That was the second week in a row for the weakening US Dollar. As the global economic growth perspective is clouded by the news from Japan and the Eurozone, traders are delaying their expectations of the Fed’s first move on interest rate to the second half of 2015.

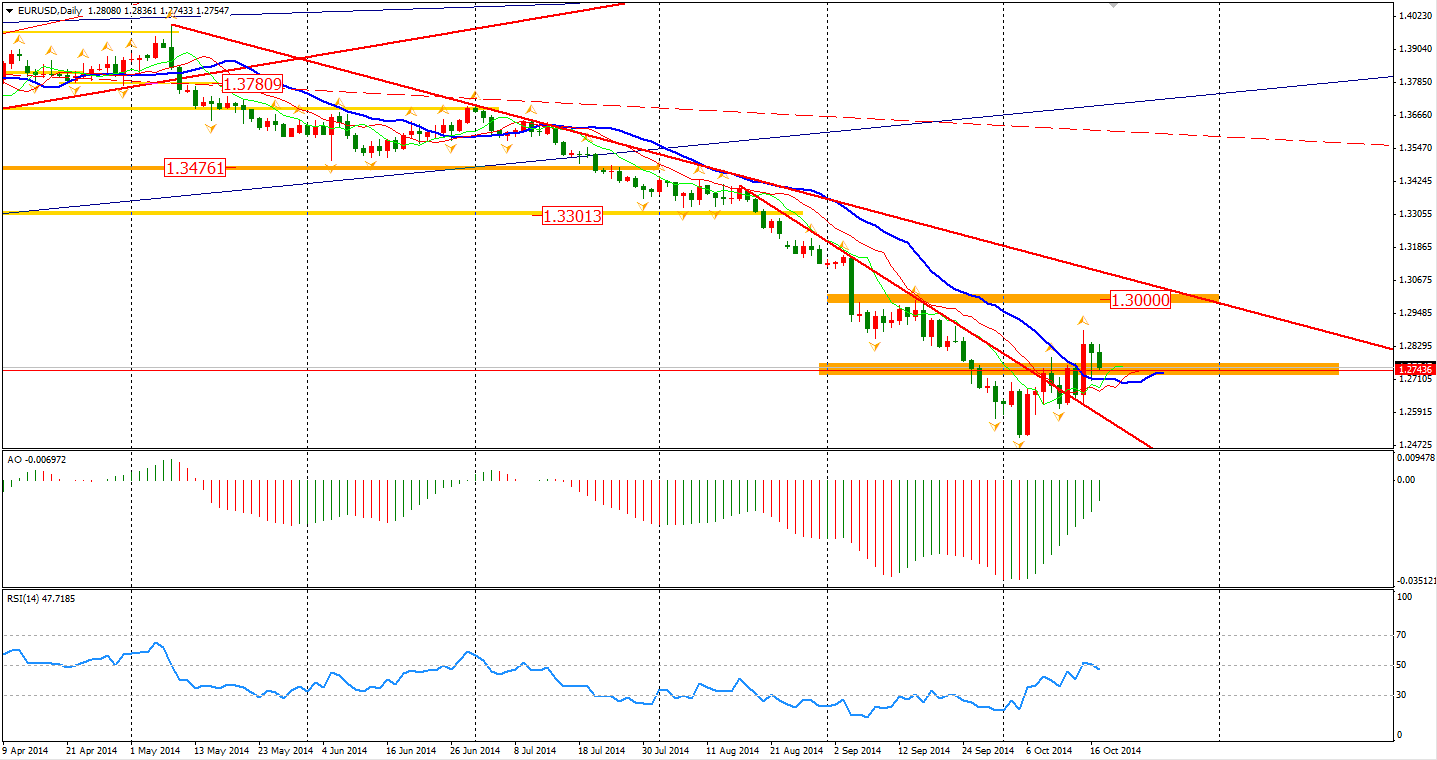

During the last week, the Euro rose 1.1% against the Dollar to 1.2760 – the biggest rally of the last six months. The pair is positioned beyond the 1.2740 level after it upwardly breaking this level and the previous trend line of last week. Technically, the rebound may continue and head to 1.30. However, considering the softening German economy and hiking Greek bond yield, traders shall be cautious when betting on the long side of the Euro.

