EUR/USD

4 hour

The EUR/USD is showing a new lower low but still has some space left towards the two main Fibonacci targets. The oscillator will need to move down a lot lower and break below the previous bottom (purple) to avoid double divergence. The FOMC meeting minutes could heavily impact price action during today.

1 hour

The pace of the EUR/USD’s bearish wave 3 has been rather slow and price has only just managed to reach the 100% Fibonacci level. Typically waves 3 should reach the 161.8% target.

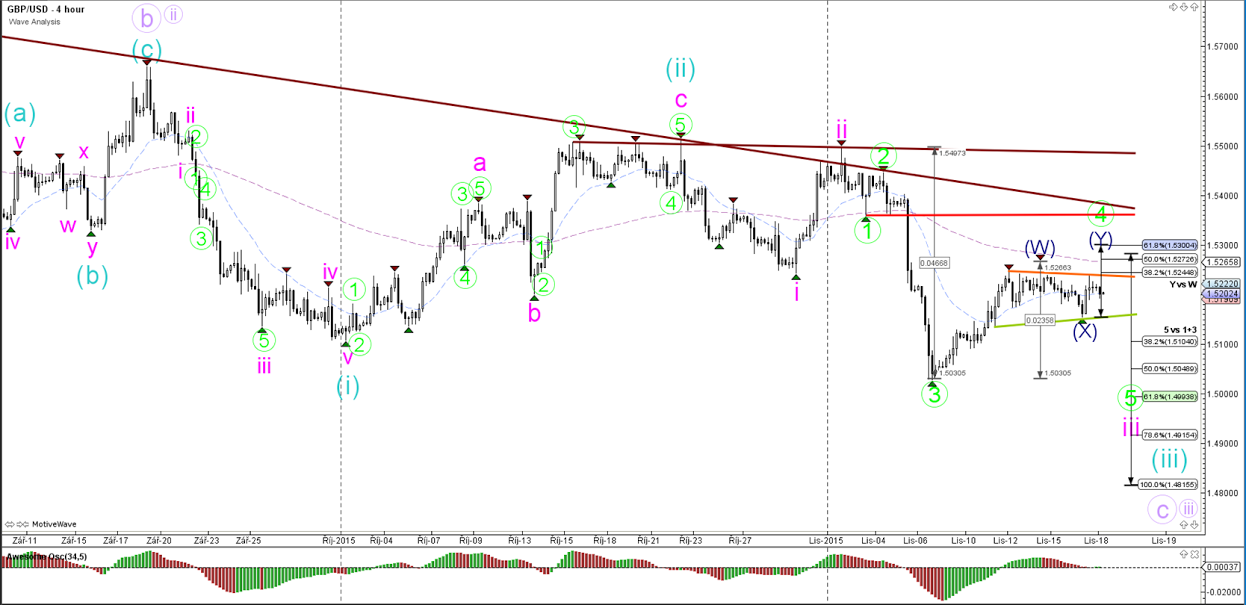

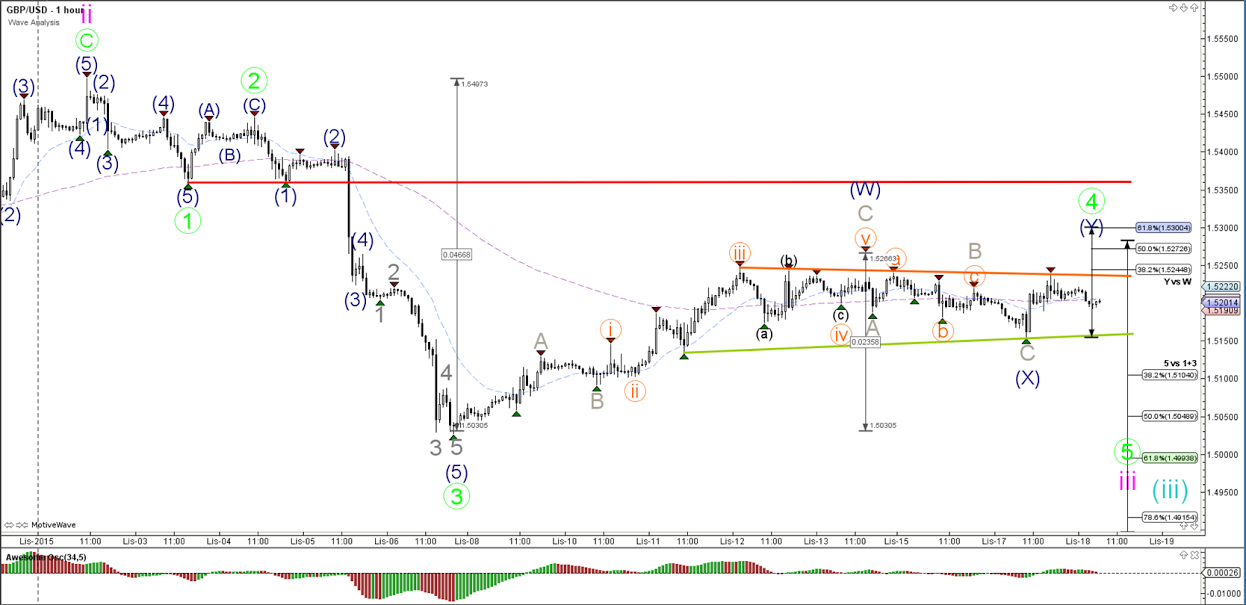

GBP/USD

4 hour

The GBP/USD is currently still in a wave 4 (green), which will be invalidated once price crosses the bottom and origin of wave 1 (red line). A bearish break of the small triangle (green/orange lines) could see price continue its downtrend for wave 5 (green) of wave 3 (pink). The FOMC meeting minutes could heavily impact price action during today.

