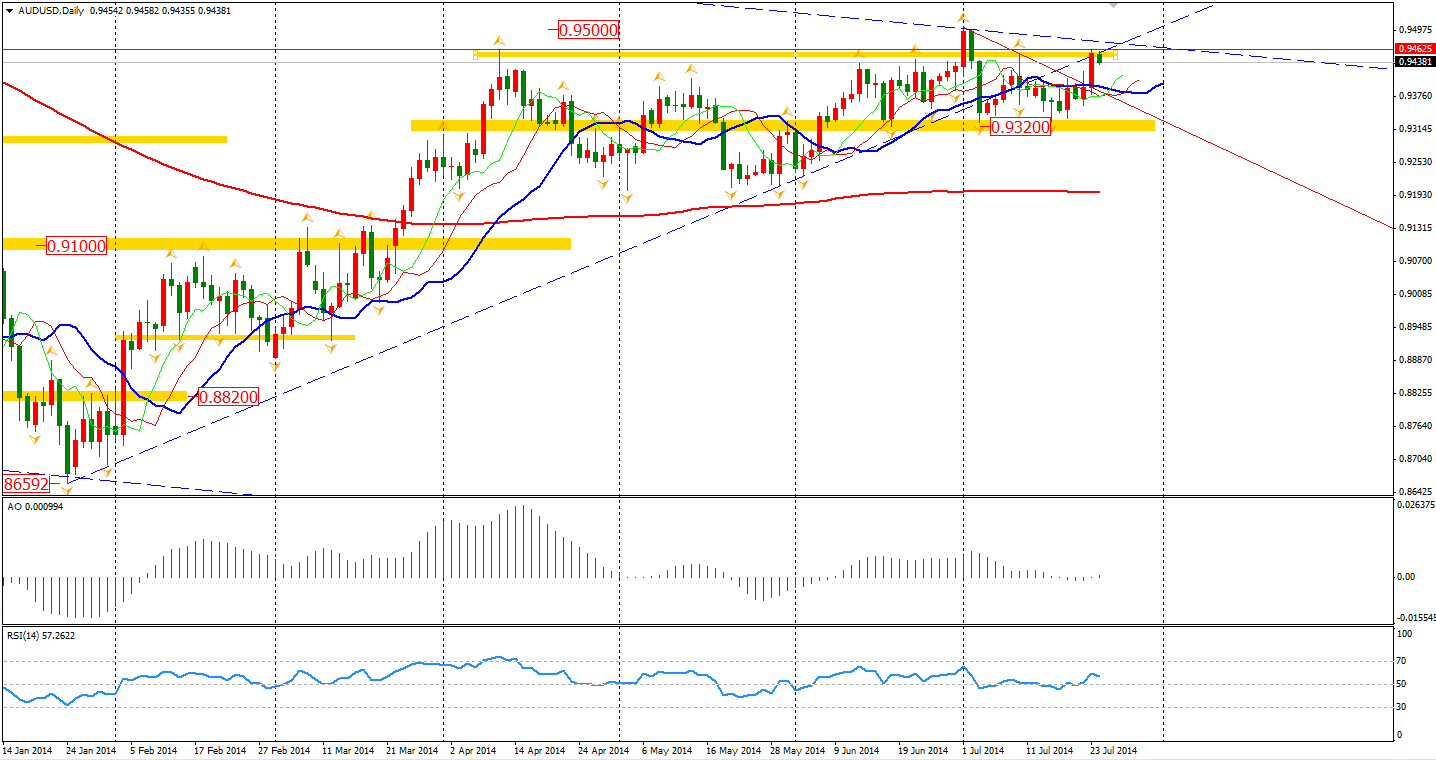

The Australian CPI annual rate reached the 3% upside boundary of RBA long term inflation. The Aussie surged over 50 pips to earlier highs of 0.9456 after the release. Personally though, I don’t think this will mean the RBA will raise its interest rate anytime soon as the economy still needs the time to recover strength. This might be a good area for some long-term strategy traders to short the Aussie Dollar.

