Last week Cable unfolded as expected and both targets were reached and exceeded.

Cable has been diving head first since mid-July and we expected that downtrend, however we should be asking ourselves, is the momentum behind that downtrend increasing to support that downtrend or is it diminishing and therefore requires an upwards correction to regain the momentum to sustain such a downtrend !!

The MACD chart below should answer that question for us.

As always we will wait for either counts confirmation point to be reached to determine the highly probable count.

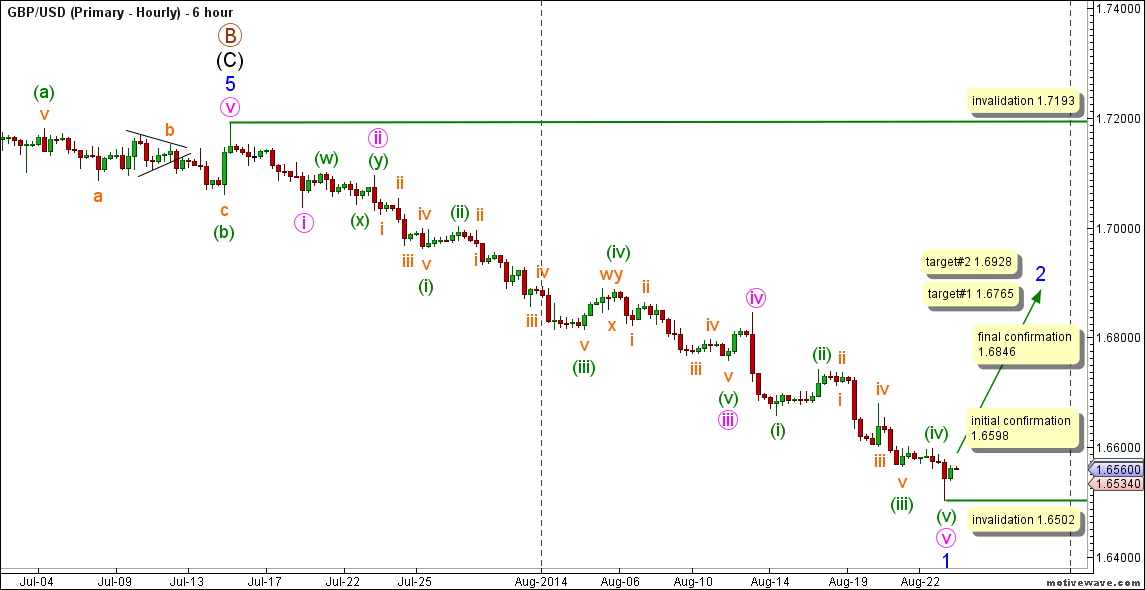

6-Hours Main Count

- Invalidation Point: 1.7193 -- 1.6502

- Confirmation Point: 1.6598 -- 1.6846

- Upwards Targets: 1.6765 -- 1.6928

- Wave number: 2 blue

- Wave structure: Corrective

- Wave pattern: Zigzag

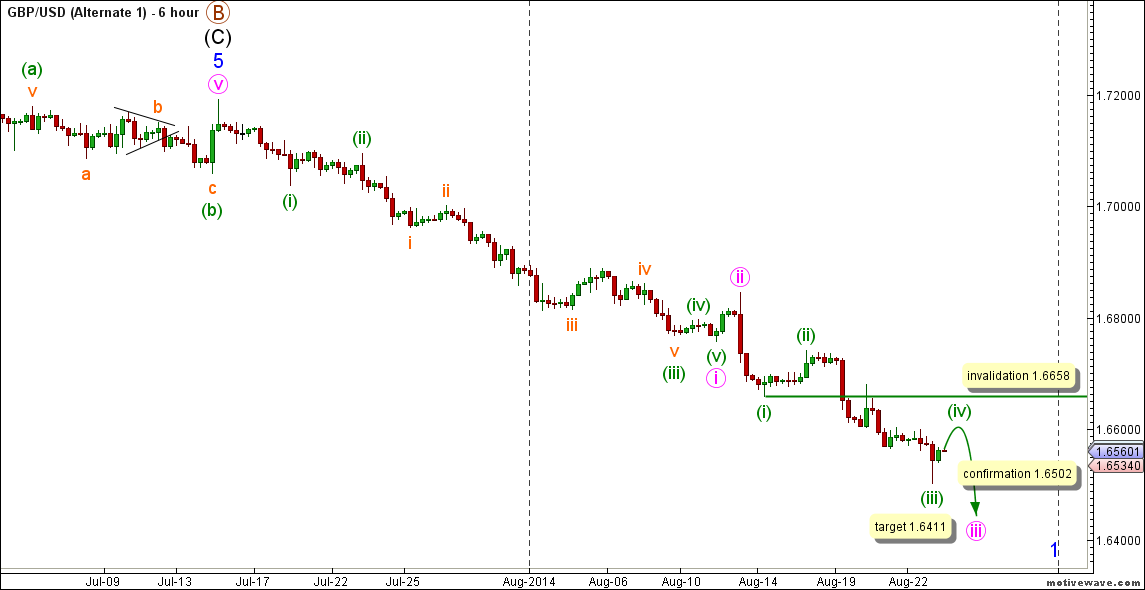

6-Hours Main Count

- Invalidation Point: 1.6658

- Confirmation Point: 1.6502

- Downwards Target: 1.6411

- Wave number: iii pink

- Wave structure: Motive

- Wave pattern: Impulse

Main Wave Count

This count expects that wave B maroon is complete as a zigzag labeled waves (A), (B) and (C) black and that wave C maroon is starting to unfold towards the downside.

Wave (C) black within wave B maroon unfolded as an impulse labeled waves 1 through 5 blue.

Wave 5 blue is complete as an ending diagonal labeled waves i through v pink.

Wave iv pink unfolded as a zigzag labeled waves (a), (b) and (c) green.

Wave v pink unfolded as a zigzag labeled waves (a), (b) and (c) green with wave (a) green unfolding as an impulses labeled waves i through v orange.

Within wave C maroon wave (1) black is expected to be underway with wave 1 blue likely complete and that wave 2 blue is at its very early stages.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave ii pink unfolded as a double combination labeled waves (w), (x) and (y) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (i) green unfolded as an impulse labeled waves i through v orange.

Wave (iii) green unfolded as an impulse labeled waves i through v orange.

