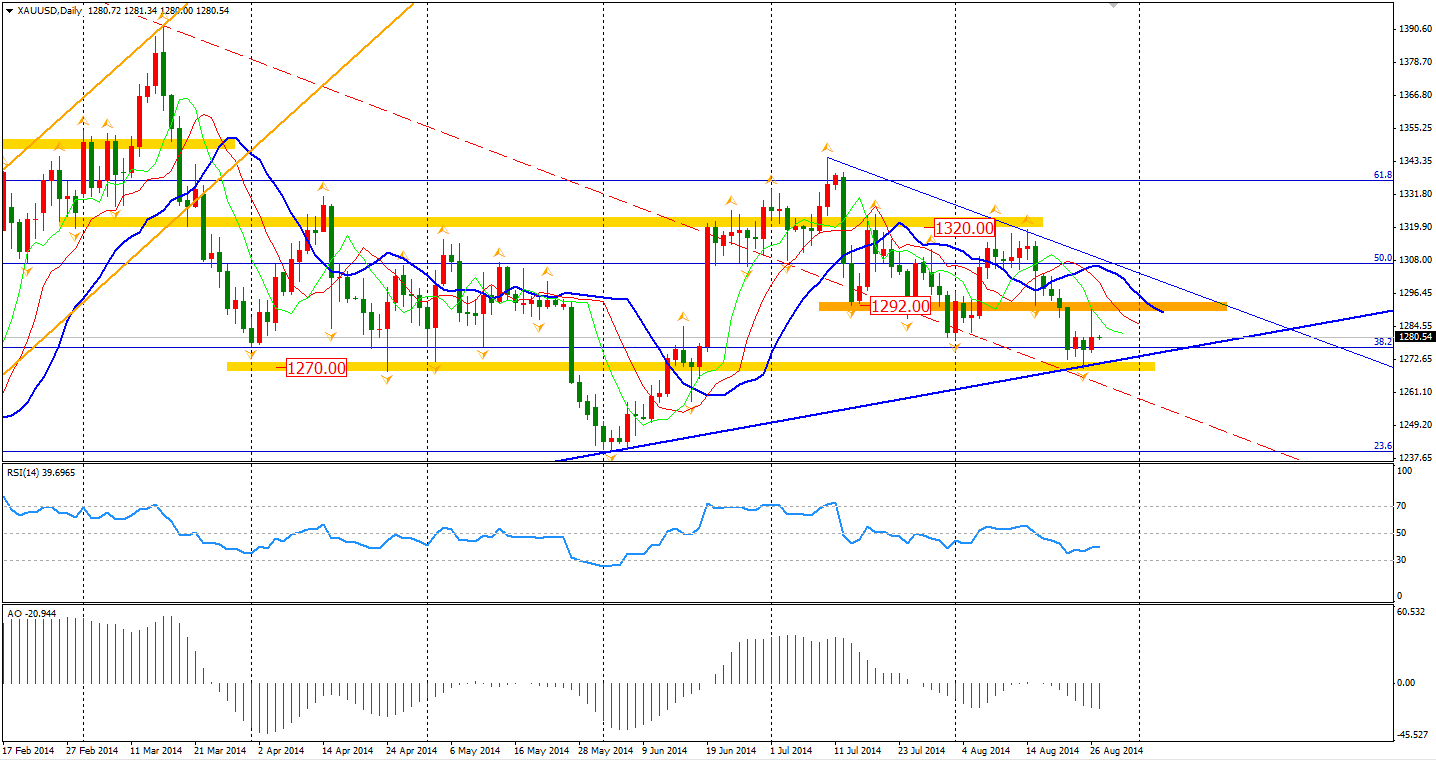

Gold departed from its sideway movement of recent days and rebounded to $1290 per ounce in the early European trading session. As we have mentioned previously, the $1270 is a strong support level – the bounce was in line with expectations. It then lost most of its gains over the rest of the day. Geopolitical fears were eased as Israel and Hamas finally reached an agreement on a Gaza truce and the result of the Russian and Ukrainian Presidential meeting was amiable.

