Growing unemployment in February has been reported today in the EU. Deflation in March slipped but kept on track, driving the euro down. However, we believe that until the Friday Non-Farm Payrolls the common currency will be traded in a range. A number of important macroeconomic indices will be released in the US today: Chicago Purchasing Manager at 15:45 CET and Consumer Confidence at 16:00 CET. The tentative outlook is slightly positive for the American dollar.

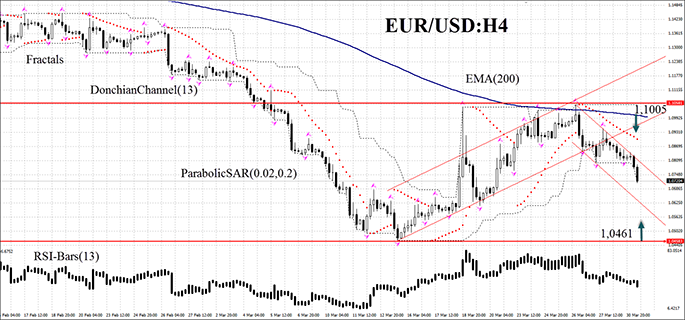

The EUR/USD currency pair escaped the down-trend on the H4 chart and is now traded in a range: 1.1052 – 1.0461. The curve is a little bit below the corridor center and is moving towards the lower boundary. Thus, we do not rule out that until Friday the pair will reach the top or the bottom and rebound back to the middle. If RSI-Bars touches the overbought or the oversold zone that may confirm our assumptions. A sell order may be placed at the moving average – 1.1005. Stop loss may be placed at the Donchian Channel upper boundary and at the local fractal high – 1.1052. A buy order may be located at the flat corridor's bottom – 1.0461 with a stop loss slightly below (at 1.0431 for example). After pending order activation stop loss is to be moved every 4 hours near the next fractal, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes that were not considered.

- Position Sell

- Sell limit above 1,1005

- Stop loss above 1,1052

- Position Buy

- Buy limit below 1,0461

- Stop loss below 1,0431

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.