Wave (v) green unfolded as an impulse labeled waves i through v orange.

Wave v pink is likely complete as an impulse labeled waves (i) through (v) green with wave (iii) green unfolding as an impulse labeled waves i through v orange.

As far as MACD study goes, the presence of a divergence between wave (iii) green within wave iii pink and the end of wave v pink suggests that wave 1 blue is complete as well that divergence is supported by the presence of yet another minor divergence between the ends of waves (iii) and (v) green within wave v pink itself.

This count would be initially confirmed by movement above 1.6598 and the final confirmation point is at 1.6846.

At 1.6765 wave 2 blue will reach 0.382 the length of wave 1 blue and at 1.6928 wave 2 blue will reach 0.618 the length of wave 1 blue.

This count would be invalidated by movement above 1.7193 as wave 2 blue may not retrace more than 100 % the length of wave 1 blue and as well this count would be invalidated by movement below 1.6502 as within wave a pink within wave 2 blue no second wave may retrace more than 100 % the length of the first wave.

Alternate Wave Count

The difference between both main and alternate counts is within the subdivisions of waves 1 blue as the alternate count expects that wave i pink within wave 1 blue was an extended first wave and that wave 1 blue has more to offer towards the downside.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (iii) green unfolded as an impulse labeled waves i through v orange.

Within wave iii pink waves (i) through (iii) green are expected complete and wave (iv) green is underway. Following the completion of wave (iv) green, Cable is expected to resume moving towards the downside within wave (v) green.

This count would be confirmed by movement below 1.6502.

At 1.6411 wave iii pink will reach equality with wave i pink and we will be able to refine that target once wave (iv) green within wave iii pink is complete.

This count would be invalidated by movement above 1.6658 as wave (iv) green may not enter the price territory of wave (i) green.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.