GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: (Full Content - VIP Subscription Only)

GBP/USD: long at 1.5275, target 1.5440, profit locked in at 1.5290, risk factor *

USD/CAD: short 1.3080, target 1.2730, profit locked in at 1.3070, risk factor **

AUD/USD: (Full Content - VIP Subscription Only)

AUD/JPY: long at 86.80, targer 89.80, stop-loss 85.80, risk factor **

Pending Orders:

USD/JPY: (Full Content - VIP Subscription Only)

USD/CHF: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

EUR/CAD: (Full Content - VIP Subscription Only)

AUD/NZD: (Full Content - VIP Subscription Only)

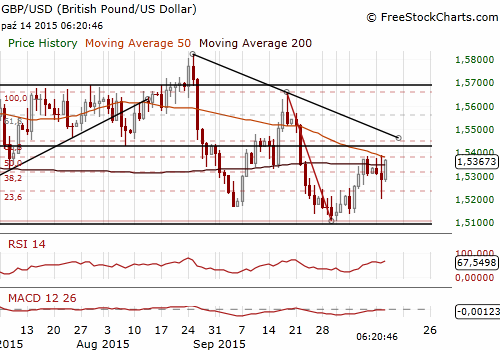

GBP/USD: Long In Good Shape After British Jobs Report

(long for 1.5440)

Britain's unemployment rate unexpectedly fell to its lowest level since mid-2008 in the three months to August. It fell to 5.4%, down from 5.5% in the three months to July and below the market forecast of 5.5%. The number of people in employment jumped by 140k, pushing the employment rate to 73.6%, the highest since records began in 1971, while those unemployed fell by 79k , the biggest fall since the three months to January.

The total earnings of workers, including bonuses, rose by 3.0%, edging up from the three months to July, but short of market expectations of 3.1%. In the month of August alone, total wages in the private sector, which are monitored closely by the Bank of England, rose by 3.5%, slowing from 4.3% in July. Excluding bonuses, average weekly earnings growth slowed slightly to 2.8% in the three months to August, down from 2.9% in the three months to July which was the strongest growth rate in over six years.

British jobs report was mixed – slightly weaker wages growth against lower-than-expected unemployment rate. The GBP/USD had fallen to 1.5285 after investors saw earnings data but it broke above the levels from before the release then.

British consumer price inflation in September dipped back below zero, according to data released on Tuesday. We used a fall in the GBP/USD after CPI data to get long. Our long is in good shape now and our target is 1.5440. The nearest resistance levels are not very strong - 1.5388 high on October 13 and psychological level of 1.5400.

Significant technical analysis' levels:

Resistance: 1.5388 (high on Oct 13), 1.5400 (psychological level), 1.5448 (61.8% fibo of 1.5659-1.5107)

Support: 1.5250 (session low Oct 14), 1.5201 (low Oct 14), 1.5141 (low Oct 6)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.