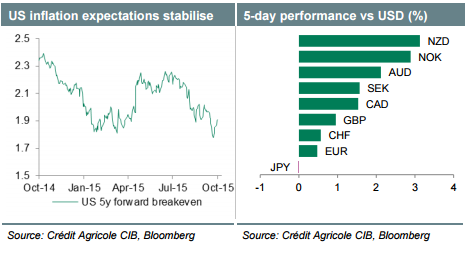

We could be at an important junction that could determine the price action in the FX markets going into year-end. The IMF meetings of central bankers and finance professionals in the next few days should tell us more about what policy action will be taken to address the growing downside risks to global growth and inflation. We worry that the lack of stimulus plans, especially in China, could undermine the latest nascent recovery in risk sentiment and drag down G10 riskcorrelated and commodity currencies. Disappointing trade data out of China next week should strengthen investors’ defensive positioning.

Next week could prove pivotal for the policy divergence trade with important releases out of the US and the UK likely to determine whether the recent aggressive repricing of Fed and BoE rate hikes has been justified. We think that the US activity and inflation data as well as the UK inflation and labour market data will highlight that investors may have overreacted selling USD and GBP of late. At the same time, we think that data out of Japan should strengthen the case for more QE at the end of the month (CACIB’s central case) and weaken JPY.

Elsewhere, Australian labour data will attract attention, especially after the RBA kept an unchanged policy stance this week. Continuing uncertainty related to Asia may keep the risk of slowing conditions intact.

What we’re watching:

JPY – CACIB economists have front-loaded their call for BoJ QE to 30 October from January 2016. We revised our year-end forecast for USD/JPY higher to 125 from 123 previously.

USD – Better-than-expected data may bring expectations of the Fed considering higher rates this year back on the agenda.

GBP – Still constructive labour market conditions as reflected in next week’s data should prevent rate expectations from falling further.

AUD – Disappointing labour data should keep RBA rate expectations strongly capped. We remain in favour of selling AUD rallies.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.