Focus on central banks, not data I really don’t see how this works. US jobless claims fell sharply, bringing the closely watched four-week moving average down to a new low for this economic cycle. Nonetheless, the fallout from Wednesday’s FOMC minutes predominated and Fed Funds rate expectations simply collapsed – down 10.5 bps in the long end (March 2017). The stock market rout spread from tech and social media to the broader market and the S&P 500 index fell 2.1% to be down for the year, dragging 10yr Treasury yields down 4 bps, and the dollar generally weakened. It’s off its lows, actually gaining against half its G10 counterparts and many EM currencies, but the result is clear – the market is focusing on what the FOMC says, not what the numbers imply. Even the Wall Street Journal, hardly a left-wing publication, said “financial markets are in thrall to central banks rather than caring about the health of the economy.”

Similarly, the market seems to be ignoring the Eurozone data as well. Yesterday saw a slew of Eurozone CPIs for March released and they were generally lower than expected, some flirting with or moving deeper into deflation. France’s CPI slowed to +0.7% yoy from +1.1% (expected: +0.8%), Denmark’s CPI slowed to +0.4% yoy from +0.5% (expected: +0.5%), Netherland’s slowed to +0.1% yoy from +0.4% (expected: +0.3%), and Greece slipped further into deflation at -1.5% from -0.9% (expected: -1.1%), as did Portugal at -0.4% vs -0.1%. Only Ireland saw its rate of inflation accelerate to +0.2% from -0.1%. This makes it harder for the ECB to claim that below-target inflation in the region is due to differences in how they calculate prices in Germany. We will get more data on this matter today, when the final CPIs for Germany and Spain are released. I still believe that eventually the ECB will have to ease policy further, which should provide a leg down for EUR/USD. However, it’s clear that the ECB has a greater tolerance for below-target inflation than I had thought, and this is likely to take longer than expected. If the April inflation data due out on April 30th don’t show any rise in inflation, that may cause more verbal intervention at least from the ECB, but it could take a political jolt from the May elections to focus the Council’s mind on the need to promote growth. Either that, or perhaps the 40,000 Russian troops allegedly massing on the Ukrainian border will eventually impact

Same in Japan, too. I expect the Bank of Japan to come in with another round of easing later this year as the economy slows. Nonetheless, there too the BoJ seems relatively confident in its current path and is in no hurry to change course. We will probably have to wait some time there as well before the authorities decide that they need to add to their stimulus.

A light economic calendar today. We get Germany’s final CPI for March, as mentioned above. The final figure rarely varies much from the initial estimate and so normally is not a big market-mover. The market pays more attention to the preliminary figure, which comes out one day before Eurozone’s CPI estimate. Nonetheless it would confirm the inflation slowdown in Eurozone’s largest economy and in Euro-area in general.

In the US, the PPI rate excluding food and energy for March is forecast to have remained unchanged at 1.1% yoy, while the University of Michigan preliminary consumer sentiment for April is forecast to have risen to 81.0 from 80.0 in March.

We don’t have any speakers on Friday’s schedule.

