Major currencies contained for the moment

Be prepared for a take it or leave it deal

SNB’s Jordan will intervene or lower rates

Liquidity to become more of an issue

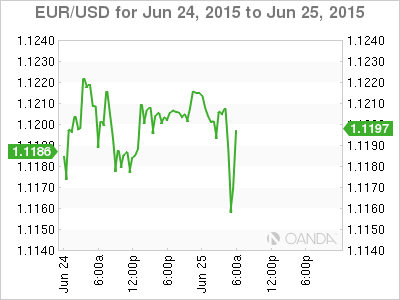

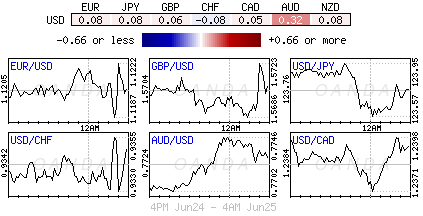

So close, but now so far, so it seems. The forex market appears totally jaded with what’s going down, or not, with Greece and its creditors. For now, currency price moves are relatively contained, notwithstanding the odd fluctuation from a jibe or two from a couple of Central Bankers, like Swiss National Bank (SNB)’s Jordan. Aside from that, and with the lack of any real fundamental news, both investors and traders are back to news ticker watching while Europe sorts itself out.

Month-end and half-year end is upon us, and investors should be preparing themselves for some hectic prices moves as a number of portfolio managers try to both mitigate and navigate their way through a Greek default price risk move.

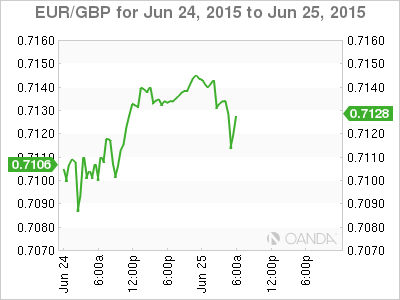

Last Monday’s Greek proposal lasted less than two-days before their creditors threw it out. It appears that the IMF, ECB and EU would prefer to go back to a plan from a couple of weeks ago where an austerity composition relies more on spending cuts rather than tax increases. However, no one seems confident in how Greece collects taxes; hence, this proposal was always going to be a non-starter if tax revenue was to be the foundation of their plan.

Greek debt timeline before default

There is not much time for a deal to be finalized, especially with the ‘hard’ date of June 30 penciled in for a Greek/IMF repayment.

If both sides do not find any common ground today, but are at least still talking, then the market will be expecting negotiation to go deep on Friday. If a deal is struck, Greece will have the weekend to commandeer parliament approval, which is easier said than done, while German parliament approval can be completed on Monday. It sounds so easy, but as of now they are worlds apart.

Nonetheless, if there is no deal by June 30 then, according to the IMF, Greece will be technically in default. The process requires that IMF’s Lagarde will have to acknowledge that scenario before actually triggering a plethora of repayment default clauses.

So aside from month-end demands, capital market moves are expected to be held hostage to Euro/Greek shenanigans over the next few days, unless of course if Greek creditors present a ‘take it or leave it’ choice to Greece today. This scenario shortens the whole process and may ruin many an individuals weekend.

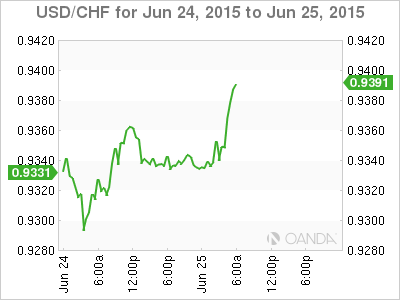

It difficult for many to have respect for the Swiss National Bank (SNB), especially after the under handed policy move they pulled last January (scrapping the €1.20 currency cap). Their actions will leave a bad taste in investors’ mouths for a very long time. Nevertheless, the market needs to listen to SNB’s Jordan for directional clues, especially when the Swiss franc remains in such demand mostly from a safe haven perspective.

It’s no surprise that SNB’s chairman sees the CHF as “significantly overvalued” (€1.0484). He cautions that the central bank has no easy fix for the problems that it’s creating for his country. However, the SNB again reiterated that they could still intervene in the forex market, and/or apply more negative interest rates to release some of the external pressures on their currency. Verbal intervention seems to be the first tool of choice to weaken a currency. The RBA’s Governor Stevens uses the same technique at every available opportunity.

Despite today’s warning shots from Jordan, he acknowledges that the situation is unlikely to improve anytime soon. It seems that he is putting his economic faith in an improving global economy. Be forewarned, the SNB has set a precedent of not sticking to the script.

It does not get any easier

For capital markets next week most things back up rather quickly. U.S non-farm payrolls (NFP) will be released a day early (Thursday July 2) due to the Independence Holiday on Friday. The ongoing Greek fiasco, coupled with quarter and half-year end and a holiday-shorted week will mean that market liquidity will be expected to be a rather significant issue for investors and traders next week.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.