Getting up to Date:

Monday morning and we’re ready for another big week! But first, what happened over the weekend?

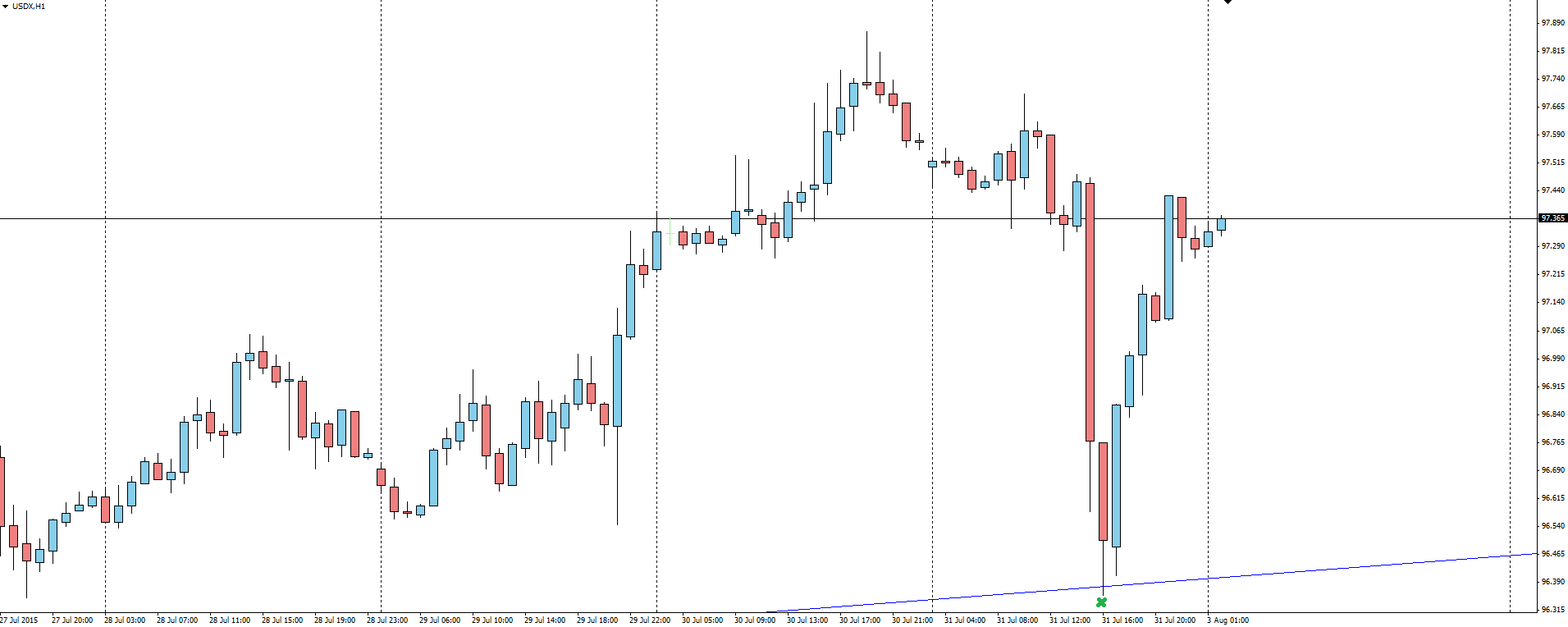

Most importantly, the USDX once again tested major trend line support but kicked off it hard in a volatile Friday night’s trading full of 2nd and 3rd tier data.