THE MARKET

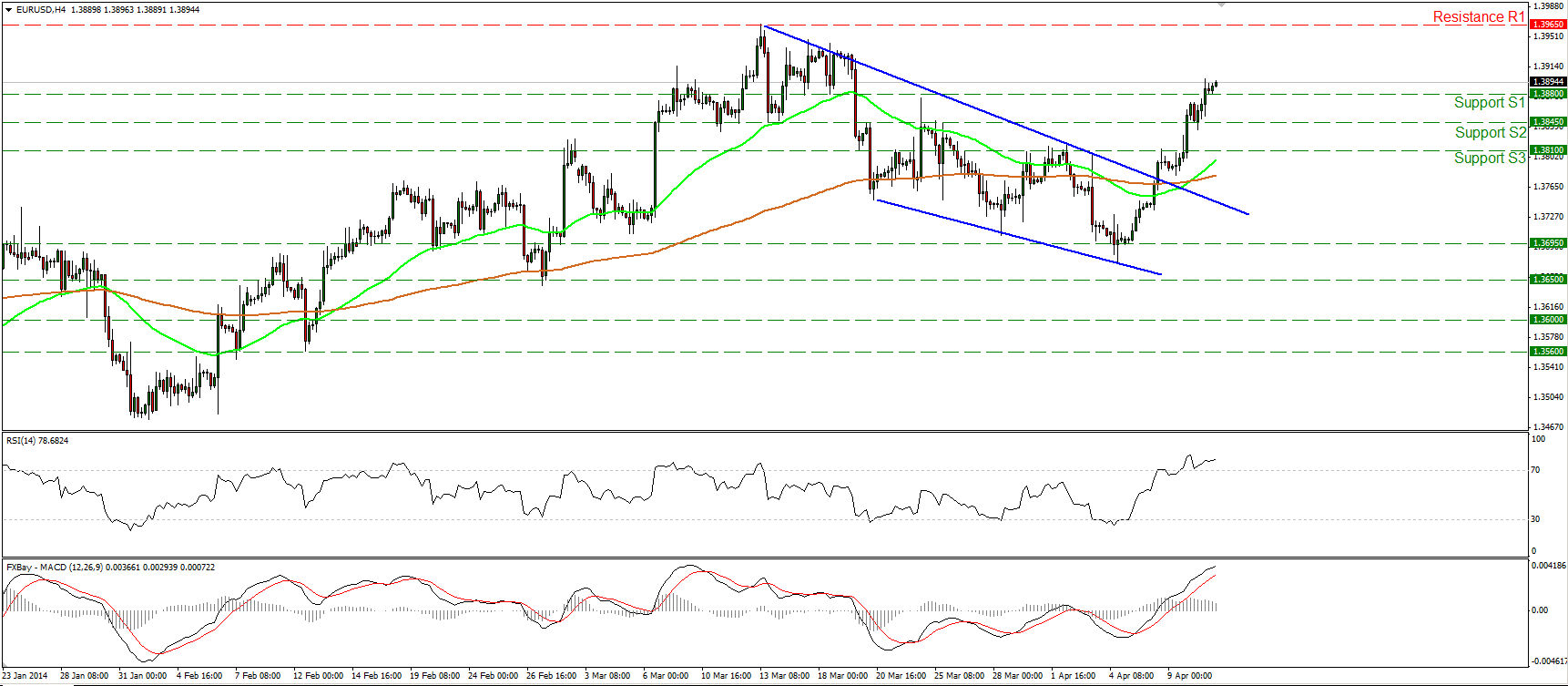

EUR/USD

EUR/USD continued moving higher and managed to overcome the 1.3880 bar yesterday. I would expect such a break to have larger bullish implications and pave the way towards the highs of 1.3965 (R1). As long as the rate is trading above the peak of 1.3810 (S3), I consider the short-term outlook to remain positive. I would ignore the overbought reading of the RSI, since it is now pointing up, indicating that the upside momentum remains strong. In the bigger picture, a clear move above the 1.3965 is needed to confirm the continuation of the longer-term uptrend.

Support: 1.3880 (S1), 1.3845 (S2), 1.3810 (S3).

Resistance: 1.3965 (R1), 1.4000 (R2), 1.4200 (R3).

