GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/JPY: long at 86.80, target 89.80, stop-loss at 86.10, risk factor **

AUD/NZD: (Full Content - VIP Subscription Only)

Pending Orders:

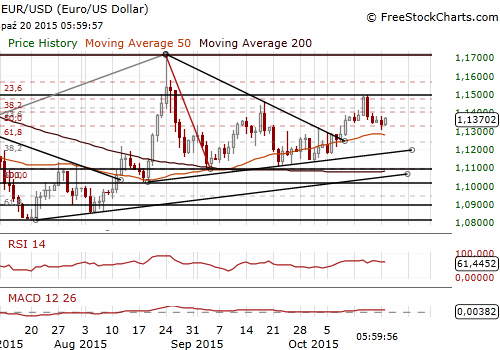

EUR/USD: buy at 1.1345, target 1.1550, stop-loss 1.1285, risk factor *

GBP/USD: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

USD/CAD: (Full Content - VIP Subscription Only)

AUD/USD: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/JPY: (Full Content - VIP Subscription Only)

EUR/CAD: (Full Content - VIP Subscription Only)

EUR/USD: Expectations For Dovish ECB Are Exaggerated

(buy at 1.1345)

San Francisco Fed President John Williams said the Federal Reserve should start raising interest rates in the near future despite strong headwinds from overseas that are holding down inflation. The decision on timing, he said, is a “close call,” with good arguments on both sides.

Three other speeches of Fed policymakers are scheduled for today. President of the New York Federal Reserve William Dudley and Federal Reserve Governor Jerome Powell will speak at 13:00 GMT and Fed Chair Janet Yellen’s speech is scheduled for 15:00 GMT.

ECB governing council member Christian Noyer said late on Monday the European Central Bank's quantitative easing programme was well calibrated and did not need to be adjusted, following similar words from Austrian central bank chief Ewald Nowotny. On the other hand, Bank of Spain Governor Luis Maria Linde said the ECB could extend and modify its asset purchase programme aimed at boosting inflation and growth in the Eurozone.

The EUR recovered from a 10-day low against the USD on Tuesday after opinion from Noyer and Nowotny. Any signs that an extension of the bank's existing programme of quantitative easing, or of a further cut in some of its key interest rates that are all already at or around zero, would act against the EUR. But in our opinion expectations for such a sign are too strong now. It is too early to discuss the extension of current quantitative easing programme, as current programme expires in Septmber 2016. A disappointment in case of lack of dovish hints from the ECB on Thursday may support the EUR. That is why we have placed our EUR/USD bid at 1.1345. If the order is filled our target will be 1.1550.

Significant technical analysis' levels:

Resistance: 1.1420 (high Oct 16), 1.1495 (high Oct 15), 1.1561 (high Aug 26)

Support: 1.1300 (psychological level), 1.1268 (low Oct 9), 1.1233 (low Oct 8)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.