European Central Bank

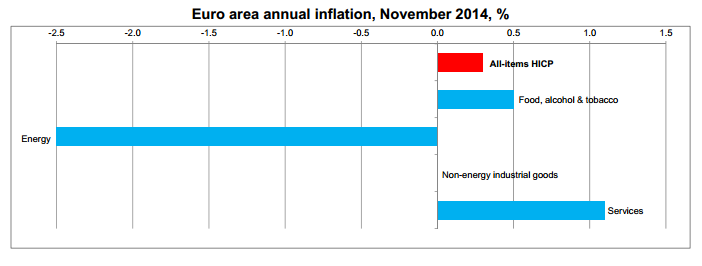

Ahead of the European Central Bank’s monetary policy decision on Thursday, we do not expect an announcement of sovereign quantitative easing purchases. Instead, the more likely scenario is the announcement of a wider scope of the current asset purchase programme. This more likely scenario may be tempered by the condition that that current ECB monetary policies fail to gain significant traction and that we continue to see weak Eurozone inflation growth – both of which are almost a foregone conclusion.Although some may try and hide behind falling oil prices, even ex energy, Eurozone HICP-measured inflation is at 0.7 percent, while the headline 0.3 percent rate is threatening to tip into deflationary territory as oil prices continue to be held low.

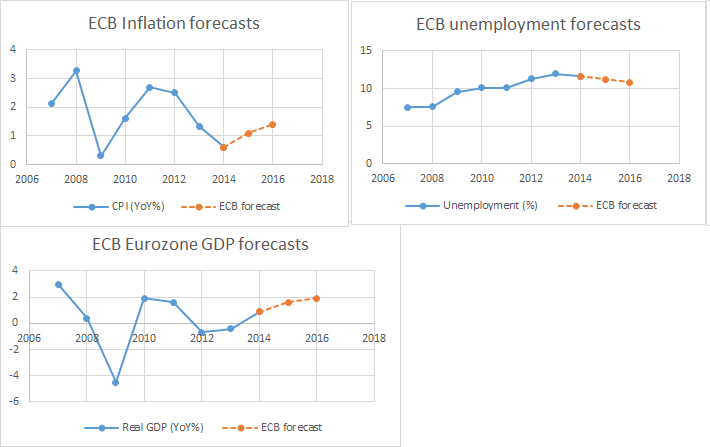

Eurozone HICP has now held below 1 percent since September 2013, and has been on a steady slide from the ECB’s 2 percent target rate since January 2013. Even the ECB’s optimistic forecasts only see CPI breaking to 1.4 percent in 2016 after a forecasted 0.6 percent growth in 2014 (private bank forecasts put 2014 CPI growth at 0.5 percent and 2016 at 1.4 percent, but even that may be ambitious.)

With Eurozone inflation growth in such a confirmed downtrend, and disinflation the norm, it is arguably only persistent recovery in inflation growth that has the potential to cause a shift in the ECB’s policy stance.

Sovereign QE talk welcome

Bundesbank president Jens Weidmann has stated that any moves to launch ECB sovereign bond purchases would face “significant legal challenges”. However, the lack of noise from Germany – whether from the Bundesbank or from Chancellor Angela Merkel – has been notable. When it comes down to it, German policy makers are probably quite happy for talk of sovereign QE to continue, so long as it remains only talk.

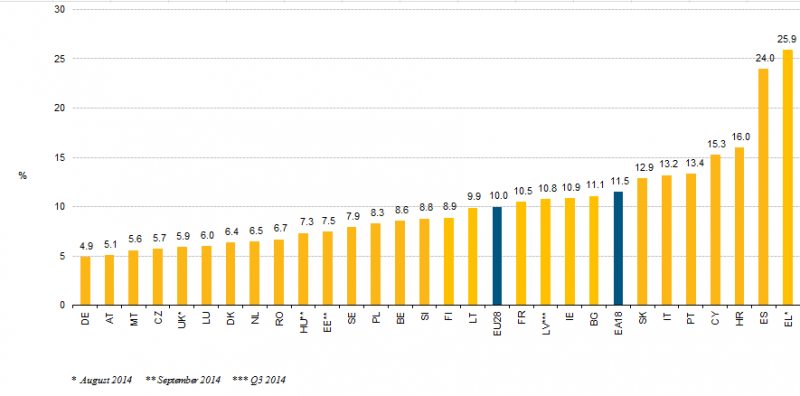

While Spain, France, Italy et al have significant structural reforms that need to be enacted, Germany does not have that fat to cut. Its unemployment rate is running at 4.9 percent with youth unemployment at 7.7 percent. Compare this with 24 percent unemployment in Spain and 53.8 % youth unemployment. Germany needs to see some upside in demand, and right now it’s not going to get that from its Eurozone bedfellows. A weaker euro on sovereign QE chatter from the ECB should help with that, but the Bundesbank is not prepared to put its balance sheet on the line in order to allow QE to actually be enacted.

