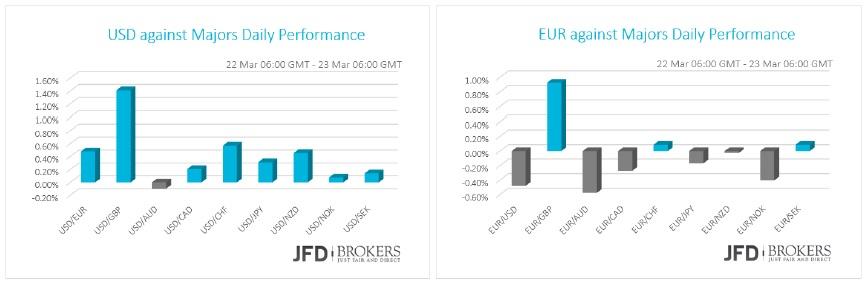

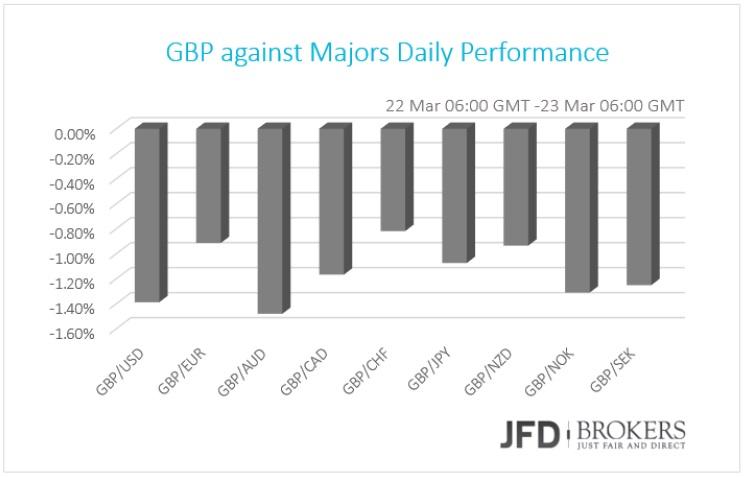

The markets remained virtually unchanged despite the deadly attacks in Brussels. The only heavilyaffected currency was the sterling as the high‐risk of terrorism in Europe intensifies the votes for Brexit. UK Inflation Rate was also a disappointment that added to sterling’s losses. The U.S. stocks also remained relatively unchanged.

No heavyweight numbers are expected from the most economies today, thus, only politics and terrorism concerns will dominate the trades today.

Eurozone Data Surprised Positively

In Eurozone, the confidence among the economists fueled by upbeat figures came out. The flash Markit Manufacturing PMI for March rose at 51.4 from 51.2 before, while the services sector surpassed expectations and increased at 54.0 from 53.3 before. In Germany, the IFO survey surprised positively in all of its three aspects. Expectations surged to 100.0 from 98.9 in February, Current Assessment jumped to 113.8 from 112.9 and the Business Climate beat expectations by rising to 106.7 from 105.7 prior.

EUR/USD – Technical Outlook

The euro edged down on Tuesday as investors reacted to the early Tuesday attacks in Brussels though hawkish comments from U.S. Federal Reserve official Charles Evans underpinned the U.S. currency. The last couple of days the movements are limited, however, the EUR/USD pair fell more than 1% since 18th of March. It may be too early to say that the pair is looking bullish again following the aggressive rally from 1.0800, but there is certainly a slight bearish bias being seen in the price action right now following the failed attempt above the 1.1340 level. The 23.6% retracement level – 8 October lows to 2 January highs – has been providing clear support for the pair over the last year. A key resistance level in recent months has been 1.1500 and the pair is once again struggling at this level. Another level that is very significant is the 1.1380 barrier as the bulls failed in their last attempt to move above there. A break of either of these two levels could give a strong hint about the next move in the pair, with any move to the downside also needing to break through the significant level at 1.1030, which coincides with the 50‐SMA and the 200‐SMA on the daily chart, in order to confirm the short‐term bearish bias.

Pound plunged after terror attacks and Inflation Report

The sterling has fallen heavily in all fronts and to its lowest level against the Euro in the last fifteen months. The market concerns that after the recent terror attacks in Brussels the number of British citizens will vote for UK leaving the Europe in June increased. The UK final Inflation Rate for March remained unchanged at 0.3% on a yearly basis, far below Bank of England’s 2% target. The monthover‐ month indicator disappointed the market forecasts of 0.4% and rose to 0.2% from ‐0.8% before.

