Morning View:

Good Morning Traders.

We had a fair bit going on across markets late Friday night and into the weekend with story lines coming out of the UK, Europe and the US so take a seat, get out your coffee and ease back into the trading week with us here at Vantage FX.

You Emailed it to Who?!:

- “Bank of England accidentally emails Brexit taskforce plans to newspaper”

- “Central bank has set up a taskforce, led by Sir John Cunliffe, to look at the effect a UK exit from the European Union would have on our economy”

This one is almost too hard to believe. The incompetence it must have taken for someone inside the Bank of England to forward a sensitive document featuring ‘guided responses to media questions’ and all to one of the biggest newspapers in the country is just mind boggling.

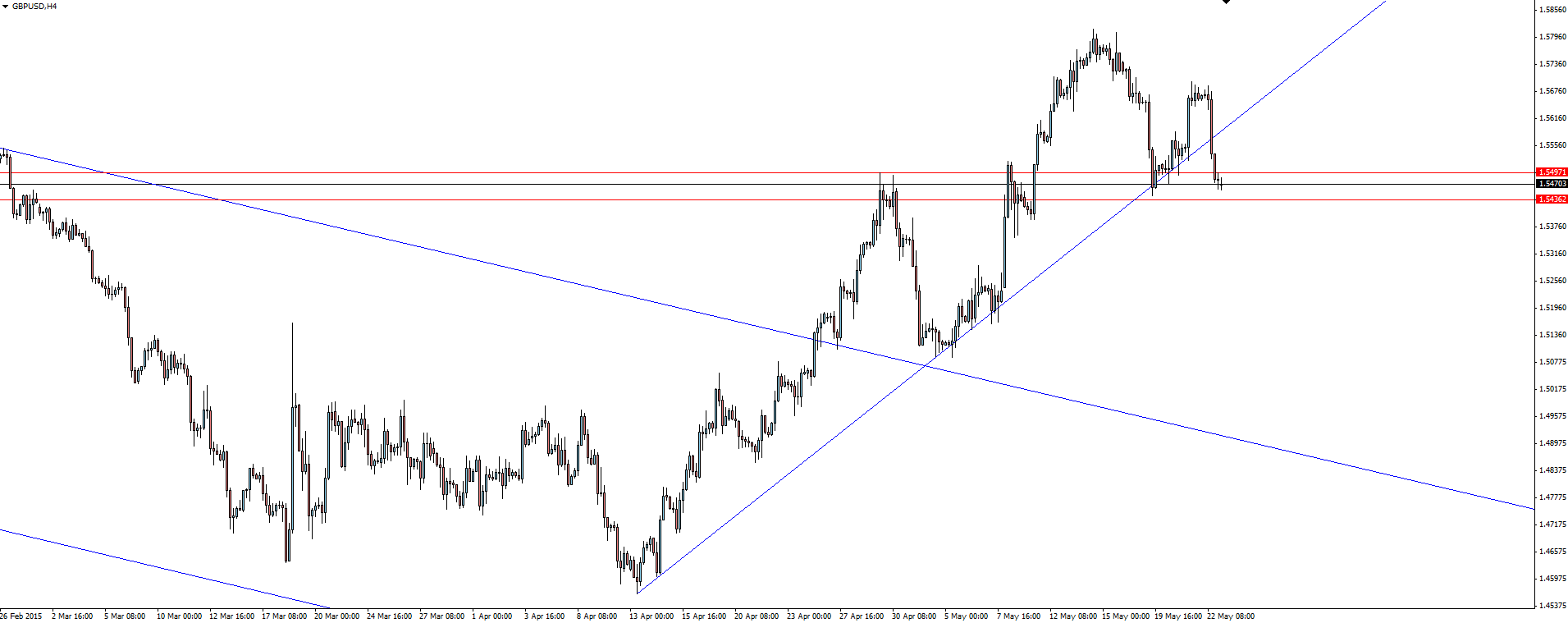

GBP/USD Daily:

Click on chart to see a larger view.

GBP/USD Hourly:

Click on chart to see a larger view.

This just added to Cable’s pain, the news of the UK’s uncertainty in the EU combining with Yellen’s ‘on track’ comments to wipe out gains on the back of the good UK retail figures earlier in the week.

Price has broken through that short term trend line but stalled nicely in the marked zone. I’m expecting some sort of consolidation and a creep back along the underside of it, but new highs could well be out of the question in the near term.