Eurostat unemployment:

T-LTRO take-up

In recent weeks we have had some playing down of sovereign QE from policymakers, with officials stressing the need to allow recent policies to have an effect. To this end, the uptake of the 10 December T-LTRO may be key – especially if the anticipated increased demand fails to materialise.

While trying and fend off calls for sovereign QE, Draghi will instead likely lean on a broader scope for large-scale asset purchases and match earlier talk on dragging down the euro.

“There is evidence that both the various large-scale asset purchase programmes of the Fed as well as the Bank of Japan’s quantitative and qualitative easing programme led to a significant depreciation of their respective exchange rates, even in a situation in which long-term yields were already very low, as in Japan.” - Mario Draghi

ECB Staff forecasts

ECB forecasts for inflation and GDP growth will almost certainly see another cut. Official ECB forecasts of 0.9 percent year-on-year GDP growth and 0.6 percent CPI growth would likely have been in trouble even without recent energy price declines. Forecasts for 2015 and 2016 CPI are likely to take a chop from their current 1.1 and 1.4 percent levels, but too where could be one of the key pieces of information to come out of the ECB and any accompanying talk of “excessively low” inflation conditions could act as a signal that the central bank is prepared to become even more aggressive.

Conclusion

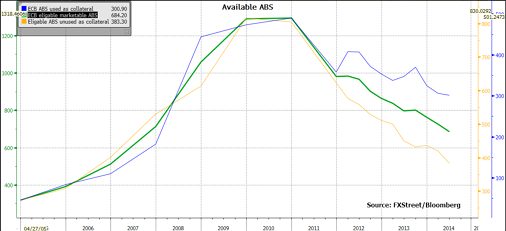

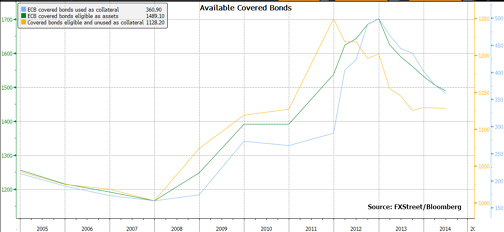

Ultimately, the ECB is most likely to remain committed to its aggressive balance sheet expansion targets, and stress the need to wait for the results of the next round of T-LTRO, the ABS purchase programme (ABSPP) and the third covered bond purchase programme (CBPP3).

Bank of England

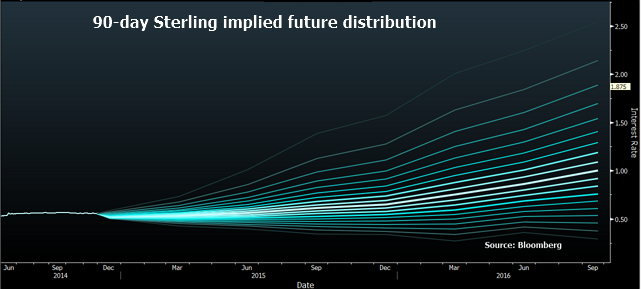

It is taken as a given that the Bank of England will hold its rates at current levels at the Monetary Policy Committee meeting. It is also likely that any subsequent minutes will follow similar lines to the BoE’s Inflation Report. Mark Carney announced that UK inflation would “more likely than not” fall below 1 percent at some point over the next six months and would not return to the 2 percent target within current BoE forecasting periods.With the recent dovish rhetoric we have seen rate hike expectations increasingly pushed into late 2015. While implied sterling 90 day options still point to a late Q1-Q2 2015 hike, Citibank among others have recently pushed their rate hike forecasts into the last quarter of 2015.

Coming against a backdrop of weak Eurozone inflation, as well as declining energy prices, the lower UK inflation forecast did not, and will not, ruffle many feathers. The overall picture of the BoE is that policymakers are not overly under pressure to hike rates, despite dissent from Martin Weale and In McCafferty at the last MPC meeting. As Mark Carney pointed out during the MPC’s appearance before the Treasury Select Committee, global economic conditions have deteriorated in two of the major economies – Europe and Japan and that the geopolitical situation remains difficult, posing external risks to the UK economy.

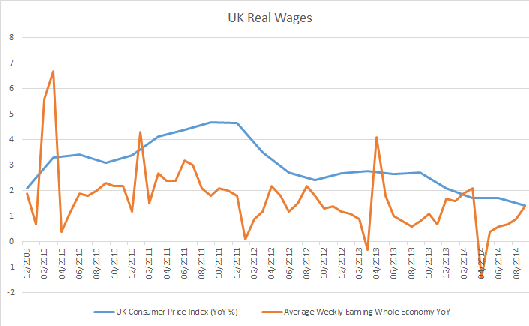

Wage growth concerns are perhaps the biggest persistent home-grown concern for the BoE. Despite the steady slide in inflation, nominal wages continue to struggle to exceed inflation, meaning pay packets in real terms are stagnating or declining.

