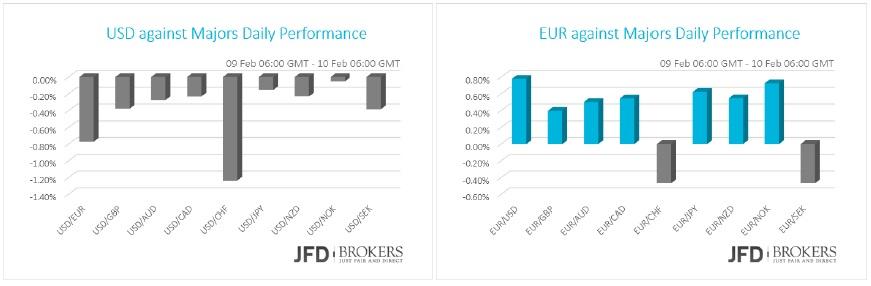

The investors turned to safe‐haven assets due to the global instability setting the market. The last ten days the main beneficiaries were the Japanese Yen, the Swiss franc and the gold that gained more than 5% against the U.S. dollar and the other major currencies. The stocks market is falling while the oil is more volatile than usual. The Chinese stock market is still in the risk of another turmoil as it fell more than 20% since the beginning of the year.

In Eurozone, the finance ministers of the major country‐members continue to discuss ways to recover to the weakness of the 19‐nation economy. The health of the banking sector looks gloomy while the European Central Bank will review its economy in March and most likely will ease it further. The Deutsche bank shares suffer from heavy sell‐off falling 14% the last week and 40% the last year period.

The greenback is about to face the big question if the historical rate hike in December was a right move and moreover if the economy is capable of adopting the planned further gradual rate hikes. The Fed representatives stated that the economy is growing at a slower than expected pace as well as the inflation pick up, therefore, the pace gradual rate rises will slow down further than expected too. The Fed Chair will testify later in the day and all the traders will hang on every word of her speech. The labour market didn’t show in the jobless rate but the wages rose at a respectable pace. The next FOMC meeting is in five weeks ahead and the all the traders want to decipher if Yellen is going to prepare the market for another rate hike or to hold the current monetary policy.

USD/CHF – Technical Outlook

The USD/CHF had a volatile session on Tuesday, with the dollar falling sharply during the European session from around 0.9870 to a low of 0.9693. Around there, the 50‐SMA on the weekly chart is ready to provide a significant support to the pair while the daily 200‐SMA is ready to support the bears slightly below the 0.9800. Therefore, the level to watch today, ahead of Yellen’s speech, will be the 0.9690, yesterday’s low, and to the upside the 0.9785, December low. Looking to sell rallies remains the overall theme, but a choppy session may lie ahead today.

USD/JPY – Technical Outlook

The aggressive sell‐off on the Nikkei during the last couple of days (‐7.80%) set off another round of safe haven and sent the Japanese yen in a fresh 2 year low on early Wednesday. It should be noted that the USD/JPY pair is testing a critical level, around 114.00, which coincides with the 23.6% Fibonacci level of the move from December 2012 low to August 2015 high. Both the short and medium term indicators are oversold and appear to be trying to recover, which suggests that could take off some of the recent selling pressure. Therefore, we could sell the dips for now, with the next level to the upside being the 115.20 barrier. Alternatively, if the selling pressure continues then I would expect the pair to test yesterday’s low at 114.00 and a dip below that level should open the way towards the psychological level of 110.00.

Gold – Technical Outlook

The yellow metal rose for a fourth consecutive week, climbing towards an 8‐month high as most investors turned to safe haven assets the last few weeks. The precious metal rose more than 8% the last month and is trading positive 12.30% YTD. Gold futures settled near $1,200 an ounce on Monday for their best finish since June 22, 2015. It is very significant that the metal is trading above the 200‐SMA on the daily chart, as well as above the 50‐SMA on the weekly chart, adding to the bullish picture of the metal. In the coming hours, the metal could find support near the $1,180 ‐ $1,185 zone, which coincides with the 50‐SMA on the 1‐hour chart, therefore, we could buy the dips for now.

