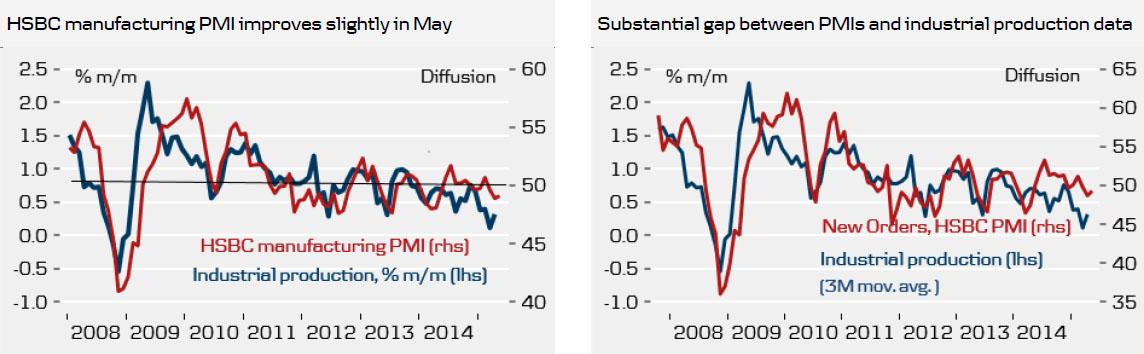

In China the flash estimate for HSBC manufacturing PMI in May improved slightly to 49.1 (Consensus: 49.3, DBM: 48.7) from a final reading of 48.9 in April.

The details were relatively strong with new orders improving to 49.3 from 48.9. On a negative note, export orders declined markedly to 46.8 from 50.3 suggesting that the improvement in new orders was driven solely by an improvement in domestic orders. Inventories were cut at a faster pace in May with the finished goods inventory component easing to 49.0 from 49.7 meaning that the new order-inventory balance improved in May. Current output also declined markedly to 48.4 from 50.4 suggesting that new orders are now increasing faster than production.

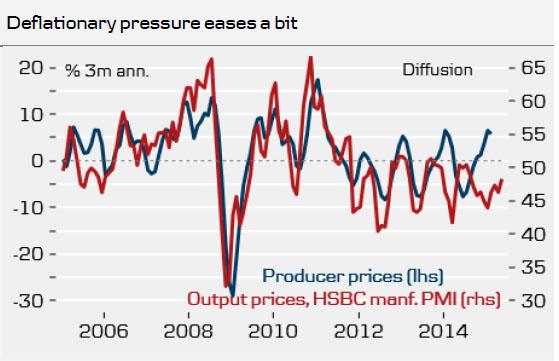

There were also some signs that the deflationary pressure is easing with the output price component improving to 48.3 from 46.3 (see chart below). For the output price component this is the highest level since August 2014.

The relative strong details in the HSBC manufacturing PMI suggest that the HSBC manufacturing PMI has bottomed out. That said, there is still a considerable gap between the manufacturing PMIs and the hard industrial production data with the hard industrial production data substantially weaker than the manufacturing surveys (see chart below).

Overall today’s HSBC manufacturing PMI supports our view that the Chinese economy will recover moderately in H2 supported by current monetary easing. Hence, the HSBC Markit manufacturing PMI should again improve to above 50 in the coming months. It does not change our view that GDP growth will drop below 7% y/y in Q2 and for that reason we expect to see further monetary easing in the coming months.

In Japan the flash estimate for Markit/JMMA manufacturing PMI in May also improved to 50.9 (consensus: 50.3) from a final reading of 49.9 in April. This is the first improvement since January. The details were also stronger with new orders improving markedly to 51.2 from 48.5. However, also in Japan there was signs of a bit of softness in exports with export orders declining slightly to 50.5 from 51.0 but overall exports are still doing reasonably well. On a positive note, the improvement in new orders appears to be driven mainly by domestic orders. In addition, inventories were cut at a substantially faster pace in May, so the new order-inventory-balance improved markedly in May. So we have a relatively strong signal about further improvement in Japan’s manufacturing PMI in the coming months. With signs that both China's and Japan's manufacturing PMIs are bottoming out, there are tentative signs that the global manufacturing cycle could be stabilising.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.