Fed sees slower rate rise path; BoE Policy Meeting Ahead

Fed left rates unchanged weakening the dollar especially after Yellen didn’t hint a rate hike in the horizon. The pound tumbled as the UK Chancellor Osborne warned for the bad economic sequences of UK leaving European Union and the still existent government’s deficit despite his efforts. On the other hand, commodity currencies seen higher as well as the U.S. stocks that eked out slight gains.

Dollar Tumbled as Fed holds off rates

The Fed kept current monetary policy unchanged as expected and kept the dot-plot forecasts indicating two rate hikes in 2016 unchanged but less than four rate cuts had planned in December. However, the dollar dived as Fed Chairwoman avoided to speak much for the upcoming rate hikes and instead she underlined the global economic headwinds. Although, she stated that tightening in April’s meeting is still on the table and the U.S. GDP growth will run above potential. The inflation rate published before the meeting indicated a stability in the improvement of consumer prices. The consumer prices rose by 1.0% in February higher from the market consensus of 0.9% but by far below last month’s figure of 1.4%. However, above 1% figures boost confidence that it will soon approach Fed 2% target.

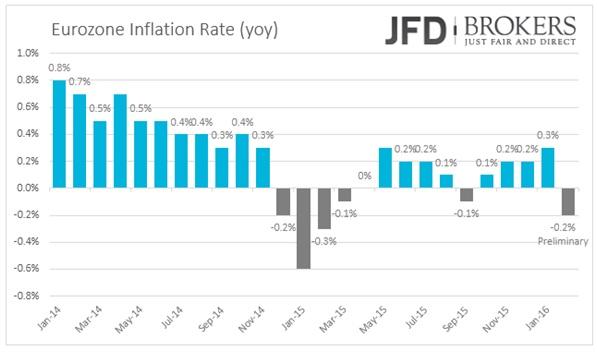

Eurozone’s CPI ahead!

All quiet in Eurozone’s macroeconomic front. The single currency ended the day virtually unchanged against most of the currencies, recording significant gains against the U.S. dollar and edged lower versus the commodity prices, especially versus the New Zealand dollar. EUR/USD rose more than 1% as the greenback weakened following FOMC meeting and EUR/NZD plunged by 1.30% due to the above expectations New Zealand GDP. Today, Eurozone’s final CPI for February will be closely eyed.

The EUR/USD pair has recovered well from the 1.1060 lows seen earlier in the session, and which also coincides with the 1-hour 200-SMA, to currently sit at 1.1215. The area that the pair rebounded it also coincides with the 4-hour 50-SMA and 200-SMA, as well as the ascending trend line, which started back in December. Ahead of yesterday’s reaction, the psychological level of 1.1300, which includes the 23.6% Fibonacci Retracement level, will act as a target.

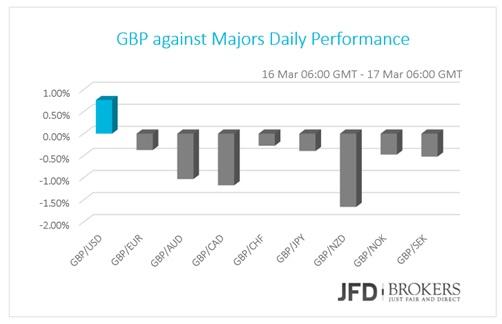

Pound tumbled on Budget Report; BoE Meeting Ahead!!

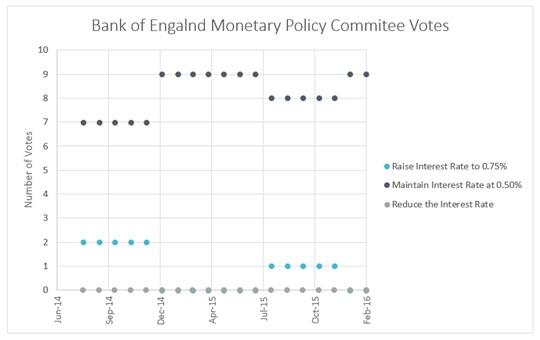

The sterling plunged due to the non-expected changes to the taxes, the lowered GDP forecasts from 2.4% to 2% and the bad consequences of Britain exiting the European Union. The Chancellor also increased spending cuts by £3.5 billion. The UK employment report released earlier from the budget report boosted confidence. The unemployment fell down by 18.0K and the average earning rose by 2.1% above expectations of 2%. The unemployment rate for the three months to January remained at 5.1%. Today, the Bank of England policy meeting is expected to keep the current policy unchanged, however, the voting pattern of the policymakers will attract traders’ attention as well as the meeting minutes.