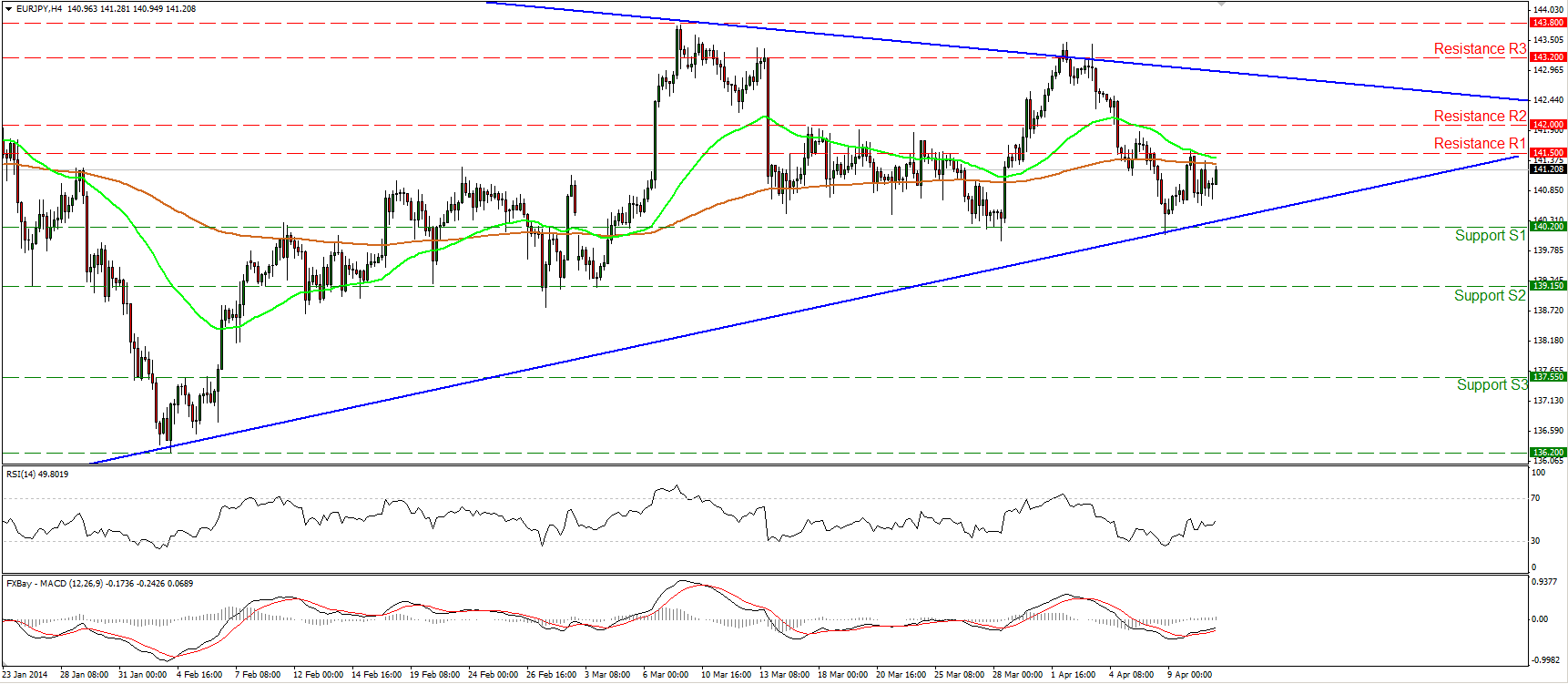

EUR/JPY

EUR/JPY moved higher after finding support at the hurdle of 140.20 (S1). I still consider the overall picture to be neutral since the pair is not in a clear trending mode. Considering that the MACD, although in negative territory, lies above its signal line, the continuation of the upside wave is possible. On the daily chart the rate remains within a triangle formation and only a break out of the pattern could give further indications about the forthcoming long-term directional movement of the rate.

Support: 140.20 (S1), 139.15 (S2), 137.55 (S3)

Resistance: 141.50 (R1), 142.00 (R2), 143.20 (R3).

