EUR/USD: It Is Finally Done!

The Federal Reserve raised its target rate by 25 bp. The decision, which was unanimous, was explained by the considerable improvement in the labor market, confidence in rising inflation rates, and the lag with which monetary policy works.

In conjunction with the statement, the Fed released an update of its Summary of Economic Projections. Compared to September, there were barely any revisions to the growth, unemployment and inflation forecasts. The FOMC members’ median interest rate projections (the “dots”) for 2016 were also left unchanged, as was the longer-term dot at 3.50%. The median dots for 2017 and 2018, on the other hand came down by about one rate hike.

As pointed out repeatedly over the past several months, we think that this first step of the policy normalization is more than justified given the significant progress made in the labor market and the pick-up in underlying inflation rates. And even after yesterday’s move does the policy stance remain more accommodative than it was at the height of the financial market crisis, after the bankruptcy of Lehman Brothers.

The rate hike was not quite as “dovish” as some market participants expected. To be sure, several FOMC members lowered their interest rate projections. But only the median dots for 2017 and 2018 came down by some 25 bp. The language of the statement was rather sanguine as well. In particular, it emphasized that the “underutilization of labor resources has diminished appreciably since early this year.” The tone on inflation, on the other hand, was more cautious. The statement mentioned the decline in survey-based inflation expectations and added the following important sentence, introduced by Chair Yellen in her speech earlier this month: “In light of the current shortfall of inflation from 2%, the Committee will carefully monitor actual and expected progress toward its inflation goal.” The addition of “actual” is an important shift from the previous language, which had solely focused on medium term expectations. In other words, the Fed soon wants to see a pick-up in inflation rates to materialize.

With today’s rate hike, the focus of the monetary policy debate is inevitably shifting to the medium-term trajectory for interest rates. And the main word used to describe the likely rate hike path is “gradual”: “The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen.”

However, as we have learned over the past several years, any type of forward guidance is only as good as the underlying economic forecast. Chair Janet Yellen herself emphasized earlier this month that “the actual path of monetary policy will depend on how incoming data affect the evolution of the economic outlook.” Today’s statement added: “In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2% inflation.” A more prominent role in that context has now been assigned to the actual inflation development: ”In light of the current shortfall of inflation from 2%, the Committee will carefully monitor actual and expected progress toward its inflation goal.” The one issue that we see here is how this progress will be monitored. If the Fed continues to place a disproportionately large weight on the core PCE deflator, it will in our view inevitably underestimate inflation dynamics. Other measures, such as the core CPI or trimmed-mean inflation measures do, after all, already is close to 2%.

In addition to actual inflation and labor market developments, the monetary policy path will also be shaped by the reaction of financial conditions, such as equity prices, credit spreads, the USD and yields, to rising short-term rates. Vice Chair William Dudley highlighted repeatedly, and most recently in mid-November that “if financial conditions were to tighten more than expected when we began to normalize monetary policy, then I suspect we would go more slowly. In contrast, if financial conditions did not respond at all, or eased, then I suspect we would go more quickly, all else equal.” As we do not anticipate financial conditions to tighten much further from here, the Fed in our view will have some room to continue its policy normalization over the coming quarter. We expect three rate hikes for 2016 and the next one in April.

The USD hit a two-week high against a basket of major rivals today after the US Federal Reserve raised interest rates and signalled four more hikes are to come next year. The EUR/USD fell to as low as 1.0832. The USD appreciation was not sharp, but it was quite surprising, given the hike was widely expected. We do not expect a strong appreciation of the USD, because if we do see it, the Fed will react to that by postponing rate hikes. However, the EUR/USD broke below the 10-day ema at 1.0891, which is a bearish signal and further falls in the short-term cannot be excluded.

Traders in Europe were focused today also on German Ifo business climate index. The Ifo index inched down to 108.7 in December from 109.0 in November. The reading was slightly below the market forecast of 109.0.

GBP/USD: Key Support At 1.4897

British seasonally-adjusted retail sales volumes in November alone jumped by 1.7% from October, more than triple the median forecast of 0.5% rise. Retail sales rose by 5.0% yoy, also well above expectations.

For the three months to November as a whole, which also included strong September data, sales were 5.3% up on the previous year, the biggest increase since March.