The pound has also headed higher against the dollar, taking out the resistance at 1.4200, as well as the hourly 50-SMA. The momentum indicators generally look positive, so further gains could now see a run towards 1.4350. On the downside, back below 1.4200, support will be seen at 1.4170, minor, and then at 1.4150. Further out, we could yet see a move towards 1.4100, although this seems unlikely to be seen again for a while.

Commodity Currencies Gain Ground

From yesterday’s Fed meeting favoured the commodity currencies. The dovish stance of the Fed policymakers relieved a part of the pressure there s on the commodity economies. The New Zealand’s steeper than expected GDP pace sends the domestic currency higher. Australian unemployment rate fell to 5.8% in February from 6% before and employment increased by 0.3K. In Canada, the only noteworthy indicator came out was the manufacturing shipments for January that increased by 2.3% versus 0.5% expected.

USD/CAD has headed sharply lower following the Federal Reserve decision to leave rates on hold and is currently in the process of breaking down through the return line of the downtrend, which started back in early January. There is a bit of Japanese data due today, including the Wholesale Sales for January, although the greater risk event for the Canadian dollar could come tomorrow, where the Canada Statistics releases the CPI numbers. Therefore, a cautious stance is required, and while I would still be looking to trade from the long U.S. dollar side in the medium term, since most of the indicators are overbought.

The U.S. dollar has come under pressure against the New Zealand dollar following the Federal Reserve decision and is now back above 0.6700, having so far been down to 0.6575. In the previous report we have suggested the pair to break below the significant level of 0.6560 and to reach 0.6500, before moving North. Following the dovish tone from the Fed the NZD/USD pair surged aggressively higher from 0.6570 to 0.6780 to end the day 1.90% higher. It should be noted that the pair is up 2.70% so far this month following a +1.67% gains the previous month. Going forward, the pair remains inside the symmetrical triangle, which started back in mid-August 2015. The pair is continuing to trade in a fairly tight range, with 0.6880 capping any moves to the upside, with the help of the Bollinger Band and 0.6300 – 0.6350 propping it up. The pair is nearing the apex of the triangle and a breakout is expected anytime soon. There are strong expectations for an upside move, given the fundamentals surrounding the US dollar.