EUR/USD – Technical Outlook

The single currency rally on the back of the safe haven demand and rose against the dollar, reaching the psychological level of 1.1300 on Tuesday, a level that we have suggested during yesterday’s report. The short and the medium charts are becoming increasingly overbought and thus, the upside is getting overstretched so we could see a brief correction in the next few hours ahead of Yellen’s testimony. It should be noted that the EUR/USD pair is testing the ascending trend line, which started back in mid‐November, from below. Therefore, the level to watch for now will be the 1.1235, which I consider a key support for the pair.

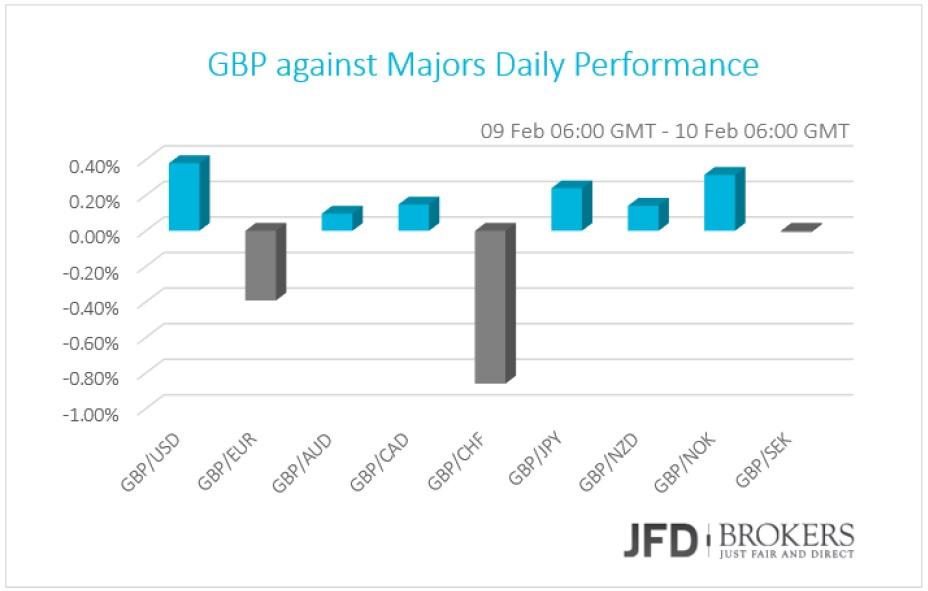

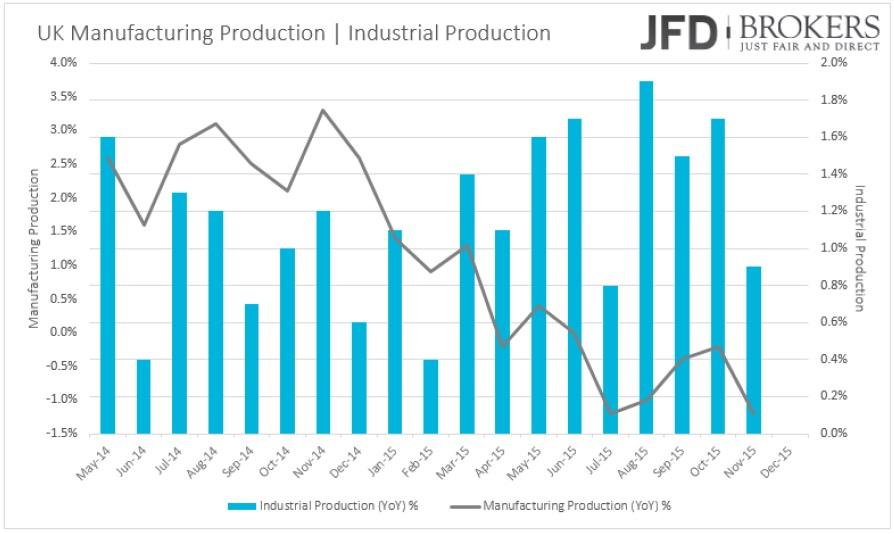

Pound mixed Despite the Narrowed Trade Deficit

The pound was traded mixed against the major currencies on Tuesday and early Wednesday despite the more than expected narrow of the traded deficit. In December, the nation’s trade deficit narrowed to £2.709 billion from £4.031 billion before. This improvement is more likely due to the cheap oil in the country. Today, the bold macroeconomic data coming out are the manufacturing and industrial production for December as well as the NIESR GDP for the three months to January.