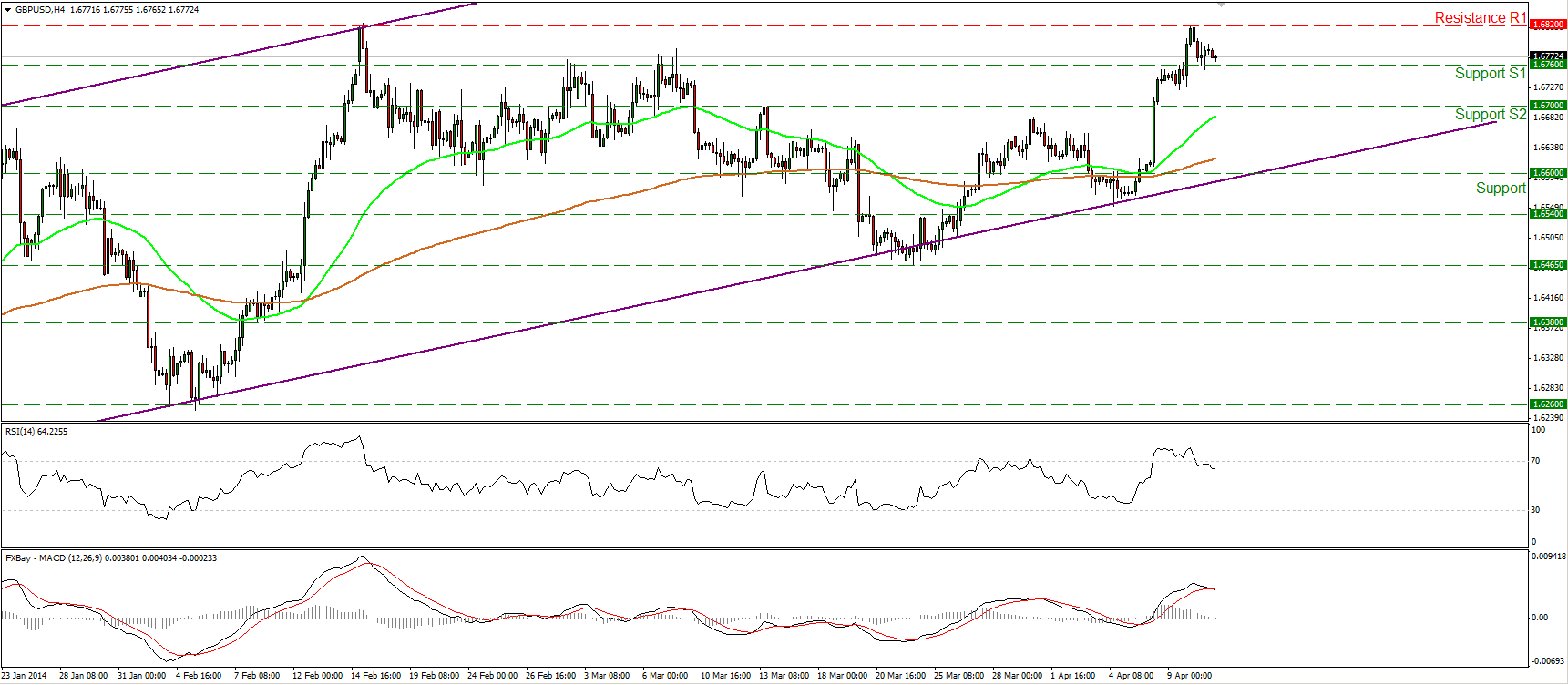

GBP/USD

GBP/USD retreaded after hitting the resistance of 1.6820 (R1) to challenge the 1.6760 (S1) bar as a support this time. The short-term picture remains positive and a clear violation of the 1.6820 (R1) hurdle may trigger extensions towards the next resistance at 1.6885 (R2). However, considering that the RSI exited overbought conditions and the MACD crossed below its signal line, I would not exclude the continuation of the pullback. In the bigger picture, cable remains within the upward sloping channel, keeping the long-term outlook to the upside.

Support: 1.6760 (S1), 1.6700 (S2), 1.6600 (S3).

Resistance: 1.6820 (R1), 1.6885 (R2), 1.7000 (R3).