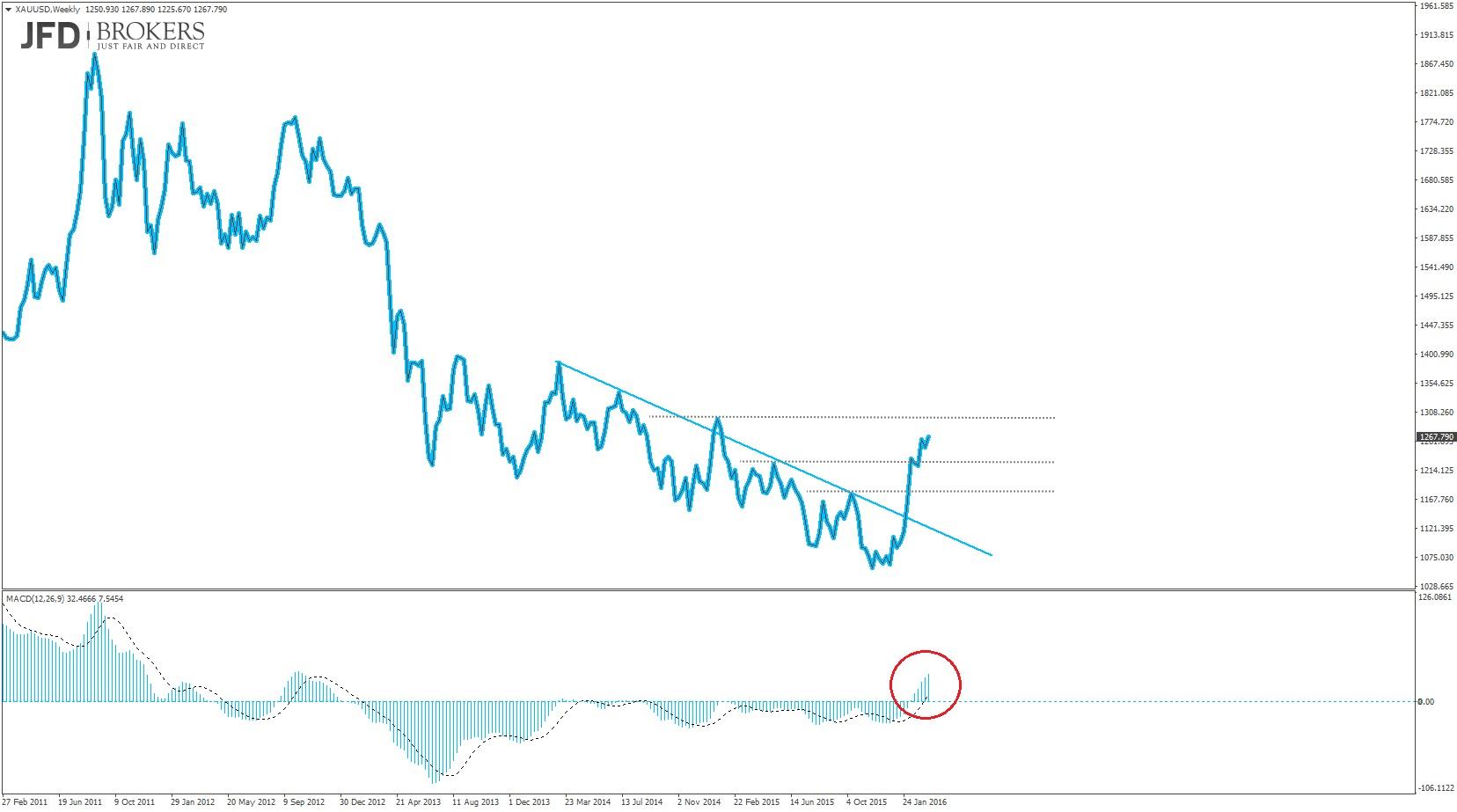

Gold – Technical Outlook

The precious metal surged higher following the Federal Reserve's decision to cut the number of planned interest rate hikes, adding to pressure on the U.S. dollar. The precious metal finished the day 2.10% higher to $1,263 an ounce, snapping its biggest one-day rally since February 11. It should be noted that gold reacts strongly to monetary policy changes and currency moves, as higher interest rates make non-yielding bullion less attractive for investors.

Technically, the key for the next few days will be the session highs, at $1,263, where it will determine the short-term outlook for the metal. The yellow metal is now pushing above some important obstacles, including the 50_SMA on the 4-hour chart, near $1,250. A sustained move above this area would look towards $1,263 and to $1,270 above which would test the year high at $1,284.

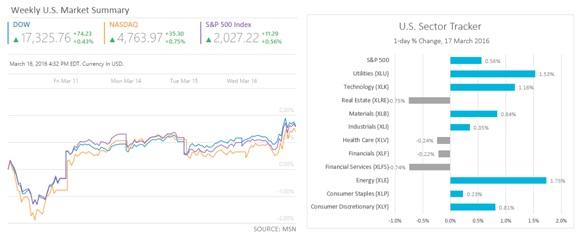

U.S. Indices Closed in Green

The U.S. stock exchange closed Wednesday trading session in the green. The Blue-Chip Index posted gains of 0.43% while high-tech index edged 0.75% higher. The S&P500 added 0.56% of its value, dragged up by energy stocks that surged by 1.73%.

The S&P 500and the Dow Jones Industrial Average both moved higher following the dovish outlook from the Fed and their decision to leave rates on hold. On the weekly chart, the US30 has seen four consecutive positive bars, bringing us above the key support level of 17000. Following the strong rebound from the 15500 area, we remain bullish on the Dow Jones index, with the next obstacle for the bulls being the 17750, which includes the descending trend line, which started back in mid-2015.

A similar story for the S&P500 index. The index surged higher following the Fed meeting and is now testing the weekly 50-SMA. I think further gains are on the cards and the next target for the next 2 sessions will be the psychological level of 2100. Alternatively, given how aggressive the rally has been over the last few weeks, we could see a brief period of consolidation, with a move back below 1990 to open the way towards the 1950 area, which includes the 50-SMA on the daily chart.

What to watch today

Today Eurozone’s Inflation Rate and the BoE policy meeting will attract the attention. Eurozone’s Consumer Prices are expected to have decreased by 0.2% yoy as the preliminary figures. The 19-nation union’s Trade Balance and Construction Output, both for January will be published.

At 12:00 GMT time, the BoE policymakers are going to vote for the central bank’s Interest Rates.

Even though no changed are expected, the voting pattern and the meeting minutes will be closely watched.

In U.S., the weekly Jobless Claims will be out, as usual, followed from the JOLTS Job Openings for January and the CB Leading Indicator for February. During the night, Bank of Japan’s Monetary Policy Meeting Minutes will be published.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.