Quick Recap

A huge night beckoned with the release of the FOMC and the solid lead that China handed stock market traders with its late rally yesterday afternoon.

That helped stocks everywhere, except Milan, finish higher at the close of trade. That also augurs well for another good day on the ASX 200.

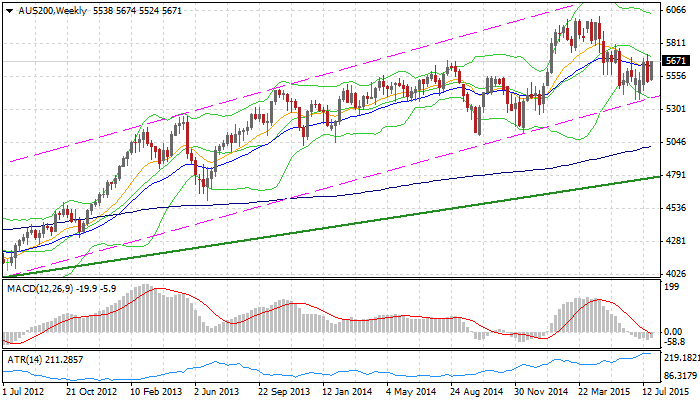

The dailies are a bit messy, but suggest higher prices for the ASX. But if I get in my helicopter I reckon how we end this week is vital to the next leg. Here’s the chart.

Back to the FOMC and I reckon Westpac’s New Zealand based strategist Imre Speizer summed it up nicely. I quoted him at Business Insider. Here is what he said:

The FOMC kept policy unchanged and repeated the economy continues to expand “moderately.” There were no surprises in the language or signals regarding tightening in September. However, the tone was slightly more upbeat than in June, the Fed sounding more confident on the labour market, now noting that that, “a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year” versus, “a range of labor market indicators suggests that underutilization of labor resources diminished somewhat”. The housing market continued to improve, though business fixed investment and net exports remained soft. The inflation outlook remained the same with the FOMC still looking for a move toward the 2% target. Overall, the slight upgrade to the labour market view keeps the September meeting in play.

On forex markets, the US dollar found a little, and it was only a little, strength on the back of the subtle change in language and the fact that September, the next meeting, is now live. That strength may continue for a little while given a number of currencies have had failed breaks against the US dollar, or run into overhead resistance, this week. In the end though it is going to be GDP tonight for the US and the massive data dump next week which will determine if the Aussie, amongst others, can grind higher again.

The overnight scoreboard (9.08am AEST):

- Dow Jones +0.69% to 17,751

- Nasdaqup +0.44% to 5,111

- S&P 500 +0.73% to 2,108

- London (FTSE 100) +1.16% to 6,631

- Frankfurt (DAX) +0.34% to 11,211

- Tokyo (Nikkei) -0.1% TO 20,302

- Shanghai (composite) +3.47% TO 3,790

- Hong Kong (Hang Seng) +0.47% TO 24,619

- ASX Futures overnight (SPI September) +33 TO 5,606

- AUDUSD: 0.7297

- EURUSD: 1.0985

- USDJPY: 123.92

- GBPUSD: 1.5606

- USDCAD: 1.2942

- Crude: $48.89

- Gold: $1,097

- Dalian Iron Ore (September): 406

On the day

On the data front today, we get industrial production in Japan, export prices and building permits in Australia. In Germany tonight, we get the unemployment rate along with the CPI data and EU business and consumer sentiment indices. Then it’s the big one – US GDP.

CHART OF THE DAY: US Oil

It looks like the low might be in for this run. We could see a $1.50 run higher toward my fast moving average at $50.50.

Yesterday we looked NZD break out and said “The high has not broken my slow moving average which is the latest resistance but Kiwi is building to a big move higher it seems.”

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.