Analysis for July 23rd, 2014

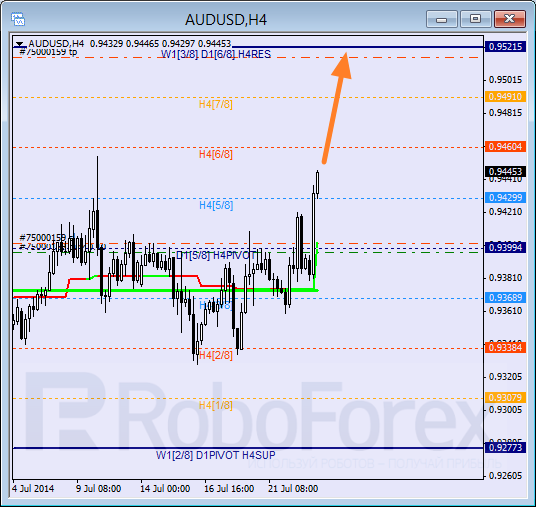

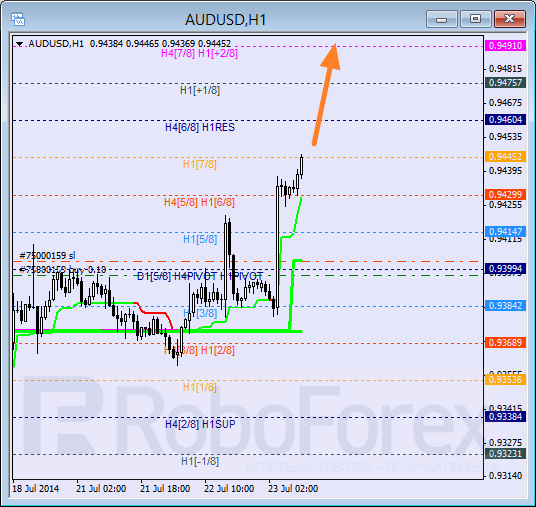

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar was able to stay above Super Trends and now continues its ascending movement, getting closer to local maximum. As upward price movement is rapid, there are some risks that bulls may stop near the 7/8 level. However, if this level is broken, next target will be the 8/8 one.

At H1 chart, price reached the 7/8 level. In the next few hours price may continue ascending movement and break the 8/8 level. Consequently, as price is moving upwards inside “overbought zone”, market may break the +2/8 level and the lines at the chart will be redrawn.

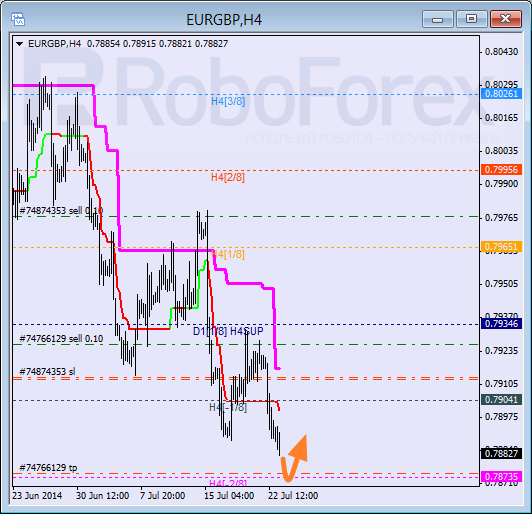

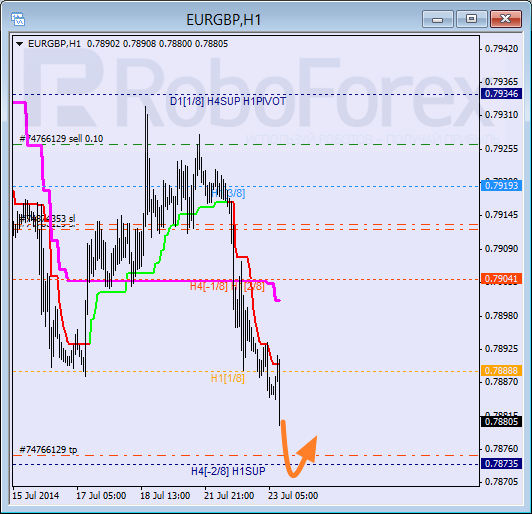

EUR GBP, “Euro vs Great Britain Pound”

Pair is still moving towards the -2/8 level. Probably, during Wednesday price may reach this level. It is more likely that price will start new correction and lines at the chart will be redrawn.

Super Trends formed “bearish cross”, thus, accelerating the quotes falling down. The main target is still at the 0/8 level that price may reach in the next few hours.

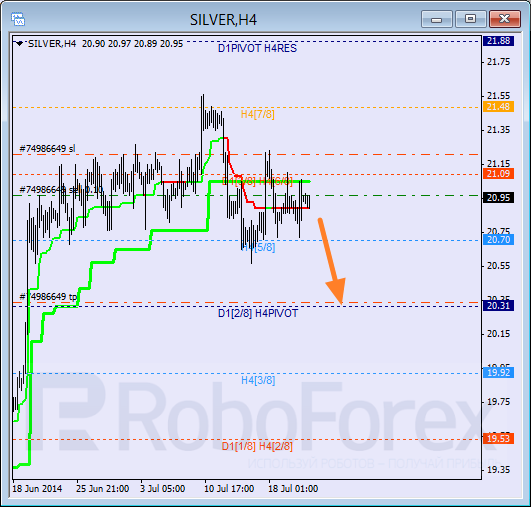

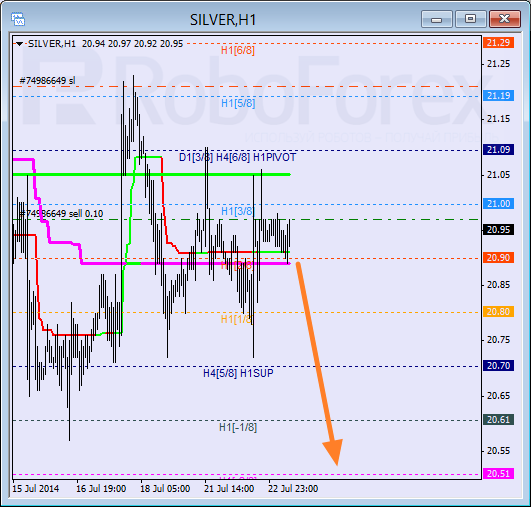

XAG USD, “Silver vs US Dollar”

Silver is still consolidating between Super Trends formed “bearish cross” last week. The price rebounded from the 7/8 level and now may reach the 4/8 level.

At H1 chart, price is moving between Super Trends. Price was not able to stay above the 3/8 level, therefore, descending movement may be resumed. When price is below Super Trends, I am planning to increase short positions.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.