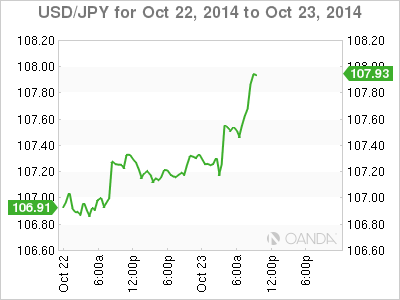

The US dollar has posted gains on Thursday, as USD/JPY trades in the high-107-range in the European session. The dollar has resumed its winning ways, gaining close to 200 points in the past week against the sagging yen. On the release front, Japanese Flash Manufacturing PMI climbed to 52.8 points. In the US, Unemployment Claims rose to 284 thousand, much higher than the previous reading of 264 thousand. However, the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low.

There is no arguing that recent US economic numbers have been solid, as the recovery continues to deepen. However, the persistent lack of inflation remains a serious concern, indicative of slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI rose 0.1%, an improvement from the previous reading of -0.2%. The estimate stood at 0.0%, so clearly the markets clearly did not have high expectations. It was a similar story from Core CPI, which also posted a 0.1%, up from 0.0% a month earlier. This was shy of the forecast of 0.2% but still within expectations.

On Monday, BoJ Governor Haruhiko Kuroda stated that Japan’s economy continues to improve modestly, although consumer demand has lessened since the consumption tax hike in April. The BoJ would prefer to stay on the sidelines, but there has been talk that the central bank could step in with additional stimulus if the economy takes a turn for the worse. Such a move would weigh on the already weak Japanese yen.

USD/JPY 107.87 H: 107.88 L: 107.10

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.