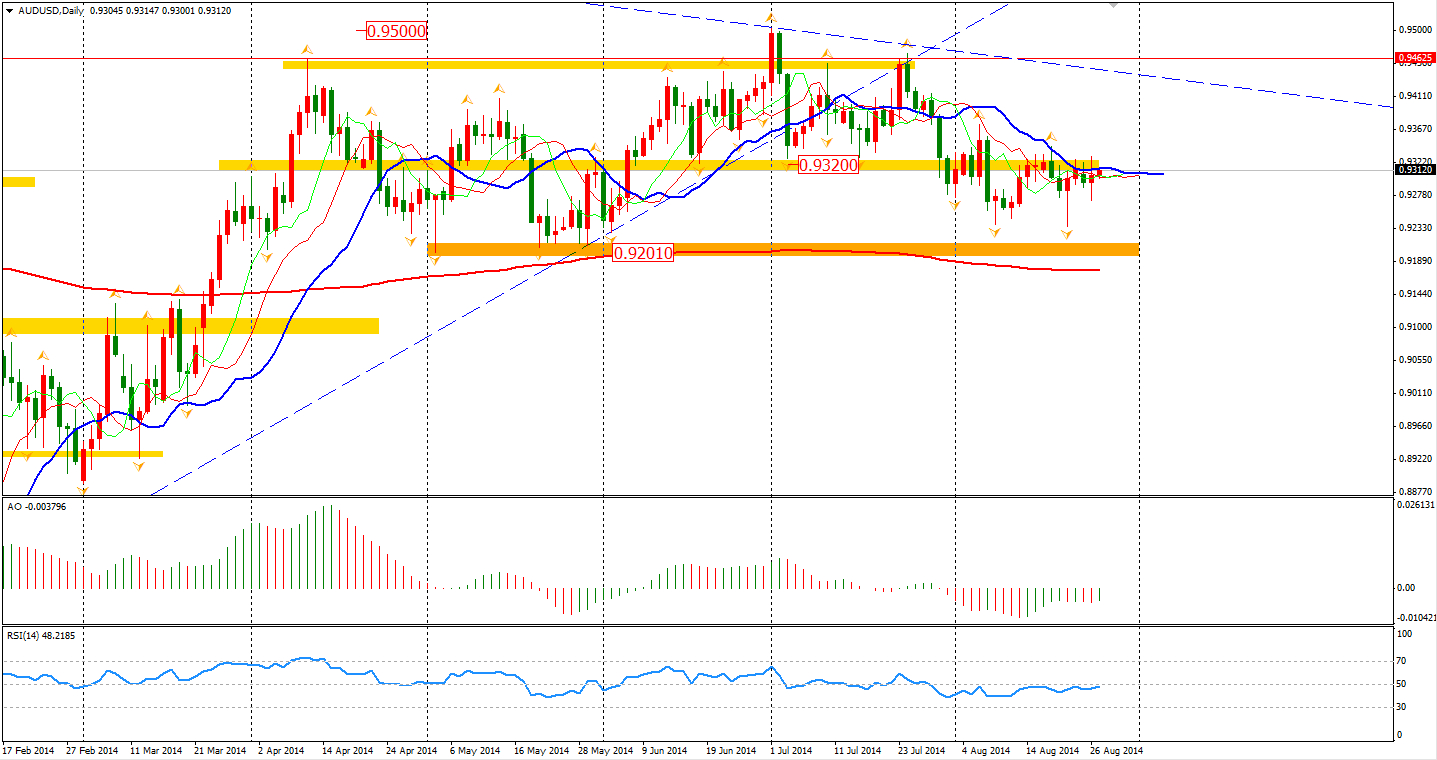

The Aussie was the best performing major currency yesterday. The rise started from an open price below 0.9280 to the day’s high of 0.9330, while other changes remained in a tight range.

Nevertheless, the neckline around 0.9320 is still effective. The Aussie now is still supported by the purchase from Europe as the Euro weakness continues. Aussie/Dollar may keep moving within the 0.9200-0.9350 range for the next few trading days.

In other news, the CB Consumer Confidence and Durable Goods Orders were upbeat, supporting the strength of the USD. The Durable Goods Orders grew 22.6% in July, far greater than the expected 8% growth. Such data confirmed the stable steps of U.S. economic recovery and strengthened the Dollar. The Euro kept falling against the Dollar yesterday to the year’s low of 1.3165 and with no bounce at all.

Most Asian stock markets closed lower with the Shanghai Composite edging 0.88% lower to 2207. The Nikkei Stock Average lost 0.59% whilst the Australian ASX 200 was up 0.05% to 5638. In European stock markets, the German DAX rose 0.82% and the French CAC Index was lifted by 1.18%.

U.S. stocks rose across the board. The S&P 500 lifted to its 29th high of the year and stayed above the 2000 integer level after the uplifting Durable Goods Orders result. The S&P 500 finally closed at 2000.02, rising 0.11%. The Dows gained 0.17% to 17107, while the Nasdaq Composite Index was up 0.29% to 4571.

Today’s data release may bore traders with only the Australian Construction Work Done data release at 11:30 AEST and the GFK German Consumer Climate will be at the beginning of European trading hours. Neither news pieces are considered that greatly important or riveting.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.