Draghi’s Jawboning:

“In a monetary union you can’t afford to have large and increasing structural divergences between countries. They tend to become explosive.”

“Therefore, they are going to threaten the existence of the union, the monetary union.”

Stating the obvious really, but with Greece looking like exiting the Euro with every headline that passes, things aren’t being sugar coated anymore. The difference between the rich and poor within the Eurozone has always been the biggest issue.

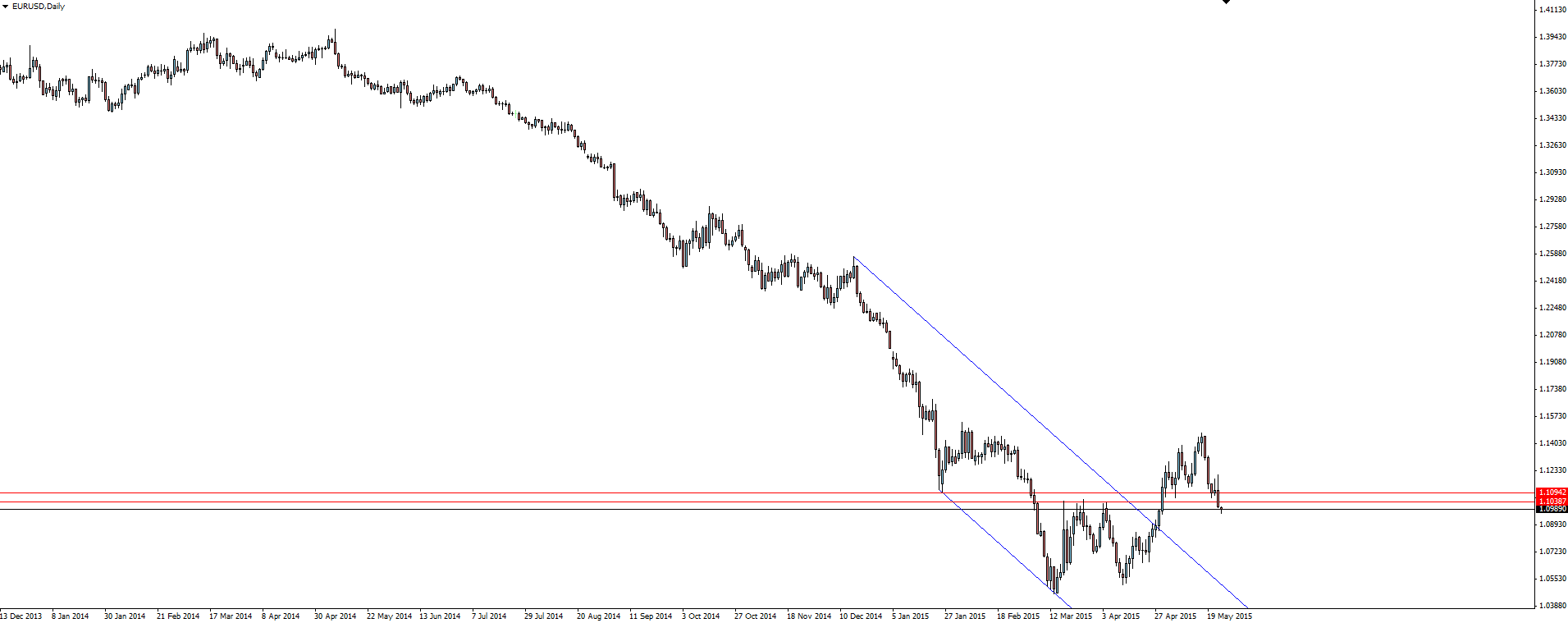

EUR/USD Daily:

Click on chart to see a larger view.

EUR/USD Hourly:

Click on chart to see a larger view.

A pretty good jawboning effort from Mr Draghi, sending the Euro lower through it’s similar short term demand zone. Definitely leading the race to new lows now.

Fed Still on Track:

“If the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target”

Janet Yellen Friday told the market that the Fed is still on track to raise interest rates this year. The Fed’s strategy of consistent, small statements on how they will go about raising rates has been a model of how to go about a change in cycle in my opinion.

