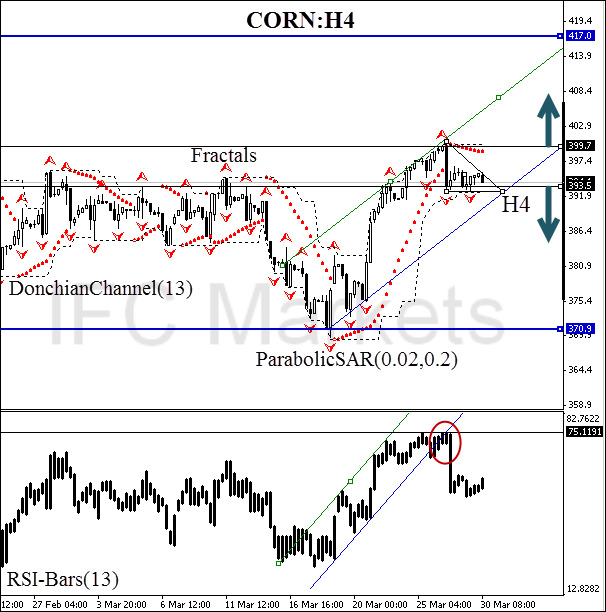

At 16:00 CET on Tuesday US Agricultural Service will release a report on crops evaluating wheat and corn reserves at state and private establishments (link). Investors are loking forward to this report because it will forecast future demand and may boost agricultural futures. Let us consider the consolidating continuous CORN futures on the H4 chart.

The price is in a range in prospect of the fundamental release. Doncian channel doesn't show an incline. The bullish momentum is confirmed by ParabolicSar, which has made a U-turn. Amid consolidation the oscillator signals should be carefully monitored. Despite the trend is keeping its direction, RSI-Bars has breached the support line (see the red mark on the figure above). That means that market is mixed: placing 2 opposite pending orders would be the best tactics. Let us allocate two key levels for that: 399.7 and 393.5. The upper level is confirmed by Parabolic historical signals and the Donchian channel boundary. The support at 393.5 is verified by the bullish “double bottom” pattern and Bill Williams fractals. When the long position is opened, we recommend to pay attention to the oscillator signals. If the ascending momentum is not confirmed by breaching the local overbought zone at 75%, we advise you to place a Stop loss at the break-even point.

When any pending order triggers, the opposite one should be canceled because market is choosing a direction. Stop loss is to be moved every four hours, following Parabolic signals. Thus, we are changing the probable profit/loss ratio for our benefit.

- Position Sell

- Sell stop below 393.5

- Stop loss above 399.7

- Position Buy

- Buy stop above 399.7

- Stop loss below 393.5

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.