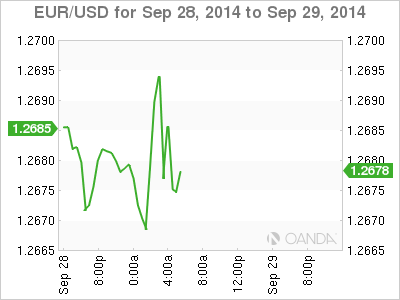

EUR/USD is steady on Monday, as the pair tries to find its footing following last week’s slide of about 170 points. EUR/USD is trading in the high 1.27 range, its lowest level since September 2002. On the release front, Germany releases Preliminary CPI, a key release. The markets are keeping their expectations low, with an estimate of -0.1%. In the US, today’s highlight is Pending Home Sales. After a sharp gain of 3.3% in July, the markets are braced for a sharp downturn, with an estimate of -0.4%.

Friday’s German releases underscored that the Eurozone’s largest economy is in trouble. GfK Consumer Climate dipped to 8,3 points, its lowest level in 2014. Import Prices posted a second straight decline, coming in at -0.1%. This followed Ifo German Business Climate, which weakened for a fifth straight month. The sputtering Eurozone is dependent on the German locomotive to pull the region’s economy back on track, and the shaky euro will have difficulty stabilizing if German data does not improve.

On Thursday, the euro lost ground after ECB head Mario Draghi spoke in Lithuania. Draghi reiterated that the ECB stood prepared to implement additional unconventional steps if prolonged low inflation levels did not rise. Draghi acknowledged that summer economic data was weaker than expected, but said the central bank forecast modest growth in Q3 and Q4. Lithuania is set to join the Eurozone in January and will become the 19th member of the Euro region.

In the US, Core Durable Goods Orders posted a strong gain of +0.7%, bouncing back from the previous reading of -0.8%. Durable Goods Orders continues to take its riders on a roller coaster ride, plunging 18.2% in August, compared to a huge gain of 22.6% a month earlier. Unemployment Claims rose to 293 thousand, within expectations.

EUR/USD 1.2675 H: 1.2698 L: 1.2664

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.