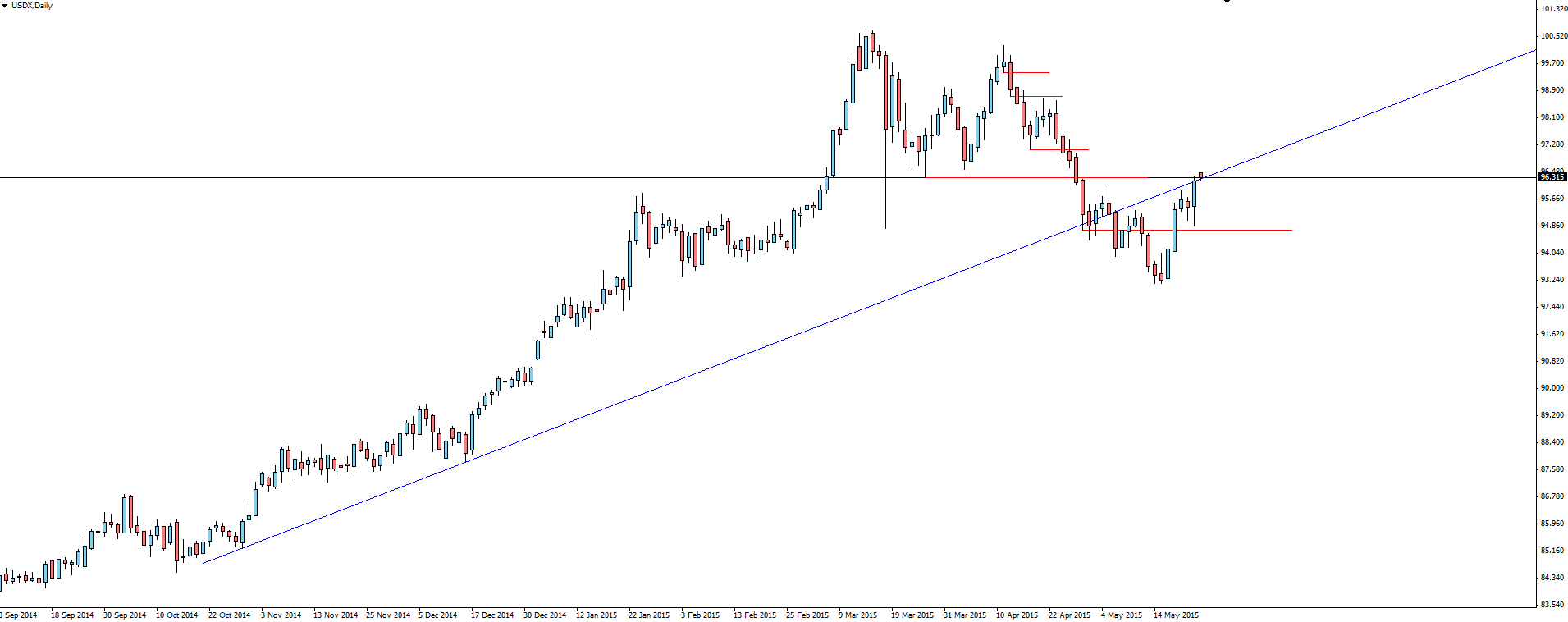

USDX Daily:

Click on chart to see a larger view.

A couple of previous levels of support have now been re-gained but most importantly price has tucked back in above the broken daily trend line. So often you see trend line breaks behave this way, consolidating and then re-validating the line again even after it has been broken.

Strength!

———-

On the Calendar Today:

The light Asian session calendar followed by a whole host of Bank holidays across both Europe and the US lets us ease into the trading week this fine Monday morning.

FOMC Member Fischer delivers a speech titled “The Federal Reserve and the World Economy” in Israel later in the evening but not something that is expected to deliver any new, market moving soundbites.

Monday:

CHF Bank Holiday

EUR French Bank Holiday

EUR German Bank Holiday

GBP Bank Holiday

USD Bank Holiday

USD FOMC Member Fischer Speaks

Sometimes finding myself in the Australian bubble, a little sheltered from the rest of the world, I like discovering some background on some of these holidays:

- “Whit Monday or Pentecost Monday (also known as Monday of the Holy Spirit) is the holiday celebrated the day after Pentecost, a movable feast in the Christian calendar.”

- “Memorial Day is a federal holiday in the United States for remembering the people who died while serving in the country’s armed forces.”

You learn something new every day!

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.