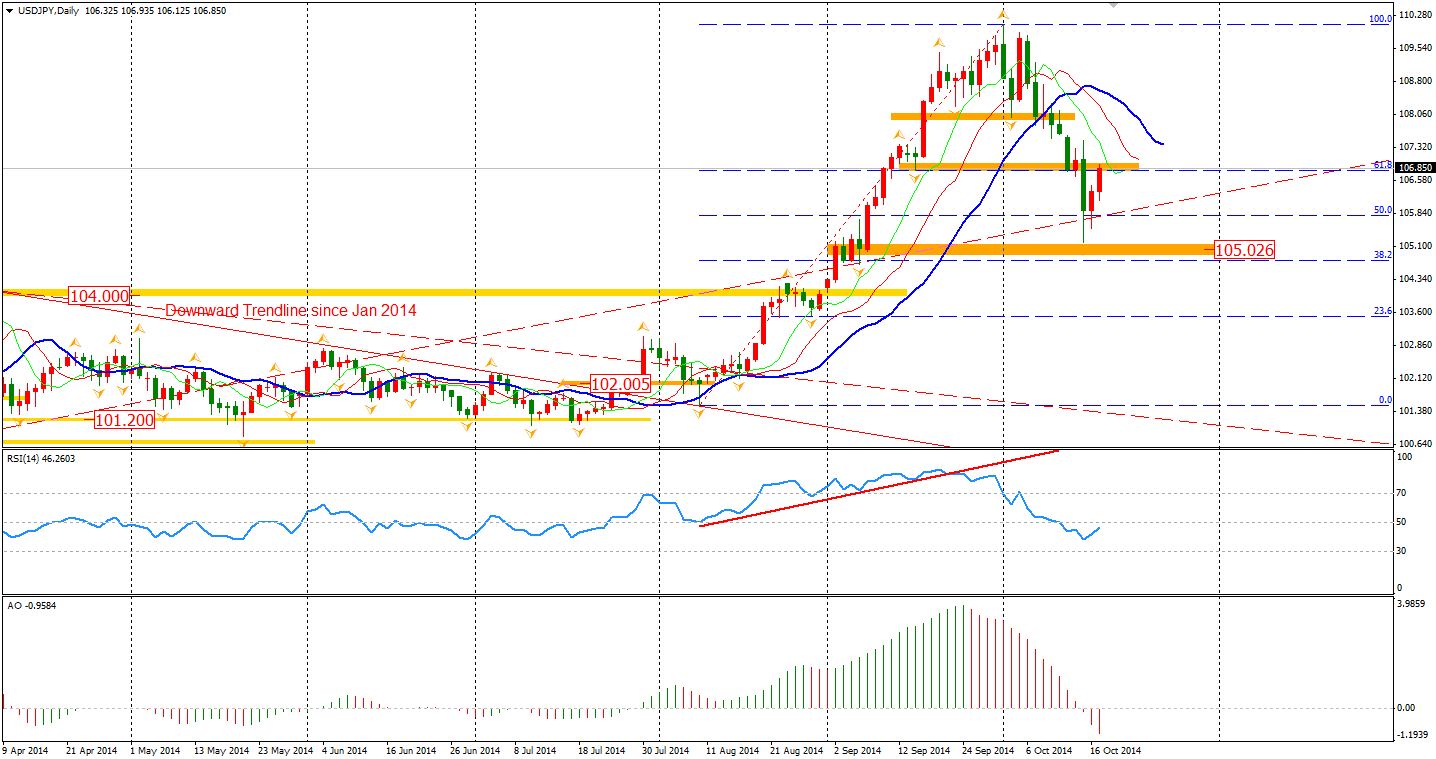

The Dollar Yen rebounded last Friday but remained below the 107 Yen level. Japan may delay the further easing policy as the benefits of a weaker Yen on the Japanese economy have been disappointing. Hence, the Yen may continue its strength for a while retesting the 105 level.

