USD Bulls don’t require patience

DXY has room on the downside

BoJ scales back on inflation

RBA opens up both barrels

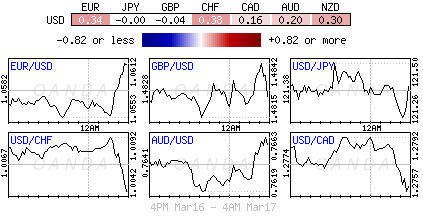

It’s no real surprise to see that major currency pairs prefer to keep to tight trading ranges ahead of tomorrow’s FOMC outcome. Tomorrow’s “patient” calls on whether U.S policy members will vote to keep it in the statement is not a forgone conclusion. Dollar longs will be in for a rude awakening if the Fed maintains its “patient” stance. Though leaving it in would come as a surprise, there is a credible risk of them doing just that.

U.S economic releases have not managed to post much glory throughout Q1, apart from jobs, which remain consistently robust and now hail an economy touting full employment. Core-PCE has trended lower since October while average hourly earnings peaked two months ago in January and have been trading lower ever since. Last week’s third consecutive monthly decline in U.S retail sales and yesterday’s softer than expected industrial production numbers, despite weather related explanations, does not necessarily justify a sense of urgency for the Fed to change market dynamics just yet. And then there are the U.S multinationals that will be pointing to the strength of the “mighty” U.S dollar affecting their bottom line most significantly in their earnings reports for Q1.

If the FED disappoints

Market positioning for the USD remains stretched on the long side, and tomorrow’s event risk is that those longs may panic to get out if Ms. Yellen decides that “patience” is needed. Technical analysts have been arguing that the Dollar Index spot exchange rate (99.63) happens to show a serious rally over the past 12-months, but with very few profit taking dips seen as the pair approaches massive resistance near 102. In other words, if the Fed Chair succeeds in giving the “bearish” cue, there will be plenty of room for the most dominant of currency’s to fall with gusto (92 and then 89).

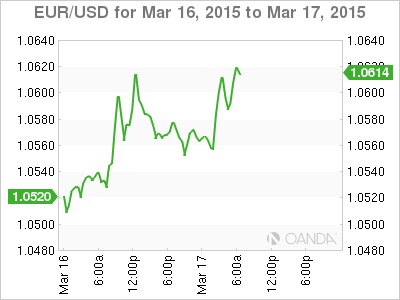

It’s neither impossible nor impractical for the Fed to keep the status quo for the time being. Nevertheless, it’s been reason enough for some short EUR/USD speculators to trade cautiously ahead of the Fed concerned rates may be held ‘lower for longer.’ The slight narrowing of US/Bund spreads has been influencing some speculators to pare their EUR/USD (€1.0600) shorts. The two-year US/German spread has narrowed just -6pbs from the trend wide – it’s still +50bps from October. Expect traders to focus on market corrections while the techies remain very bearish.

BoJ and RBA have their say

The significance of tomorrow’s Fed decision is clearly highlighted by the markets minimal involvement in the overnight’s two event risk announcements. The Fed is not the only Central Bank to “show and tell” this week. Last night the RBA and BoJ did have their say.

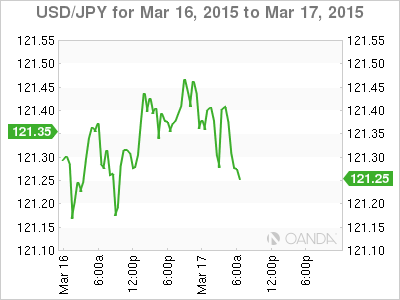

The BoJ’s policy statement was largely a reiteration of the previous month, maintaining annual rate of monetary base increase at +¥80t, and reiterating economic assessment of their economy continuing “moderate” recovery trend. Board member Kiuchi remained the lone dissenter in favor of a more protracted timeframe for inflation target (8-1).

Faced with plunging energy prices, Governor Kuroda and company last October took the lead among a number of global Central Banks in easing credit to stamp out deflation concerns and shore up its weakening economy. The only change in the statement related to inflation, where the BoJ scaled back its current CPI view to +0.0-0.5% from around +0.5%, and that the outlook for inflation to also be around +0% versus the prior “slow for time being”. The BoJ remains a long way off its ambitious target of +2% inflation in about two-years. Expect the BoJ to continue to periodically remind the market that they will not hesitate to take further action if it’s deemed necessary.

USD/JPY has since only fallen slightly below ¥121.30 on the release with little indication that further policy easing may be in the works for April.

RBA remains on the easing path

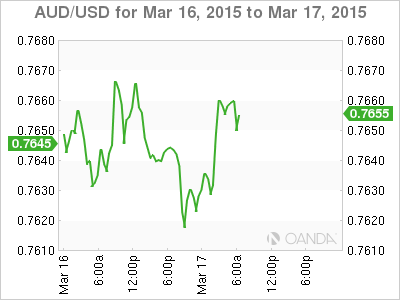

The AUD has not managed to stay trading lower (AUD$0.7619), especially after last night’s RBA’s board minutes paved the way to potential additional easing after this month’s surprise rate hold. The market was anticipating a second consecutive rate cut. The support for the AUD has more to do with U.S dollar longs being prudent and lightening up their positions against the major pairs ahead of any surprise announcements by the Fed tomorrow.

The RBA minutes said a new cut may become appropriate, the economy is operating with spare capacity, and non-mining investment is subdued for longer than expected, while also noting the risks of a property market bubble, preferring to allow the markets to digest the February rate cut before moving again.

RBA Requires Two Barrels – currency and OCR

The RBA minutes were a tad more ardent about the need for a lower AUD than an OCR (Overnight Cash Rate) statement. Nevertheless, there were a number of key points that the market has managed to take away from this morning’s release.

Board thinks a lower AUD would help; OCR statement is also likely to be needed.

RBA is fortuitous that “dormant” inflation provides the scope to embrace both outcomes.

Unless AUD data surprises to the topside further cuts are in the pipeline.

Fixed Income is pricing a +35% chance of an April cut. The forex market will be expected to be net sellers of the AUD.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.