people hate them: This is a football match being played without referees and rules now. Either team can claims to have won: Greece is claiming they made the highest amount of free kicks and that three free kicks against them equals a goal for Greece, while the EU and ECB claim the fact they had more corners than Greece make them the winners. The point of course with no rules and no referees, it's anybody’s call, but of course, in a regular match these two sides drew nil-nil.

To show how the two sides continues to ignore them both have lost, here are a few headlines:

Hardly, if you read official Europe quick response and put it in the context of the comments and front pages before the referendum:

Then The Guardian front page the other day: Hardly an open invitation!

Not that Bild is Germany, but 89% say no.

Anyone who thinks German finance minister Wolfgang Schäuble is unpopular needs to reads this German-language article in the Frankfurter Allgemeine: Alle hassen Schäuble, niemand hasst Deutschland (Everyone hates Schäuble, one hates Germany).

The first bank to comment: JP Morgan base case is now Grexit.

This, however, is what we should be talking about: A Greece that lost it ways and sees no alternative to “revolution”…

The IMF opened a new “flank” with a dose of reality.

Conclusion:

Consensus is surprised by election

Illiquidity is the big risk

Grexit is now the base case

There is 25% chance of Europe finding the “geopolitical situation” so important that they extend help to Greece despite harsh words – but still 75% against

Market will see 5% drop in equities, 20-50 in fixed income spread expansion, Eastern Europe will hurt more, uncertainty has increased (which markets never like), Greece banks will most likely remain closed, EURUSD should drop 2-3 figures at the most, and it is a screaming buy, now we have “reality” vs. talk, talk

Pretend and extend has now died. Hopefully it has been replaced with a normal business cycle, normal ebbs and flows. But first politicians will try to save face by trying to do just one more rounds of pretend-and-extend, but the patient has died.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.