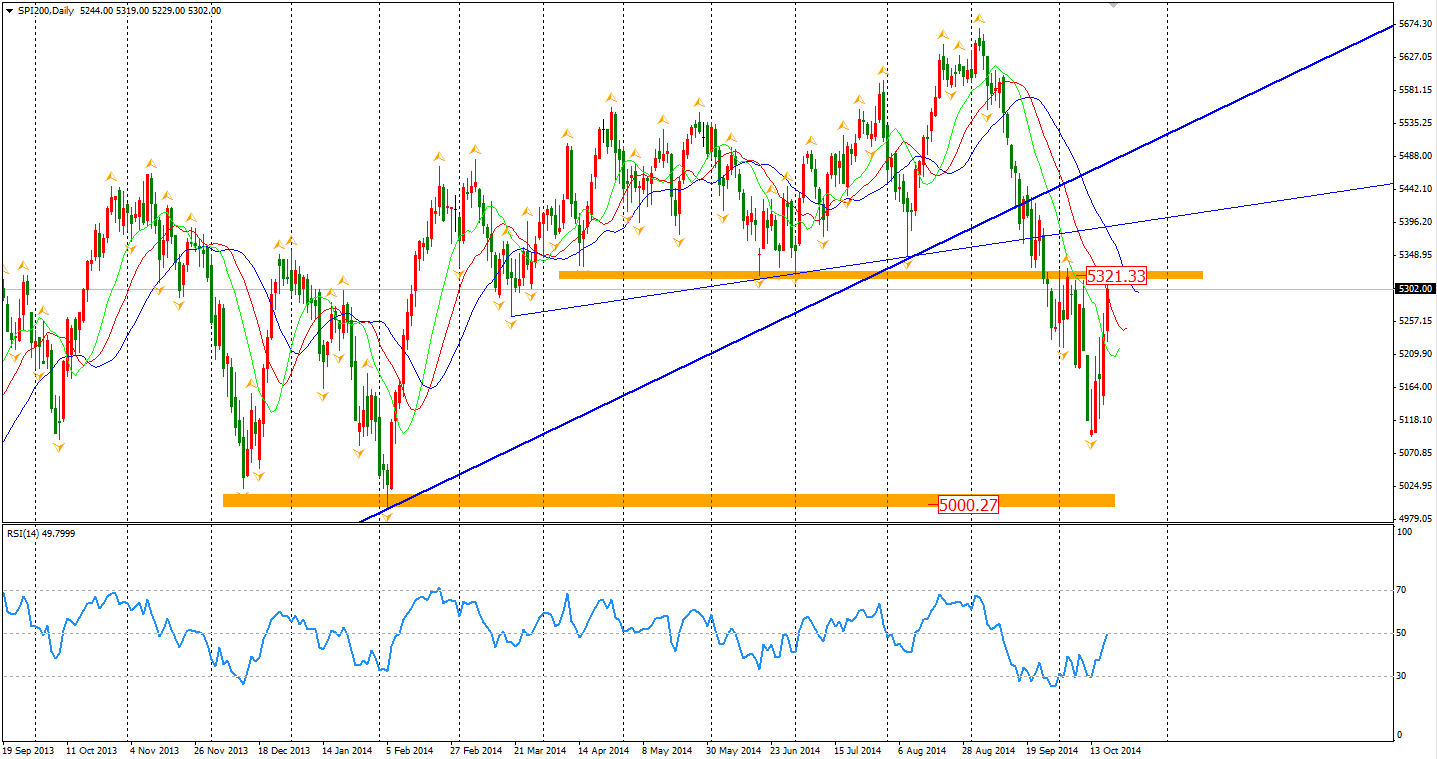

Asian stock markets performed weakly following the overnight US market on Friday. The Nikkei Stock Average slumped by 1.4%. Shanghai Composite also lost 0.6% to 2341. ASX 200 rebounded by 0.32% to 5272 as investors began purchasing oversold stocks. The index once again reached an area as high as 5320- the former critical level we previously mentioned a couple of times. Will this level again become the end of this round of rally?

The Western market was inspired by Central Banks’ officials making dovish statements to support the financial market stability. In European stock markets, the UK FTSE surged by 1.85%, the German DAX rocketed by 3.12% and the French CAC Index rebounded 2.92%. The US market bounced as well. The Dow once gained 1.63% to 16380, while the Nasdaq Composite Index edge up 0.92% to 4258. The S&P 500 surged by 1.29% to 1889.

Today’s only important data will be the Canadian Wholesale Sales release at 23:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.