GBP/USD – Technical Outlook

The dollar edged higher Tuesday, extending its gains from earlier in the session and snapping a twosession losing streak against the pound after a spate of weak UK economic data. The GBP/USD fell more than 2% the last 3 days, however, it remains positive for the month +1.95%, following 4 negative months (Feb. ‐2.30%, Jan. ‐3.34%, Dec. ‐2.10% and Nov. ‐2.42%). With a relatively light economic calendar today many traders are opting for the sidelines.

The short‐term indicators look mildly constructive so any moves to the upside today may be limited. If the pair continues the downside then we could see a test at the first intraday support 1.4160, minor though, and then at 1.4130. Below there, we look at 1.4100 and then at 1.4170, a strong technical level.

USD/JPY – Technical Outlook

The U.S. dollar is continuing to push higher against the Japanese yen currently trading above 112.00. However, USD/JPY is continuing to struggle near the psychological level of 111.00, following several failed attempts to break below it. The charts are looking rather mixed and it will continue to be the Fed that drives the direction in the bigger picture for this pair, so a cautious stance is warranted as far as the pair moves in that sideways channel.

AUD/USD – Technical Outlook

The AUD/USD pair has been choppy and fairly directionless the last couple of days as it trades in a tight range 0.7568 – 0.7627 and currently sits pretty much in the middle, leaving the outlook unchanged. Technically, on the upside back above 0.7630 would possibly look to retest 0.7680. On the other hand, if the bulls fail to sustain any gains above the intraday key support of 0.7565/68, further losses look possible and would then look to test 0.7540 and then 0.7525. For the medium and long term traders, I would be fairly neutral on any directional move and we could yet see the U.S. dollar come under further pressure, with much depending on the lead coming from the Fed.

Gold – Technical Outlook

The precious metal edged lower on Tuesday and early Wednesday, with the impact of a stronger dollar outweighing a slight swell in the metal's safe‐haven appeal after the bomb attacks on the Brussels airport and the metro station. Following the move to the downside, the metal remains in the ascending triangle, which started back in early February. Since we didn’t have any moves outside the formation, it leaves the outlook pretty much unchanged. On the downside, strong support and next possible target will be seen at $1,277 while on the upside the first serious obstacle for the bulls will be at $1,240 although I am not quite sure that we go back there before we see a test of the former level.

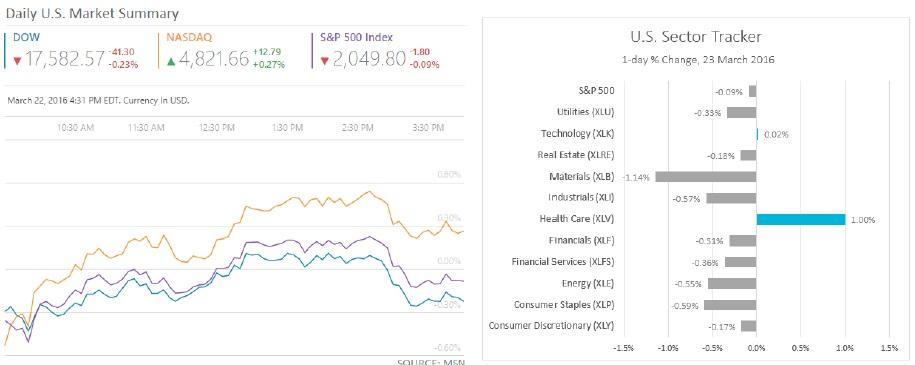

U.S. Indices Finished Virtually Unchanged

U.S. stocks finished virtually unchanged on Tuesday after a low volatile session. The S&P 500 finished 1.80 points, or 0.1%, lower at 2,049.80, while the Dow Jones industrial average was 40.30 points, or 0.2% down at 17,583.00, snapping a seven‐session win streak. The Nasdaq Composite (NDAQ) managed a slight gain, rising 12.79 points, or 0.3%, to 4,821.66. The high‐tech index was benefited from gains in Amazon.com Inc. (AMZN) and Apple Inc. (AAPL). Strong gains in health‐care shares helped both the S&P 500 and Dow finish off their session lows. The biggest gainer blue‐chip stocks were Pfizer Inc. (PFE) and UnitedHealth Group Inc. (UNH) while severe losses by Goldman Sachs Group (GS) shaved about 15 points off the Dow.

What to watch today

No major events or speeches are expected that will affect the market importantly across the Europe. In U.S., the New Home Sales for February will be released and later in the day, New Zealand’s trade balance is scheduled to be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.