EUR/USD is under pressure on Wednesday, as the pair trades in the mid-1.34 range in the European session. The euro has slipped to its lowest level since November, and has slipped over 200 points in July. The violence in Gaza and Ukraine, weak Eurozone data and talk of a rate hike in the US have helped to bolster the US dollar at the expense of the euro. Will the downward trend continue? On the release front, it’s another quiet day, with just two releases on the schedule. Eurozone Consumer Confidence has been weak, and little change is expected in the June release. In the US, the sole is event is Crude Oil Inventories.

US numbers were a mix on Tuesday. Inflation numbers continue to struggle, as Core CPI posted a paltry gain of 0.1%, shy of the estimate of 0.2%. The key index has looked anemic in 2014, with its highest gain this year at just 0.3%. CPI was bit stronger, as it gained 0.3% last month, matching the forecast. Meanwhile, Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we’ve seen since October, and follows a disappointing release from Housing Starts, which was published last week.

Geopolitical tensions are bad news for the markets, which crave stability. With violence continuing in Ukraine and Gaza, nervous investors have rallied around the safe-haven US dollar at the expense of other currencies, including the euro. In Ukraine, the downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between the West and Russia, which have already been strained since the latter annexed Crimea. Fighting continues between the separatists and Ukrainian forces in Eastern Ukraine. The Europeans are threatening stronger sanctions against Russia, and escalating tensions within Europe does not bode well for the euro. In the Middle East, the fighting in Gaza between Hamas and Israel has intensified, as Israel presses on with a land offensive and casualties rise on both sides. Meanwhile, the international community is intensifying efforts to broker a cease-fire, but in the meantime the fighting continues.

Try as it might, the ECB can’t seem to coax much inflation out of the Eurozone economy. Eurozone CPI, the primary gauge of consumer inflation, remained unchanged in June, posting a gain of 0.5%. This is well below the central bank’s target of 2%. Germany, the Eurozone’s largest economy, is also suffering from weak inflation. PPI came in at a flat 0.0%, and the manufacturing inflation index has failed to post a gain in 2014. Faced with weak inflation and growth levels in the Eurozone, the ECB will be under pressure to take some action at its August policy meeting.

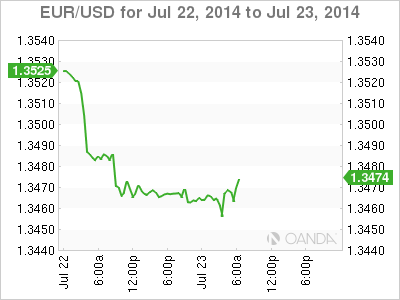

EUR/USD for Wednesday, July 23, 2014

EUR/USD July 23 at 9:25 GMT

EUR/USD 1.3464 H: 1.3473 L: 1.3455

EUR/USD Technical

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.