Treasury benchmark yields are on course to set a new all-time low in March if they keep rallying at the current pace.

Ten-year yields dropped almost 40 basis points during the past three weeks to 1.66 percent. The record low of 1.379 percent was set in July 2012. Plunging stock prices are driving demand for the relative safety of government debt, while traders abandon bets for the Federal Reserve to raise interest rates. Yields near zero in Japan and Germany are boosting the allure of U.S. Treasuries.

“We’ll see a record low around 1 percent” for the benchmark, said Toshifumi Sugimoto, chief investment officer at Capital Asset Management in Tokyo. “We’ll see more money going into U.S. Treasuries.” Sugimoto, who has 30 years of experience in fixed income, said he’s buying long-term securities and predicts the rally will last through April.

The 10-year Treasury yield was little changed Friday as of 10:20 a.m. in Tokyo, according to Bloomberg Bond Trader data. The price of the 1.625 percent security due in February 2026 was 99 22/32.

The Bloomberg U.S. Treasury Bond Index has returned 3.6 percent this year, while the MSCI All Country World Index of shares has slumped 12 percent.

The odds the Fed will follow its December rate increase with another in 2016 have dropped to 11 percent, from a probability of 93 percent at the start of the year, futures contracts indicate.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

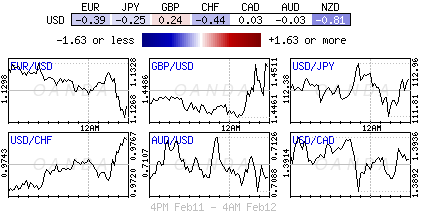

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.