1 hour

The GBP/USD has not started its wave 5 (green) impulse as yet and remains in between the support (green) and resistance (red) trend lines. Price still seems to be in a wave 4 (green) but a break above the resistance (red) invalidates the wave 4 count.

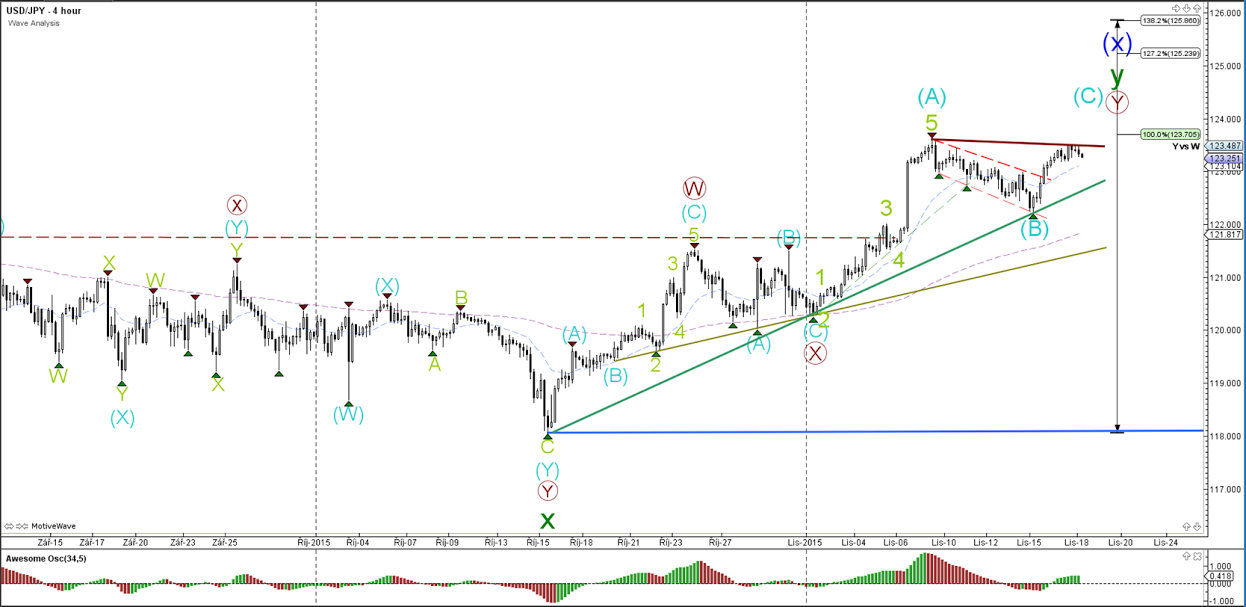

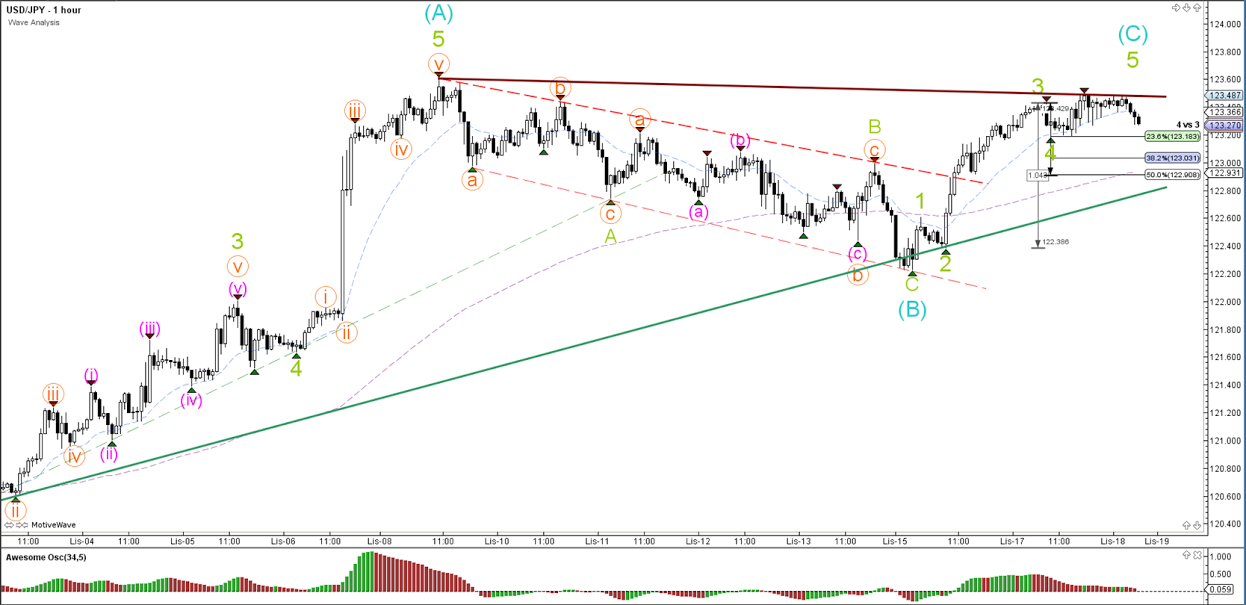

USD/JPY

4 hour

The USD/JPY is hesitating to break the previous top. The FOMC meeting minutes could heavily impact price action during today.

1 hour

The USD/JPY could still be in a wave 4 (green) retracement but in that case, price will need to respect one of the three Fibonacci levels mentioned on the chart.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.