GBP/USD – Technical Outlook

The GBP/USD pair has moved quietly the last couple of days, however, the dollar failed to maintain its gains against the pound after it tested the key level of 1.4350. The pair is trading in a tight range between the 50‐SMA and the 200‐SMA on the 4‐hour chart. Technically, despite the brief retracement above the 1.4500, the outlook remains unchanged and it would appear that the range is set to remain intact for now, using 1.4400 as a support, ahead of the release of the NIESR GDP for January.

WTI and Brent Crude Oil under heavy selling pressure

The WTI Crude oil fell for a fifth consecutive session, currently trading below the psychological level of $30 following the aggressive sell‐off which started after the peak near the $35 level few weeks ago. However, the WTI pushed slightly higher during the Asian session, after testing the critical level of $27.56, January low, with some support coming from reports Iran was willing to negotiate with fellow OPEC member Saudi Arabia over oil market conditions. OPEC releases its monthly oil market report today. Following the test of the latter level, I would expect the US crude oil to test the key resistance barrier at $29.20 before turning downwards again.

A similar picture with the UK Brent which came under selling pressure the last 5 days, recording a 10% drop the last week, currently trading slightly above the $30 level. The 50‐MS and the 200‐SMA on the daily chart, both are supporting the downtrend, while the 100‐SMA on the 4‐hour chart is currently preventing any moves above the critical level of $36.00. However, most of our indicators are trying to pick momentum and overcome the oversold levels, therefore, we should expect a pullback in the coming hours, probably to test the $32.00 ‐ $32.10 zone before continuing south.

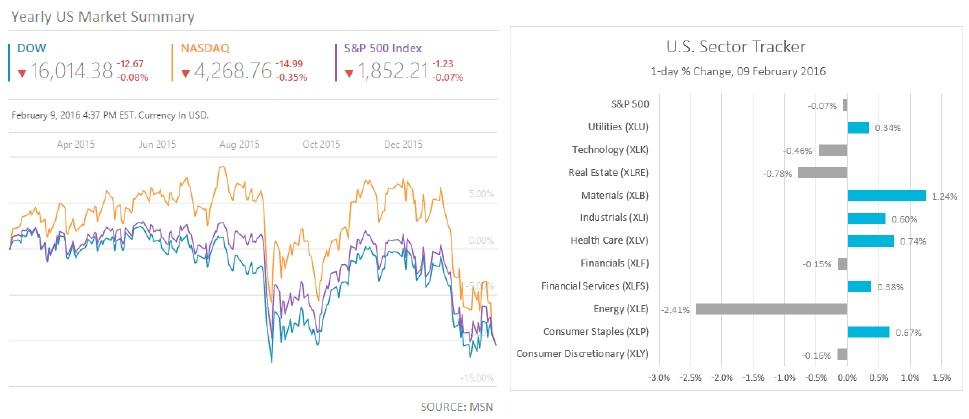

U.S. Indices are also falling

The U.S. indices are not an exception of the concerns mount for the global and domestic economies. The New York Stock Exchange closed another day in red while Dow Jones falling 0.08%, Nasdaq 0.35% and S&P500 0.07% down. The energy shares plunged by 2.41% dragging down the three vital stock indices. The three popular U.S. indices are more than 10% since December while the losses of Nasdaq surpass 15%.

Economic Indicators

Today, the UK releases its December Industrial and Manufacturing production data. The manufacturing sector is expected to show a decline of ‐1.4% year‐over‐year while the industrial production to rise by 1.0%.

Later in the day, NIESR GDP estimate is coming out. During the European session, the European Commission will release Economic Growth Forecasts. Later in the day, the U.S. weekly MBA mortgage applications and Monthly Budget Statement for January are released. Investors will be closely watching the testimony of the Federal Reserve’s chairwoman Janet Yellen. Overnight we will get Australia Consumer Inflation expectations for February as well as Business Confidence for January.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.