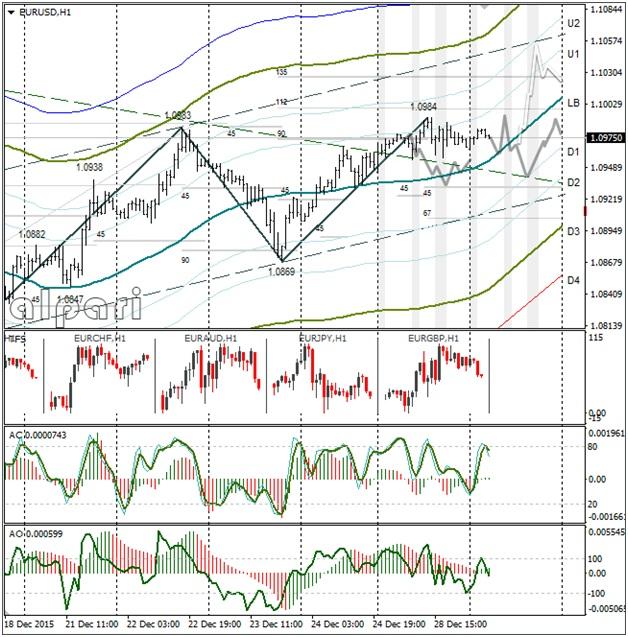

EURUSD 1H

Yesterday’s Trading:

The DXY on Monday sat in a 97.80 – 98.05 point range. The euro/dollar was consolidating in a 1.0955 – 1.0985 range. The ranges were narrow due a fall in trading volumes throughout the day. Many traders closed their positions before Christmas and this meant a fall in market liquidity.

Main news of the day (EET):

- 17:00, US consumer confidence.

Market Expectations:

As New Year approaches, trader activity remains low. However, this does not mean that currency rates will sit in sideways trends until 4th January. I’ve included a graph of the euro/pound in the analysis today. It should help us find the vulnerable spot for the euro/dollar.

The calendar is empty, so a spike in volatility is likely to occur through the cross rates. On the cycles I have the euro/dollar down in the first half of the day and only on the American session seeing a storm of the daily trend line.

Technical Analysis:

Intraday target maximum: 1.0988, minimum: 1.0941, close: 1.0983;

Intraday volatility for last 10 weeks: 101 points (4 figures).

The euro/dollar has been in a sideways for 16 hours on the hourly. The consolidation range is shrinking. The pair is readying to undergo some sharp fluctuations so as to stray from the LB. I think that as soon as the euro drops to the LB, the oscillator stochastic will return to the buyer zone.

Keep an eagle eye on the euro/pound cross since, if it passes the 0.7350 support, it won’t be worth expecting to see any EUR/USD growth. Due to a weakening of the USD, the GBP/USD will shoot upwards and the euro will stay in its sideways. Any strengthening of the dollar will see the market forming a mirror image, the euro will fall to 1.0920 and the pound/dollar will keep trading around 1.4886 if there is any support from the cross.

EURGBP 2H

I added the euro/pound cross because recently it has been hindering me from forecasting the direction of price movement for the euro/dollar and pound/dollar. After the fall to 0.7306 on 23rd December, the pair has flipped into a consolidational phase. The pair has been in an upward corridor for 55 hours. This pattern carries with it risks that the euro will strengthen against the pound to the U3 at 0.7441. Keep track of how the price behaves near the lower limit.

If the sellers are able to pass 0.7350, we can forget about both any strengthening of the euro and the storm of the daily trend line for the time being. In the forecasts I have shown how the price could move if it leaves the corridor.

Daily

The bulls have been trying to break the trend line, but so far have not managed it. The buyers are gathering pace. As soon as all of the indicators on the graphs are in the euro buy zone, a storm of 1.10 will begin.

Weekly

The euro bulls need to pass 1.1160 to start the facilitation of a double bottom pattern. If there is a closing of the price above 1.1030, expect to see a correctional growth in Q1.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.