- Greece set to default if no bailout agreement is reached

- Focus remains on Greek referendum on July 5

- A vote for “No” likely to cause significant market volatility

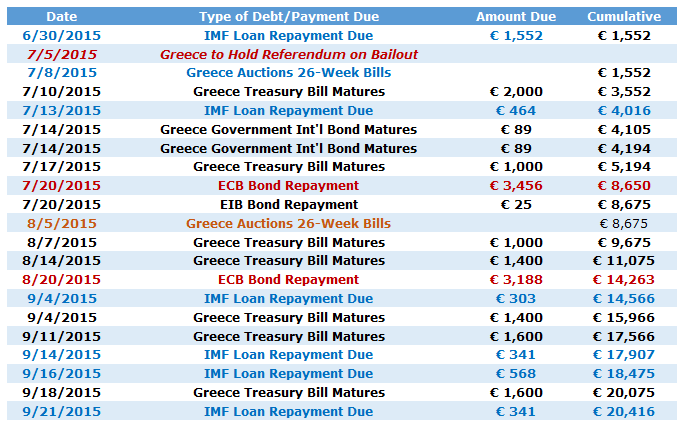

Key Dates for Greece Continue to Warn of Substantial Volatility

Data Source: Bloomberg, Wall Street Journal. Prepared by David Rodriguez

It seems as though the Greek Government has had a critical deadline in every single one of the past number of weeks, and still it remains solvent and a decline in Euro and broader financial market volatility suggests that danger has receded. Yet this is misleading for a simple reason: the central Greek Government has almost certainly run out of funds with which to pay mounting debts. Default is effectively guaranteed if it does not reach an agreement for a bailout extension with the EWG and IMF.

A Greek debt default would likely lead to a much-larger domestic crisis, an exit from the Euro Zone, and the establishment of an alternate Greek currency. This remains the major risk to broader financial markets and systemically-connected economies.

What’s the Most Important Date on the Calendar?

In concrete terms, the single most significant deadline on the calendar is likely the European Central Bank bond repayment due on July, 19—assuming that the Greek Government remains solvent up until that point. Ahead of that, a national referendum on July 5 will also prove potentially pivotal as a number of European leaders claim it is tantamount to a referendum on whether Greece will stay in the Euro Zone.

Current signs suggest that the Greek people will vote “No” and reject the current bailout offer from the Euro Working Group, and volatility is virtually guaranteed on such a result. Such an outcome would send negotiators on both sides back to the table and ostensibly strengthen Greek Prime Minister Tsipras’ hand in negotiations. It is difficult to say that this would make a deal more likely, however, and the stakes would grow ever-larger ahead of the potentially game-changing payment due to the European Central Bank on July, 19.

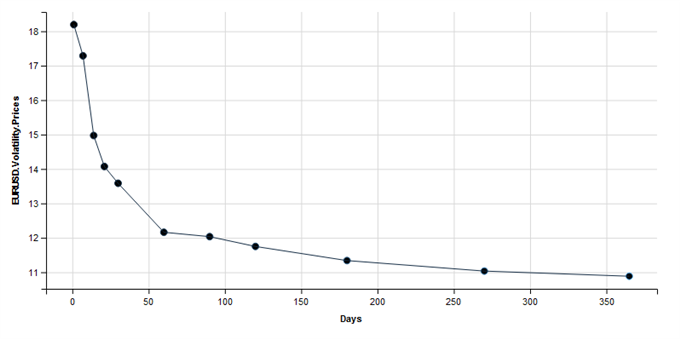

A look at forex market volatility prices for the Euro/US Dollar underlines the sense of urgency: some of the most sophisticated traders in the world believe that the coming four weeks will bring substantially more uncertainty than the coming year.

Euro Volatility Prices Substantially Higher in Near Term than Coming Year

Data source: Bloomberg. Chart source: R, ggvis

Data source: Bloomberg. Chart source: R, ggvisEuro Reactions are Far from Predictable

We’re entering a critical stretch for the ongoing Greek sovereign debt crisis, but the clear difficulty is pinpointing the exact moment at which traders should take extra caution.

If the upcoming referendum does indeed produce a “No” result, we could see substantial Euro volatility and broader financial market turmoil. Heightened sovereign risks could discourage market makers from making prices in EUR pairs, and in effect this means that the Euro could both rally and fall sharply on any news headlines.

Any surprises could force substantial market moves, and traders should limit trading leverage—particularly in EUR pairs—ahead of the key dates. Caution is advised until we see a true breakthrough in negotiations.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.