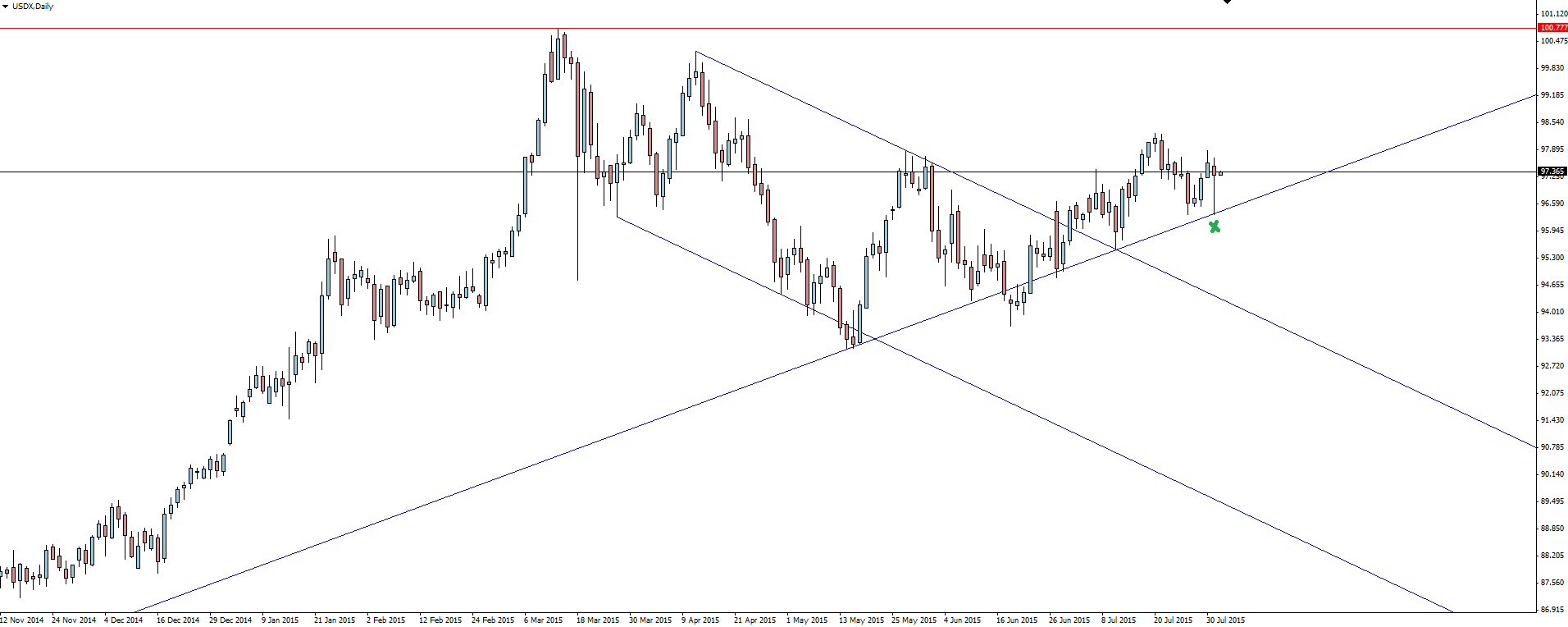

USDX Daily:

Click on chart to see a larger view.

USDX Hourly:

Click on chart to see a larger view.

St Louis Fed President James Bullard was also the first Fed official to give his thoughts on rates since last week’s FOMC meeting.

“We’re in good shape to lift rates in September.”

Bullard went on to speak about the 2nd quarter GDP data miss, saying that even though the Fed had taken a wait and see approach, the number didn’t deviate their opinion on growth. All sounding very positive!

Asian View:

Markets got drip fed a bit of news out of Asia during the weekend with Chinese Manufacturing PMI data and some good old fashioned jawboning from the Bank of Japan’s Kuroda.

Once again, take the Chinese data with a grain of salt but it is being reported that the fall in manufacturing came on the back of some of China’s major companies in the sector experiencing an unexpected drop in demand both home and abroad.

“CNY Manufacturing PMI (50.0 v 50.2 expected).”

China’s solution to all its problems seems to be artificial propping / stimulus, and market analysts are already calling for more.

Speaking of stimulus… With a bit of market chatter around the topic of the BOJ expanding its own stimulus program, in an interview with the Japan News on the weekend, Bank of Japan Governor Kuroda reinforced the central bank’s current policy of QE. Kuroda once again has said that expansion was not on the table and that monetary policy aimed at lifting the economy out of deflation was in fact working as expected.

“At this point, I do not see a need for additional easing.”

“The underlying trend for prices is steadily improving.” he said.”

Once again, a positive in terms of stability and current USD/JPY market direction. Something we will be looking at on Twitter through the week.

Athens Stock Exchange:

Finally, the Athens Stock Exchange reopens for the first time in 5 weeks today, with analysts expecting a volatile day’s trade almost unanimously in the one direction (just a hint, it’s not up).

Takis Zamanis, chief trader at Beta Securities sums it up for me:

“The possibility of seeing even a single share rise in tomorrow’s session is almost zero.”

The resumption of trading in Greek stocks will be the latest step back towards economic normality. Just keep the lead up to the August 20 deadline on your calendar with some EUR/USD twists and volatility from here a certainty.

———-

On the Calendar Monday:

AUD Bank Holiday

“New South Wales has a “Bank Holiday” on the first Monday in August — for bank employees only.”

AUD ANZ Job Advertisements

CNY Caixin Final Manufacturing PMI

EUR Manufacturing PMI’s

GBP Manufacturing PMI

CAD Bank Holiday

“Civic Holiday is the most widely used name for a public holiday celebrated in most of Canada on the first Monday in August.”

USD ISM Manufacturing PMI

USD FOMC Member Powell Speaks

———-

Chart of the Day:

Today’s EUR/USD chart of the day ties in perfectly with the USDX chart above. Looks almost perfectly inverted, showing even through all the Greek turmoil, just how much of a driver Fed policy has been.

EUR/USD Daily:

Click on chart to see a larger view.

I’ve marked Friday’s long wicked candle at trend line resistance to show just how much the US Dollar drives movements in EUR/USD. Compare this chart to the USDX chart above which puts in a long wick this time at trend line support.

Markets don’t care about Greece or the Euro. They care about the US Dollar and its main driver, the Fed.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.