Despite recent headwinds, UK GDP growth remains strong compared to its Eurozone near-neighbours. GDP expanded by 0.7 percent in the third quarter, with upwardly revised consumption numbers. In addition, retail sales have been strong, showing that despite the UK’s continuing real wage concerns, shoppers remain bullish.

The BoE will announce its interest rate decision at 12:00 GMT on December 4.

The ECB will announce its monetary policy decisions on December 4 at 12:45 GMT and with its accompanying statement at 13:30 GMT. Below you will find the full forecasts of the contributing market experts.

Yohay Elam - Analyst at Forex Crunch:

The stakes are high for this ECB meeting, even if rates are not expected to change. They have reached their lower bound. With ongoing low inflation and a lack of real growth, the European Central Bank has hinted of readiness to accelerate its expansion of the balance sheet. Recent hints show the determination of Draghi and VP Constancio to move ahead, with or without German approval. A lot depends on the updated forecasts for inflation and also for growth, that are updated in this December meeting. There is a good chance that Draghi will hit the pedal and make a big announcement towards QE, citing deteriorating forecasts. The conditionality is likely to move from the forecasts to the success of the next TLTRO, thus basically announcing it this time. Such a move is not priced in, and could send EUR/USD down.

The stakes are high for this ECB meeting, even if rates are not expected to change. They have reached their lower bound. With ongoing low inflation and a lack of real growth, the European Central Bank has hinted of readiness to accelerate its expansion of the balance sheet. Recent hints show the determination of Draghi and VP Constancio to move ahead, with or without German approval. A lot depends on the updated forecasts for inflation and also for growth, that are updated in this December meeting. There is a good chance that Draghi will hit the pedal and make a big announcement towards QE, citing deteriorating forecasts. The conditionality is likely to move from the forecasts to the success of the next TLTRO, thus basically announcing it this time. Such a move is not priced in, and could send EUR/USD down.Jameel Ahmad, Chief Market Analyst, at Forex Time:

Following dovish comments from ECB President Mario Draghi less than a fortnight ago, the markets are intense with speculation that December could be the month the ECB finally introduces QE. Since Draghi teased investors with his comments, the EURUSD has traded narrowly during European trading sessions and I think this is because investors are nervous regarding whether the threat of more stimulus will come to fruition.

Following dovish comments from ECB President Mario Draghi less than a fortnight ago, the markets are intense with speculation that December could be the month the ECB finally introduces QE. Since Draghi teased investors with his comments, the EURUSD has traded narrowly during European trading sessions and I think this is because investors are nervous regarding whether the threat of more stimulus will come to fruition. I personally don’t see the ECB acting this month, because I don’t think the EU economic problems rest with ECB policy. The ECB has loosened monetary policy greatly over the past few months, with this resulting in the EURUSD declining from 1.39 to 1.23. Despite the dramatically weaker exchange rate, no real impact on economic data has been noticed. This has led me to believe that the EU economic problems go further than ECB policy.

For example, EU trade has most likely reduced from Asia following economic fears in both Japan and China. Additionally, it is no hidden secret that the EU economy is encountering dangerously low inflation levels and when you combine this with near record high unemployment alongside weak investor confidence, trade would have also been limited between EU nations. It is also possible that the economic sanctions on Russia are starting to impact EU trade as well.

I do think the EURUSD will fall to the downside on Thursday, but this will likely be caused by dovish comments from Mario Draghi. The ECB President will probably reiterate how fragile the EU recovery has been, and open up the possibility for more action from the ECB in the future. It also would not surprise if Draghi again points towards the lack of structural reforms around governments in Europe as being one of the catalysts behind the EU economic problems, and point towards how the Spanish economy (one of those that did implement strict reforms) is continuing to improve.

Valeria Bednarik - Chief Analyst with FXStreet:

ECB:

ECB:European ominous inflation readings these days suggests “something” should be done: German monthly inflation printed 0.0% erasing the positive mood earlier up ticking data generated over the country; Spain inflation went down to -0.5%, while EZ YoY readings remained at its lows of 0.3%. Mario Draghi has attended different events this week, and did not missed any opportunity to reaffirm that the Governing Council is “unanimous in its commitment to use other unconventional instruments” if current measures are not enough, triggering 50 pips slides in the EUR/USD every time. Market players are being fast when it comes to price in some easing around the corner; but what investors seem to be ignoring is that he also said in regards of current stimulus that “time is needed for the positive effects to fully materialize.”

My take is that Super Mario will once again offer a strong jawboning on unity and further measures available, but do nothing: EUR reaction will then depend on how much the market believes him, and for how long: if at some point, saying first quarter of 2015, QE remains in blur, the EUR/USD may finally post a strong upward correction after months of decline. In the shorter term, any spike higher in the pair after ECB up to 1.2560, should only be seen as a selling opportunity.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.