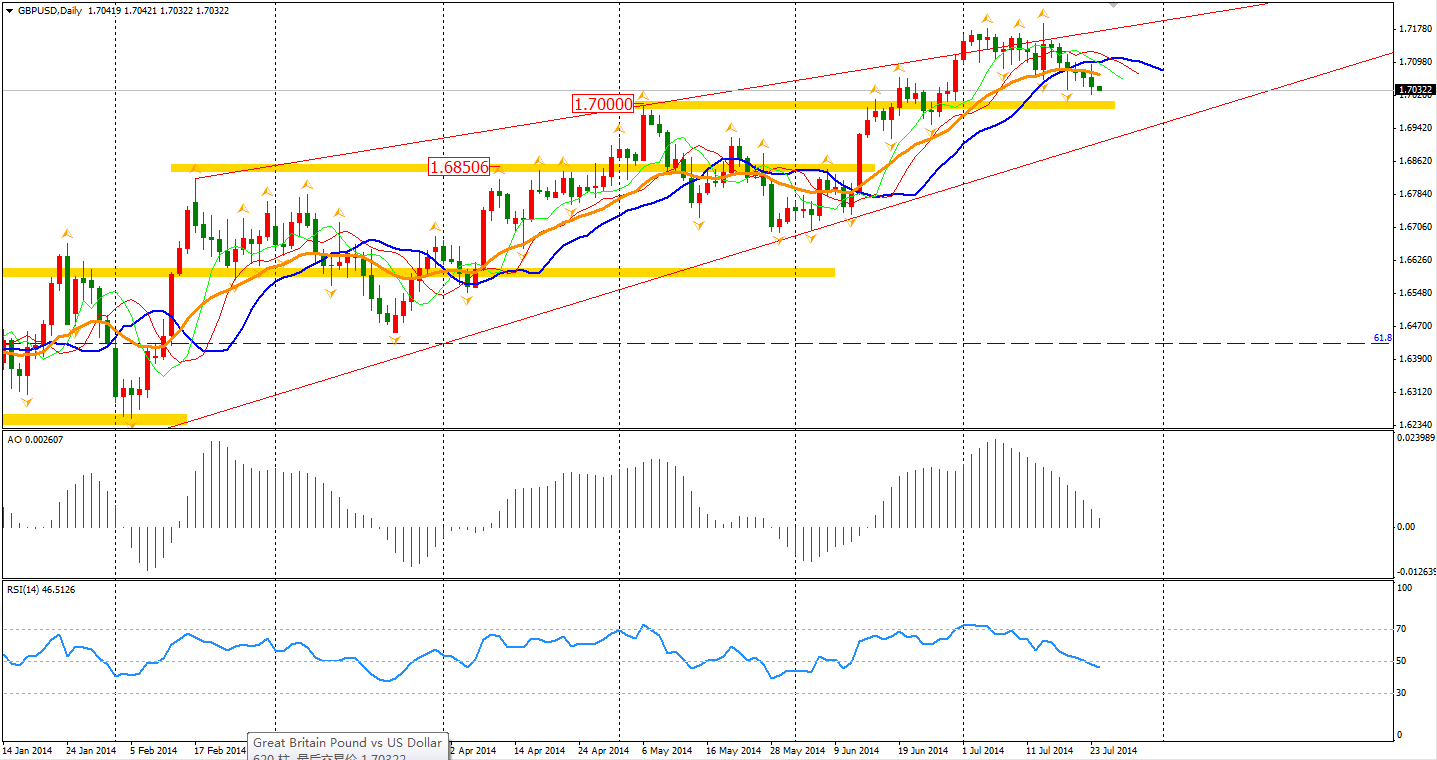

The BOE’s minutes revealed policymaker’s concerns on how the growth perspective may continue on the weak side and that early rate rising will dampen the UK’s economy. In MPC members’ view, the boost of real estate is not sustainable and there is no need to curb inflation in short term. The meeting record is certainly more dovish than former statement. Sterling fell to 1.7023, but still remain beyond support level of 1.70.

