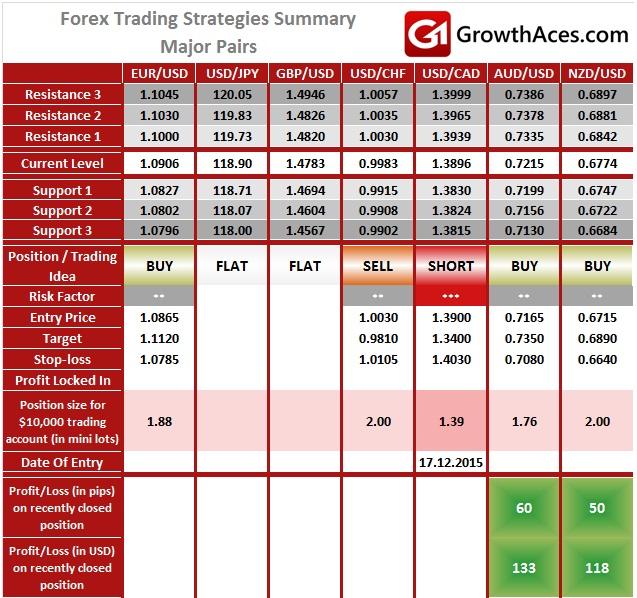

MAJOR PAIRS:

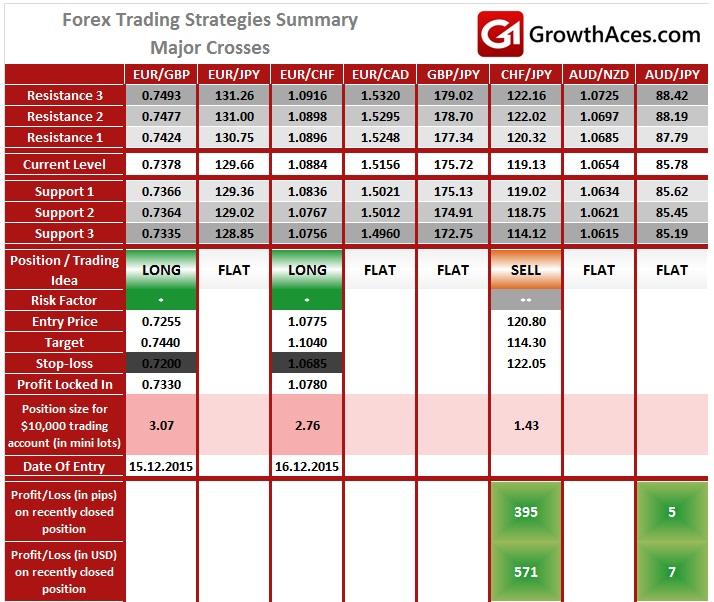

MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty).

5. Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

6. Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

EUR/USD: Eyes On US ISM Today

The Fed's vice chairman Stanley Fischer said at the American Economic Association conference: “One possible concern about our unconventional policies has eased recently, as the Fed's normalization tools proved effective in raising the federal funds rate following our meeting two-and-a-half weeks ago.” A key topic at the conference was the so-called equilibrium real interest rate: the level of borrowing costs associated with stable inflation and full employment. The debate over this rate appears set to be a defining focus for the Fed in 2016, as policymakers seek to raise rates quickly enough to head off the threat of inflation but slowly enough to keep the recovery from losing steam. Fischer said this equilibrium rate, which is key to forecasting by how much the Fed will ultimately tighten policy, is now around zero and is likely to remain low for the "policy-relevant future."

Cleveland Fed President Loretta Mester, a somewhat hawkish policymaker who regains a vote on US monetary policy this year, said the Federal Reserve's interest rate hike last month was a prudent first step to a more normal policy era and it signaled the central bank's confidence that the US economy will continue to improve. Mester was fairly bullish on the economy's prospects. She predicted "above trend" GDP growth of 2.5 to 2.75% for the fourth quarter of 2015 and for all of 2016, and an inflation rebound as the effects of weak commodities and the strong dollar wane. Mester also predicted wage growth and a further improvement in the US labor market. That optimism allows her to view more than four rate hikes as appropriate, she said.

In our opinion the EUR/USD will rise this year. We expect stronger recovery in the EUR/USD in the first quarter of 2016, as in our opinion the Fed next hike will take place later (in April) than current market consensus (March). However, the pace of Fed monetary tightening could be higher in the second half of the year and we think that four rate hikes, as it is currently assumed by Fed policymakers, are possible next year. The second half of 2016 should bring us better growth data and much higher inflation in the Eurozone. This may trigger discussion about ending the ECB QE programme. That is why we expect the EUR/USD to continue its rise despite interest rate hikes in the US. Our EUR/USD 2016-end forecast is 1.20.

The most important event today will be the release of US ISM manufacturing index (15:00 GMT) for December. The market expects a reading of 49.0 vs. 48.6 in November.

An important support area on the EUR/USD chart is 1.0795/1.0805 (lows on December 18, December 17 and December 7 and 50% fibo of 1.0539-1.1059 rise). Another important support level is near 1.0860 (38.2% fibo of 1.0539-1.1059 rise). We have placed our EUR/USD bid slightly above this level, at 1.0865.

CHF/JPY: China Sell-Off Sent Yen Higher But Franc Remained Weak

The Caixin/Markit China Manufacturing PMI slipped to 48.2 in December, below market expectations for a slight pick-up to 49.0 and down from November's 48.6. The reading was the lowest since September, remaining well below the 50-point level which demarcates contraction from expansion on a monthly basis. The survey focuses more on small and medium-sized private firms. An official survey on Friday, which looks at larger state-owned companies, showed a fifth month of contraction though at a slightly more modest pace of 49.7.

A renewed stock market selloff in China sent currency traders running for the traditional security of the Japanese currency. What is important another safe-haven currency, the Swiss franc, remained weak. As a result, the CHF/JPY fell strongly and hit the target of our short position (opened at 123.15).

In our opinion the CHF will be the weakest currency among major currencies in 2016. The Swiss National Bank reiterated that the CHF is strongly overvalued and the bank is ready to intervene in the currency market if necessary to weaken the franc. SNB Chairman Thomas Jordan said the SNB had no limit on how much it could grow its balance sheet in order to weaken Switzerland's currency. He said: “We do not rule out another rate cut.” Switzerland's export-reliant economy has avoided an anticipated recession in this year but stagnated in the third quarter due to the franc's fall. In our opinion Swiss economy will not recover without significant depreciation of its currency. A further rate cut by the SNB is not our baseline scenario, but even current rate level makes the CHF attractive funding currency for carry trade.

On the other hand, we expect slightly stronger yen in the coming year. After recent fine-tuning of the BOJ policy, we do not anticipate further easing steps in Japan.

Our CHF/JPY trading strategy will be to sell again near 10-day exponential moving average (currently at 120.93). The nearest support level is at 118.75. Breaking below this level will open the way for further drop to 114.12 low on January 14.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.