The underlying picture for British retail sales has been tricky to discern in recent months due to one-off effects linked to the timing of a late summer public holiday as well as this year's Black Friday sales promotions. Black Friday discounts have only recently become common in Britain, and they have tended to concentrate into a few days sales which previously took place over several weeks in November and December.

The GBP/USD dropped after yesterday’s Fed decision and is close to retracing the bounce from 1.4897. Our long is under threat. If the support at 1.4897 is broken, the next support will be daily low on April 21 at 1.4857.

NZD/USD Received A Brief Boost After New Zealand’s GDP

GDP rose a seasonally adjusted 0.9% in the third quarter, above market forecast of a gain of 0.8%. Growth was 2.3% on the year, in line with market expectations. It was the highest level since the third quarter of 2014, driven by growth in the service industries and manufacturing.

The service industries collectively grew 0.9% in the quarter, driven by increases in business services, retail trade and accommodation, and transport services. Manufacturing grew 2.8%, due to the largest increase in food, beverage, and tobacco manufacturing since March 2012. Production, domestic consumption, and exports of food and beverage products all increased. The construction industry was down 2.9%, driven by heavy and civil engineering construction, which reflects lower investment in other construction.

Improved growth rate provides the Reserve Bank of New Zealand some breathing space and further reduces the already-low chance of another cut in interest rates. Last week the central bank cut its benchmark interest rate to match a record low of 2.50% and virtually shut the door on further easing, saying it expected to achieve its inflation target without more monetary stimulus.

The NZD/USD rose in reaction to the data. But the kiwi was unable to sustain the gains due to broad strength in its US counterpart.

We keep our long NZD/USD position opened at 0.6760. Our medium-term outlook is bullish.

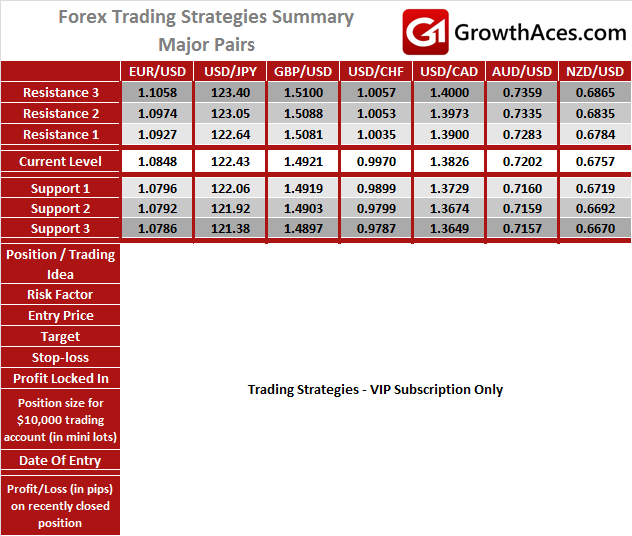

MAJOR PAIRS:

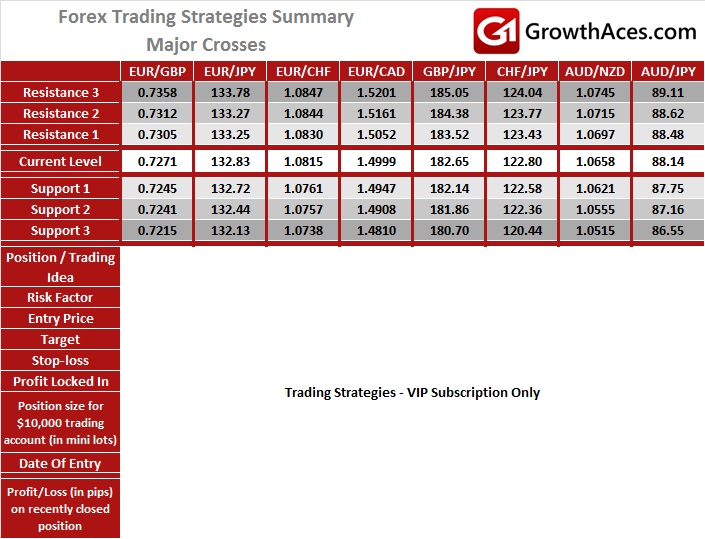

MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level. LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

6. Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.