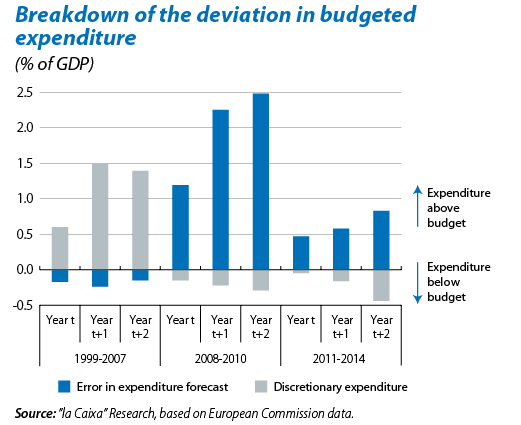

Member states often budget a larger fiscal adjustment than they end up carrying out in reality. As shown by an EC study,1 between 1999 and 2014 the budgetary adjustment approved was 0.4 pps more than the adjustment actually carried out one year later, on average. This difference increases to 0.8 pps for adjustments planned two years ahead. This gap is largely because actual expenditure ends up being larger than planned.

Such deviation in budgeted spending is due both to errors in expenditure forecasts and also to discretionary spending incurred during the budget period. A breakdown of the deviation in various countries shows that, before 2008, most of the increase in unbudgeted spending was due to discretionary measures. However, as from 2008, the reason for such deviations is greater spending than forecasted, in particular an increase in unbudgeted social expenditure.

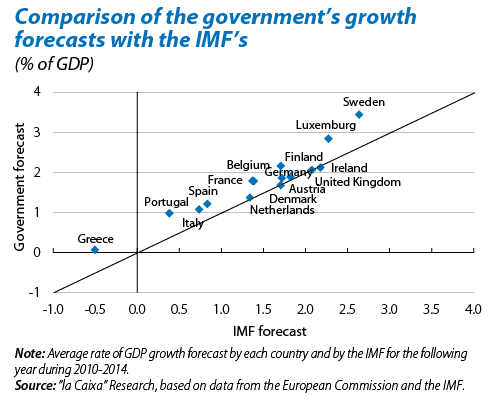

This unplanned increase in expenditure is not entirely innocent: many countries repeatedly overestimate their growth estimate when drawing up budgets. Growth forecasts for the year following the year in which public budgets are presented to the EC are, on average, 0.3 pps higher than the growth forecasts provided by other organisations such as the IMF for the same period.

Thorough budget planning is therefore seen as essential in order to improve public finances. Independent fiscal institutions, established several years ago in some countries in Northern Europe but only recently set up in Spain can be of some assistance in this task. Among other issues, these institutions analyse the macroeconomic forecasts of public budgets, the fiscal policies adopted and the cost of implementing the measures included, and they also attempt to monitor compliance of budget stability on the part of public administrations. One important aspect of their work is to make public accounts more transparent, as well as to offer recommendations regarding any possible problems, although the public administrations are ultimately responsible for taking any measures to resolve such difficulties.

Consequently, at the end of the day the public authorities are responsible for ensuring budgets are met as far as possible, and strong political commitment is required to implement the necessary changes in order to restore the state of public finances. This is the huge task facing European countries after several years of crisis.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.