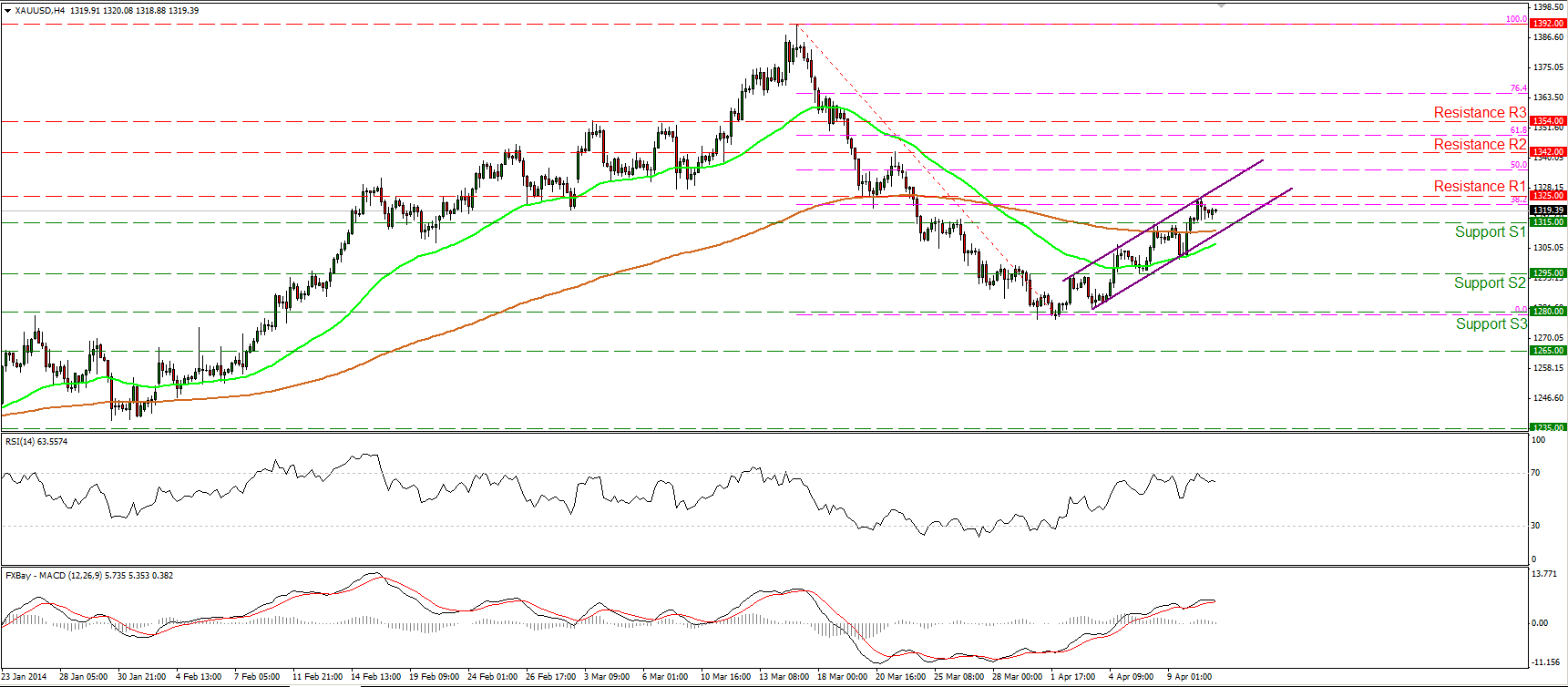

GOLD

Gold moved higher to meet the resistance zone between the 1325 (R1) bar and the 38.2% retracement level of the 17th Mar. - 1st Apr. short-term downtrend, also near the upper boundary of upward sloping channel. As long as the precious metal is printing higher highs and higher lows within the short-term upside channel, the picture remains positive, but I would wait to see if the bulls are strong enough to overcome the aforementioned resistance zone before expecting further upside extensions.

Support: 1315 (S1), 1295 (S2), 1280 (S3).

