The US Dollar index fell from 100 again on concerns that Fed may consider to delay the rate hike as USD rocketed and inflation is still at low level. The bulls of USD shall be aware that if Fed remains “patient” in its March statement and warn on the negative effects of strong Dollar on US economy, USD may face a significant retracement in a short time.

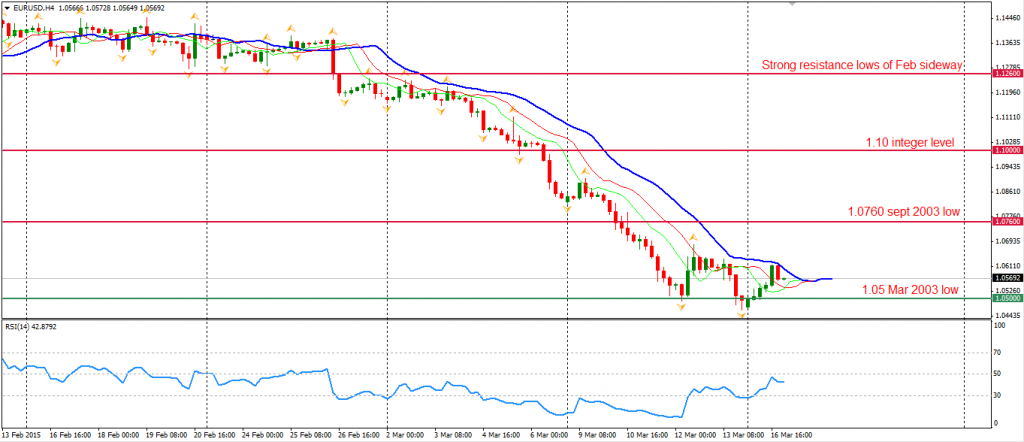

Euro rebounded from 1.05 yesterday, but failed twice on standing beyond 1.06. The ECB president Draghi said earlier this morning that Euro-area economy has started recovery, boosted by the easing policy and tumbled oil prices. The resistances upward are 1.06 and 1.0760; 1.05 is still the critical support.

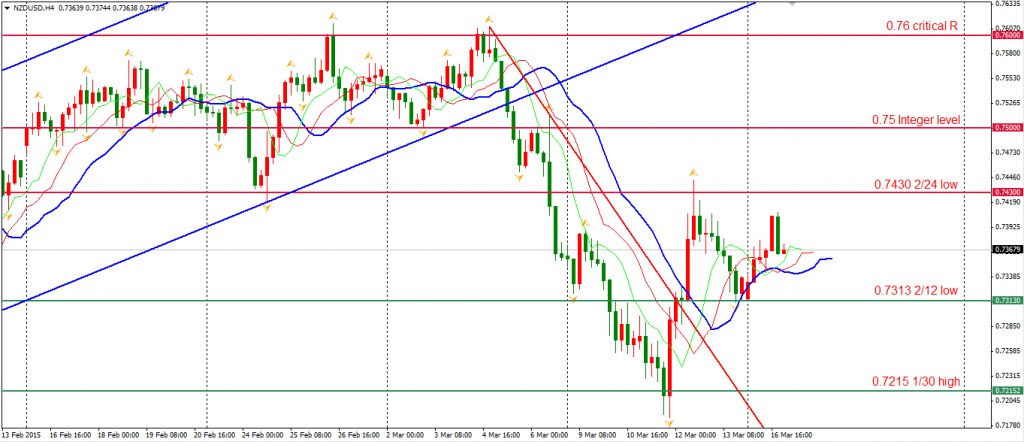

Kiwi Dollar bounced on Monday from support at 0.7320 and closed near 0.7370. The currency was supported by the fundamental aspect as RBNZ has no plan for monetary easing. Market participants will watch the GDT prices, New Zealand Q4 GDP data, and FOMC meeting at this week. The current range of NZDUSD is between 0.7313 and 0.7430.

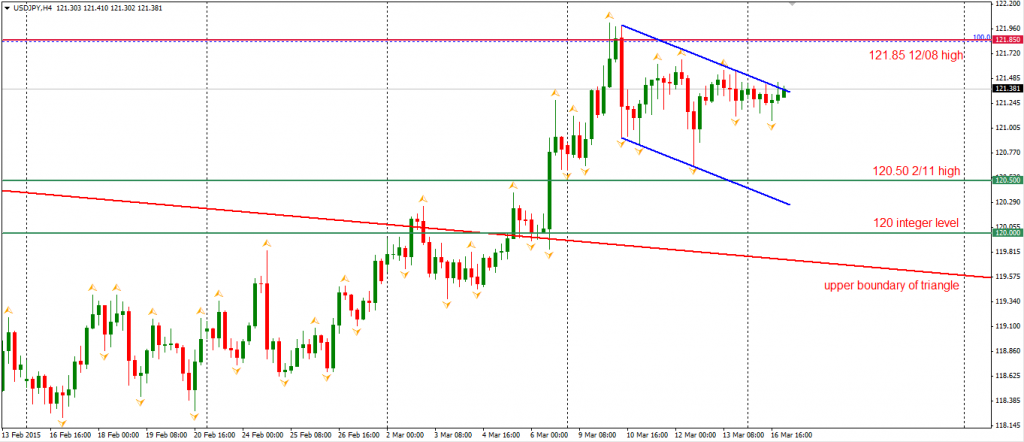

Last week Dollar Yen reached 122 by the assistance of strong Dollar, but fell later and has not effectively broken the former high 121.85. Now, the pair is moving in a flag pattern in the H4 chart. If USDJPY rises beyond 121.60, then it may refresh the high to 125.

Back to stock markets, Shanghai Composite surged 2.3% to 3449. The Nikkei Stock Average slid 0.1%. Australian ASX 200 lost 0.29% to 5798. In European markets, the UK FTSE climbed 0.94%, the German DAX rocketed 2.24% and reached 12000 the first time in history. The French CAC Index also rose 1%. The US stocks rose after the European markets. The S&P 500 closed 1.35% at 2081. The Dow rose 1.29% to 17977, and the Nasdaq Composite Index gained 1.19% to 4930.

On the data front, market will focus on RBA policy statement and BOJ policy decisions during the Asian session. Eurozone final CPI will be out at 21:00 pm AEDST. US Empire State Building Permits and Canadian Manufacturing Sales will be released at 23:30 pm AEDST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.