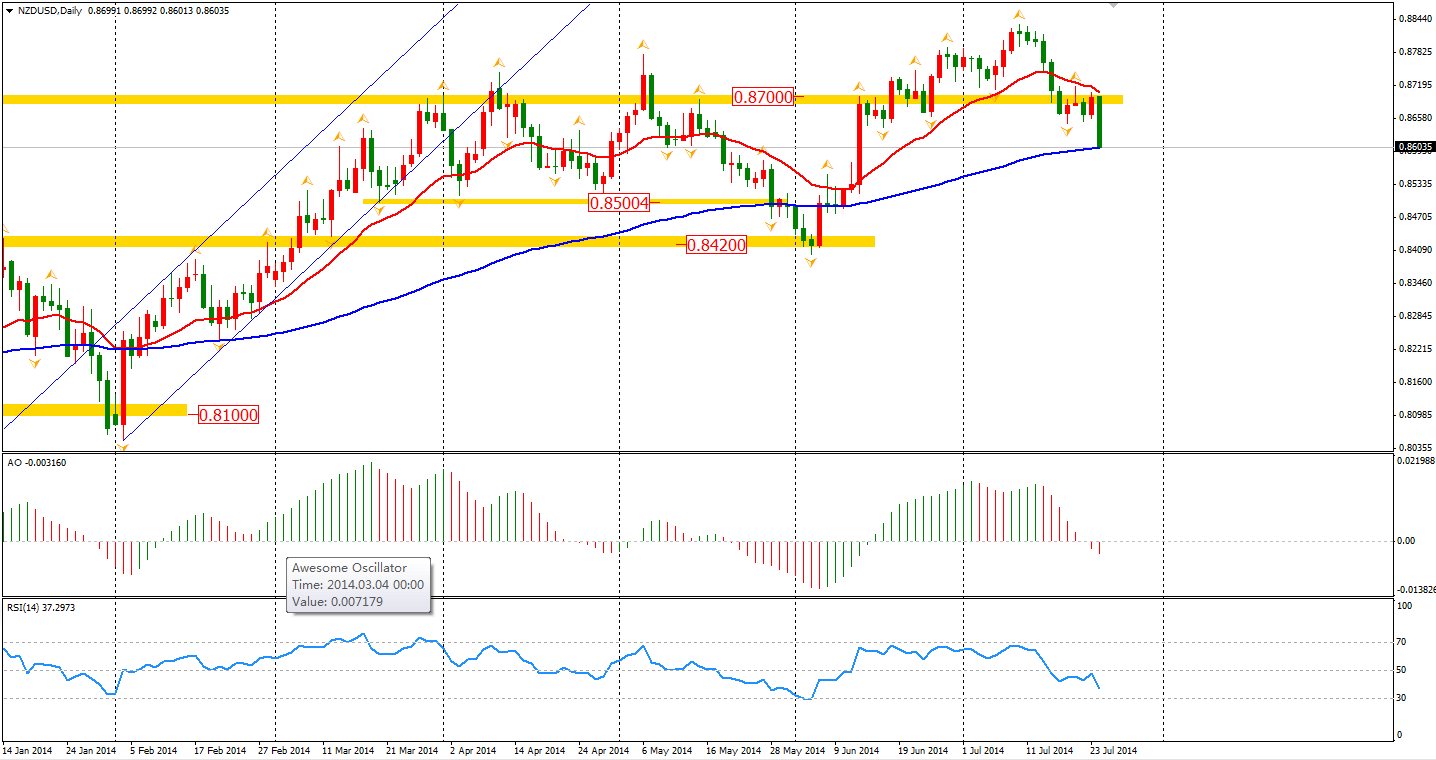

Kiwi Dollar slumped earlier this morning after New Zealand Central Bank RBNZ decided to raise interest rate another 25bp to 3.5% as forecasted. However, as economic data was not as strong as the RBNZ expected, the further raise may be delayed. The support level at 0.8650 has been broken and is now temporarily supported by 100-day MA at 0.86.

Most Asian markets made gains yesterday with Australian stocks inspired by an upbeat CPI and hit a six-year high. The Australian ASX 200 rose 0.6% to 5577. The Nikkei Stock Average went down 0.1%. Shanghai Composite gained 0.14% to 2078. In European stock markets, the FTSE closed 0.4% higher, the DAX edged 0.2% higher, and the French CAC was up 0.16%. U.S. stocks were supported by upbeat corporate earnings. The Dows slid 0.16% to 17087. The S&P 500 edged 0.18% higher to 1987, while the Nasdaq Composite Index rose 0.4% to 4474.

On the data front, investors may first pay attention to the China HSBC Flash Manufacturing PMI at 11:45 AEST. The Eurozone PMIs will be released right after the European markets open. UK Retail Sales will be out at 18:30 AEST. U.S. Unemployment Claims and New Home Sales will be released at midnight tonight.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.