Resistance: 1325 (R1), 1342 (R2), 1354 (R3)

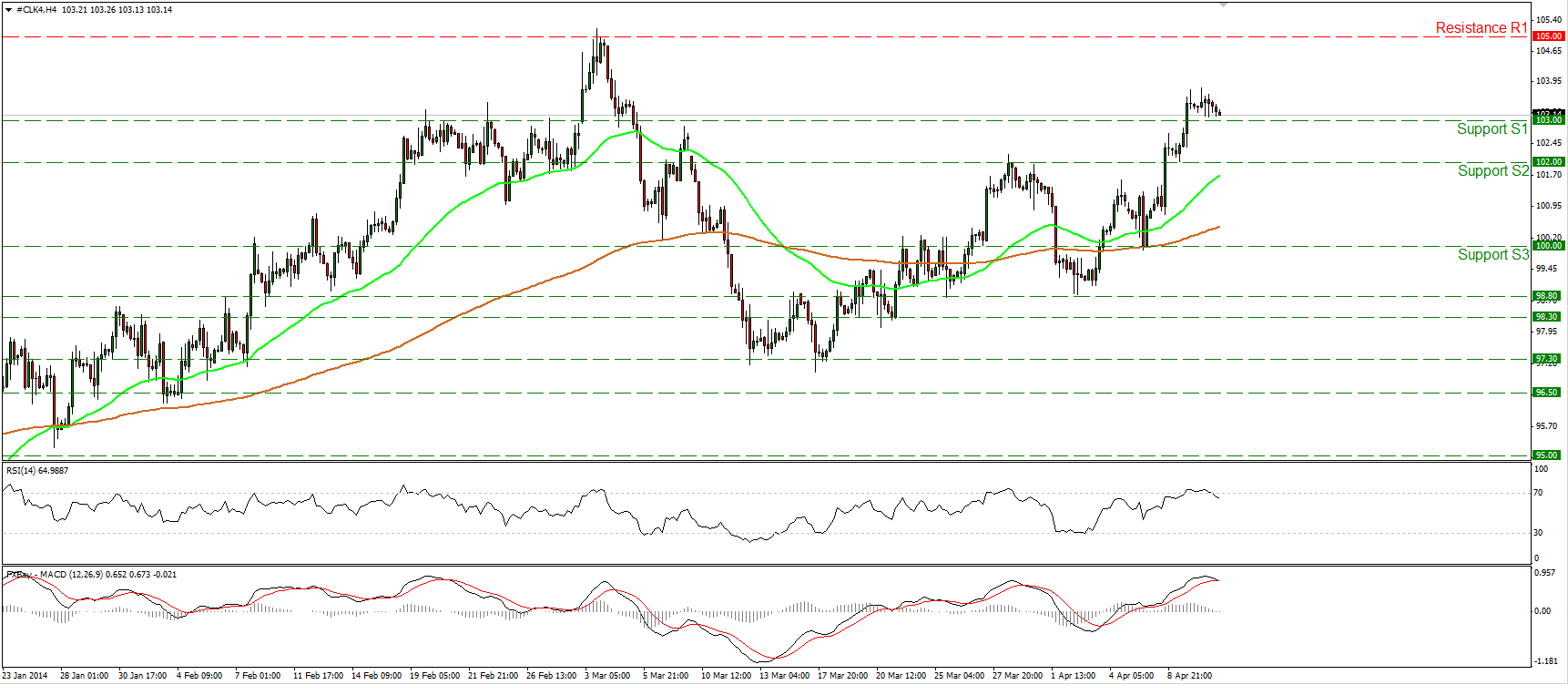

OIL

WTI pulled back and is now trading slightly above the support bar of 103.00 (S1). Considering that the RSI fell below its 70 level and the MACD shows signs of toping, I would expect the price to overcome that support barrier and extend the corrective phase maybe towards 102.00 (S2). Nonetheless, the price path remains to the upside since the structure of higher highs and higher lows remains in effect.

Support: 103.00 (S1), 100.00 (S2), 100.00 (S3)

Resistance: 105.00 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.