GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/USD: long at 1.0950, target 1.1200, stop-loss 1.0850, risk factor **

GBP/USD: (Full Access - VIP Subscription Only)

USD/JPY: short at 121.00, target 118.10, stop-loss 121.80, risk factor **

USD/CHF: (Full Access - VIP Subscription Only)

USD/CAD: short at 1.3195, target 1.2850, stop-loss 1.3340, risk factor **

AUD/USD: (Full Access - VIP Subscription Only)

EUR/GBP: long at 0.7150, target 0.7290, stop-loss 0.7085, risk factor **

Pending Orders:

NZD/USD: (Full Access - VIP Subscription Only)

EUR/CHF: (Full Access - VIP Subscription Only)

AUD/NZD: (Full Access - VIP Subscription Only)

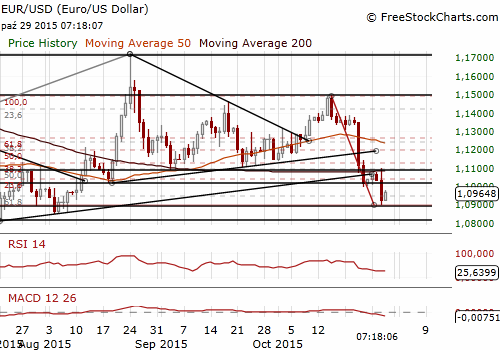

EUR/USD: US GDP Will Set The Direction

(long at 1.0950)

The Federal Reserve kept interest rates unchanged on Wednesday, but downplayed global economic headwinds and left the door open to tightening monetary policy at its next meeting in December. A statement said the Fed would seek to determine "whether it will be appropriate to raise the target range at its next meeting" by monitoring the progress on employment and inflation. It marked the first time in seven years of record-low rates that the central bank has raised the possibility that it could raise its benchmark rate at its next meeting. Richmond Fed President Jeffrey Lacker (a hawk) dissented today for the second consecutive meeting.

The statement strengthens our expectations that the Fed will hike in December.

Many investors are still not convinced about a lift-off in December given a recent run of soft US data, making economic releases in coming weeks, starting with the advance reading of US GDP (12:30 GMT), more crucial in determining the a December move.

In the opinion of our economists the advance estimate of third-quarter GDP will show 1.3% annualized expansion, from 3.9% in the second quarter. Our GDP forecast is below the market consensus of 1.6%. The slowdown is likely mainly due to a sizable inventory correction and, to a lesser extent, a drag from net exports.

While the Fed is preparing the ground for an eventual lift off in interest rates from record lows, the European Central Bank is widely expected to add to its ultra-loose stimulus before the end of the year to boost inflation and growth. Significant fall in the EUR/USD in recent days suggests that the market treats monetary easing in the Eurozone as a done deal. However, in our opinion hawkish Fed may prevent the ECB from easing its policy further in December or the scale of easing will be irrelevant and only symbolic. That is why today’s German preliminary inflation data (13:00 GMT) will be very important for financial markets. It is expected that German consumer prices harmonised to compare with other European states climbed by 0.1% yoy in October after dropping by 0.2% yoy last month.

We went EUR/USD long at 1.0950 yesterday, in line with our trading strategy. Weaker US GDP data or higher German CPI are likely to support our bullish position. The target of our long is 1.1200, which is 50% fibo of 1.1495-1.0896 fall. The nearest significant resistance level is 1.1097 high on October 28.

Significant technical analysis' levels:

Resistance: 1.1097 (high Oct 28), 1.1112 (200-dma), 1.1139 (high Oct 23)

Support: 1.0896 (low Oct 28), 1.0855 (low Aug 7), 1.0847 (low Aug 5)

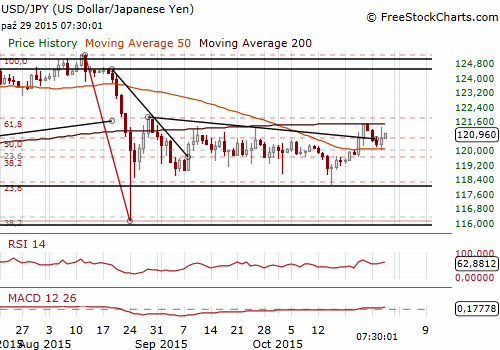

USD/JPY: Will Steady BoJ Outcome Support The JPY?

(short at 121.00)

- Japanese factory output rose 1.0% mom in September after two straight months of declines. The reading was higher than the market forecast of 0.5%. Manufacturers' surveyed by the Ministry of Economy expect output to rise 4.1% in October and slip 0.3% in November. The turnaround reduces pressure on the Bank of Japan to expand its already massive stimulus programme on Friday.

- Labor and inflation data are scheduled for today (23:30 GMT) in Japan, but market focus will be mostly on the BoJ meeting outcome (3:00 GMT on Friday).

After surprisingly dovish ECB press conference last Thursday pressure has increased for an expansion of QQE in Japan as early as at this meeting but the final result remains very close. Should the BoJ pull the trigger, we expect a sizeable negative response by the JPY. However, it is not our baseline scenario. We expect a steady outcome that should be JPY positive.

The scope for the JPY appreciation may be limited even in case of steady outcome, because the BoJ will release an updated semiannual outlook and will very likely lower its still optimistic view on the Japanese economy.

However, the revision in forecasts may be moderate. BoJ officials are arguing that resilience in private consumption and capital expenditure would offset some of the pain from weak demand for exports. Many of them expect Japan to emerge from the stagnation next year as the hit from China's slowdown recedes.

Kuroda has said he sees no immediate need to ease further, stressing that a tightening job market will lead to wage gains and boost consumption, helping Japan generate modest inflation. Not all board members share Kuroda's optimism, but many are wary of expanding the already massive stimulus programme, preferring to stand pat unless weak global demand hits corporate profits enough to discourage them from raising wages.

The BoJ is likely to cut its core consumer inflation forecast for the fiscal year that began in April in a semi-annual report. It forecast inflation of 0.7% three months ago. But the bank may still keep its forecast for the next fiscal year near the target. This would mean that the BoJ is still broadly on course to meet its inflation goal of 2% next year without needing to step up its massive asset purchase programme.

We went USD/JPY short at 121.00 after the Fed statement yesterday. The nearest support level are 120.17 low on October 27 and 10-day exponential moving average at 120.11. Breaking below these levels will open the way for stronger falls towards our target of 118.10

Significant technical analysis' levels:

Resistance: 121.15 (session high Oct 29), 121.25 (high Oct 28), 121.51 (high Oct 26)

Support: 120.58 (session low Oct 29), 120.17 (low Oct 27), 119.62 (low Oct 22)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.