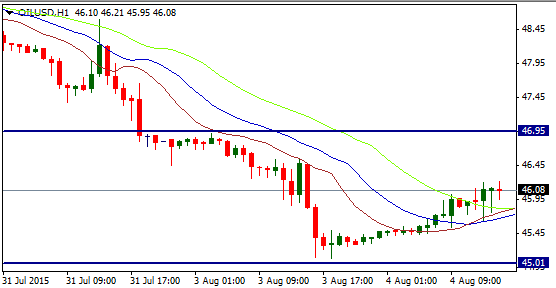

Market perception still sees overall supply very high as there continue to be new findings of oil fields and drilling operators are becoming more efficient and lowering extraction costs. WTI started the week yesterday on a low closing down at $45.29 from Friday’s close of $46.78, indicating new lows may continue to develop. Tomorrow’s data is forecast at -1 million barrels and although a negative number it shows signs of increased supply. If the number released is much higher than expected it may send the market lower, if the number is lower than expected (more negative) it may send the market higher.

Overall the market for Oil still looks depressed and the downward trend, apart from slight corrections, seems to be well in place. The options market also indicates oil is more likely to fall in 2015 (according to Reuters).

Trading WTI OIL

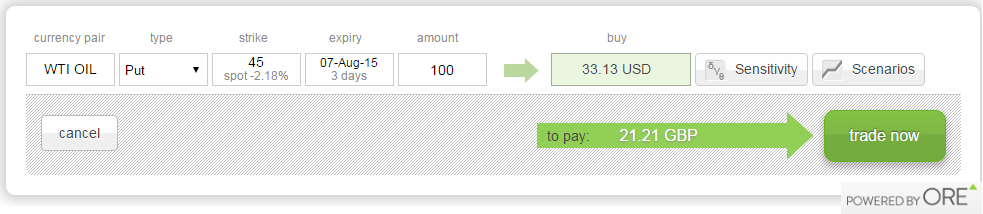

If you think the EIA's data tomorrow will be higher than expected and Oil prices will continue trending down this week, to take advantage of lower prices you may buy a Put, which gives you the right to sell Oil at a determined price within a set period. When trading on ORE’s Web-Platform, from the add new position page chose WTI OIL under pair, under type select Put, choose an expiry date and under ‘amount’ chose how many barrels you want to sell.For example, you may choose to sell 100 barrels at the predetermined price of $45 until Friday as displayed in the trade image below. This Put option will cost you a premium of 33.13 USD, this is also your maximum risk in the trade.

If the price of oil falls below $45 by Friday the Put option will gain in value and you may profit. If oil does not fall then a limited loss will be made and you cannot be stopped-out of the position.

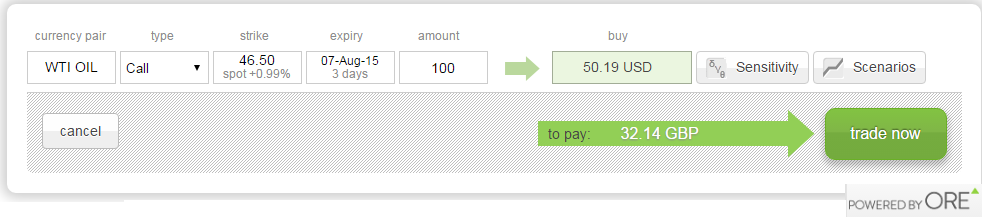

On the other hand if you think Oil is set for a correction in price and will rebound to higher prices over the next week, to take advantage of this you may buy a Call which gives you the right to buy Oil at a determined price over a set period.

For example, you may choose to buy 100 barrels at the predetermined price of $46.50 until Friday as displayed in the image below. This Call option will cost you a premium of 50.19 USD, this is also your maximum risk in the trade.

If the price of oil rises above $46.50, the Call option will gain in value and you may make a profit. If Oil does not rise then a limited loss will be made and you cannot be stopped-out of the position.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.