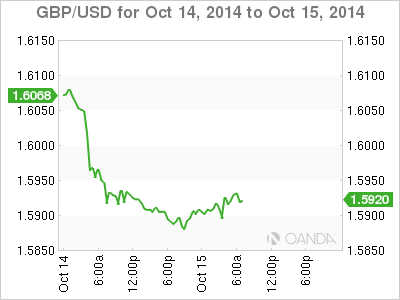

The British pound has stabilized after Tuesday’s sharp losses, trading in the low-1.59 range on Wednesday. On the release front, the Average Earnings Index improved to 0.7%. Employment numbers were a mix, as Claimant Count Change missed expectations, while the unemployment rate surprised with a drop to 6.0%. In the US, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

In the UK, the Average Earnings Index edged up to 0.7%, matching the estimate. This was a four-month high for the indicator, which is an important indicator of consumer inflation. On the employment front, Claimant Count Change continues to drop, but the reading of -18.6 thousand was well of the forecast of -34.2 thousand. Meanwhile, the unemployment rate dropped from 6.2% to 6.0%, its lowest level since November 2008. Strong employment numbers is a sign of a healthy economy and could give a boost to the wobbly British pound.

British CPI, the primary gauge of consumer inflation, continues to lose ground. The index dropped to 1.2%, a five-year low and short of the estimate of 1.4%. Core CPI and PPI Input also missed their estimates, as inflation indicators continue to point downwards. The weak CPI reading gives Governor Mark Carney more breathing room to maintain current interest rate levels, and investors responded to the news by dumping their pound holdings on Tuesday. There is growing sentiment that the BoE could delay a rate hike until the second half of 2014, with inflationary pressures continuing to recede.

The US dollar has run roughshod over the pound, gaining almost 7 cents in the past six weeks. The dollar rally was halted briefly thanks to last week’s FOMC minutes, which were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but the Fed appears to be taking a cautious approach towards the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

GBP/USD 1.5921 H: 1.5938 L: 1.5878

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.